Axon Enterprise Q1 2025 Earnings Analysis

Dive into $AXON Axon’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$604M rev (+31.0% YoY, +33.1% LQ) beat est by 6.5%

↗️GM (60.6%, +4.1 PPs YoY)

↗️GM* (63.6%, +0.4 PPs YoY)

↘️Operating Margin (-1.5%, -5.0 PPs YoY)🟡

↗️FCF Margin (0.2%, +7.1 PPs YoY)

↘️Net Margin (14.6%, -14.3 PPs YoY)🟡

↗️EPS* $1.41 beat est by 0.7%

*non-GAAP

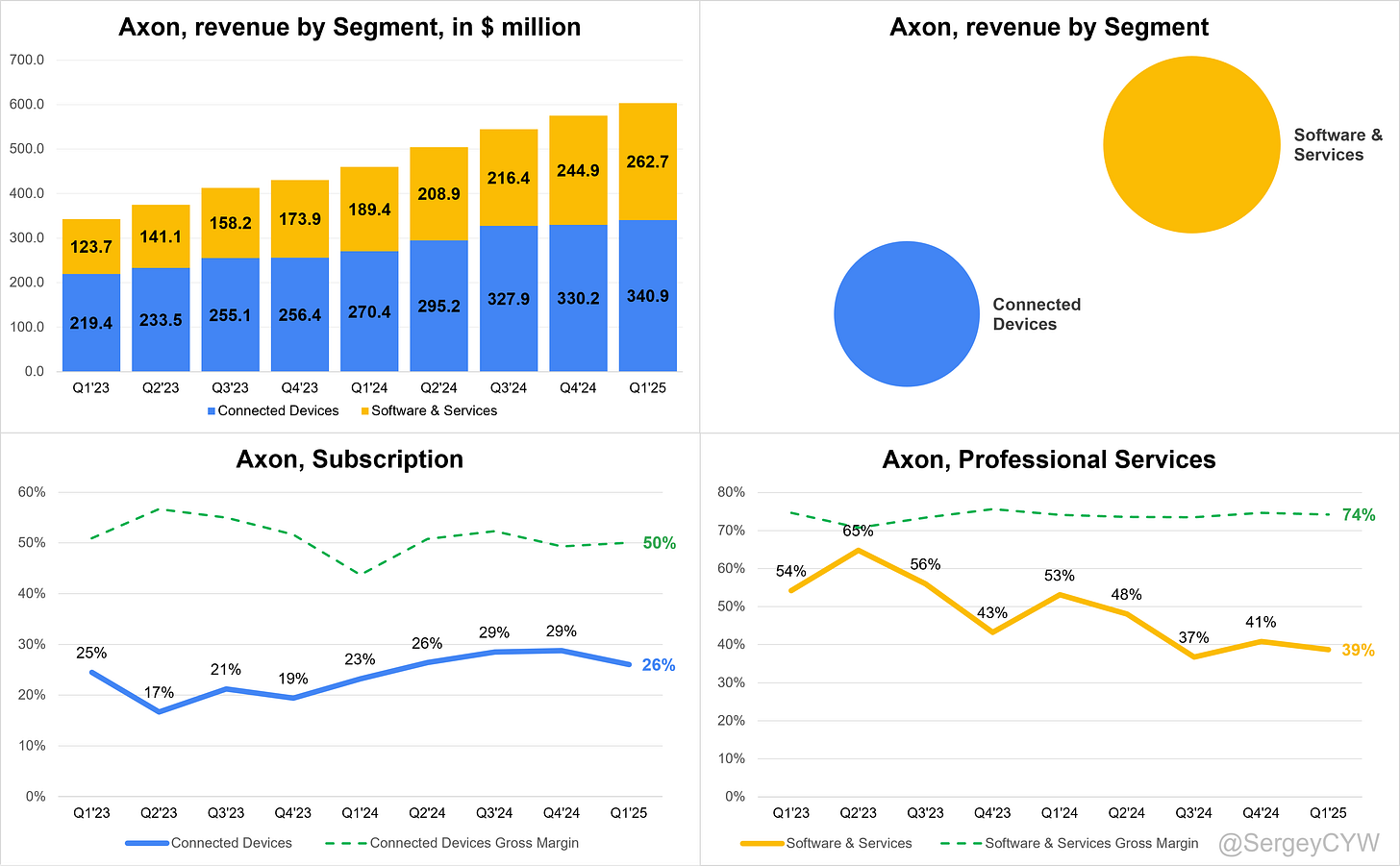

Revenue By Segments

TASER

➡️$340.9M Connected Devices rev (+26.1% YoY)

↗️GM (50.1%, +6.3 PPs YoY)

Sensors and other

↗️$262.7M Software & Services rev (+38.7% YoY)

↗️GM (74.2%, +0.1 PPs YoY)

Key Metrics

➡️NRR 123% (123% LQ)

↗️Total company future contracted revenue $9.90B (+40.7% YoY)

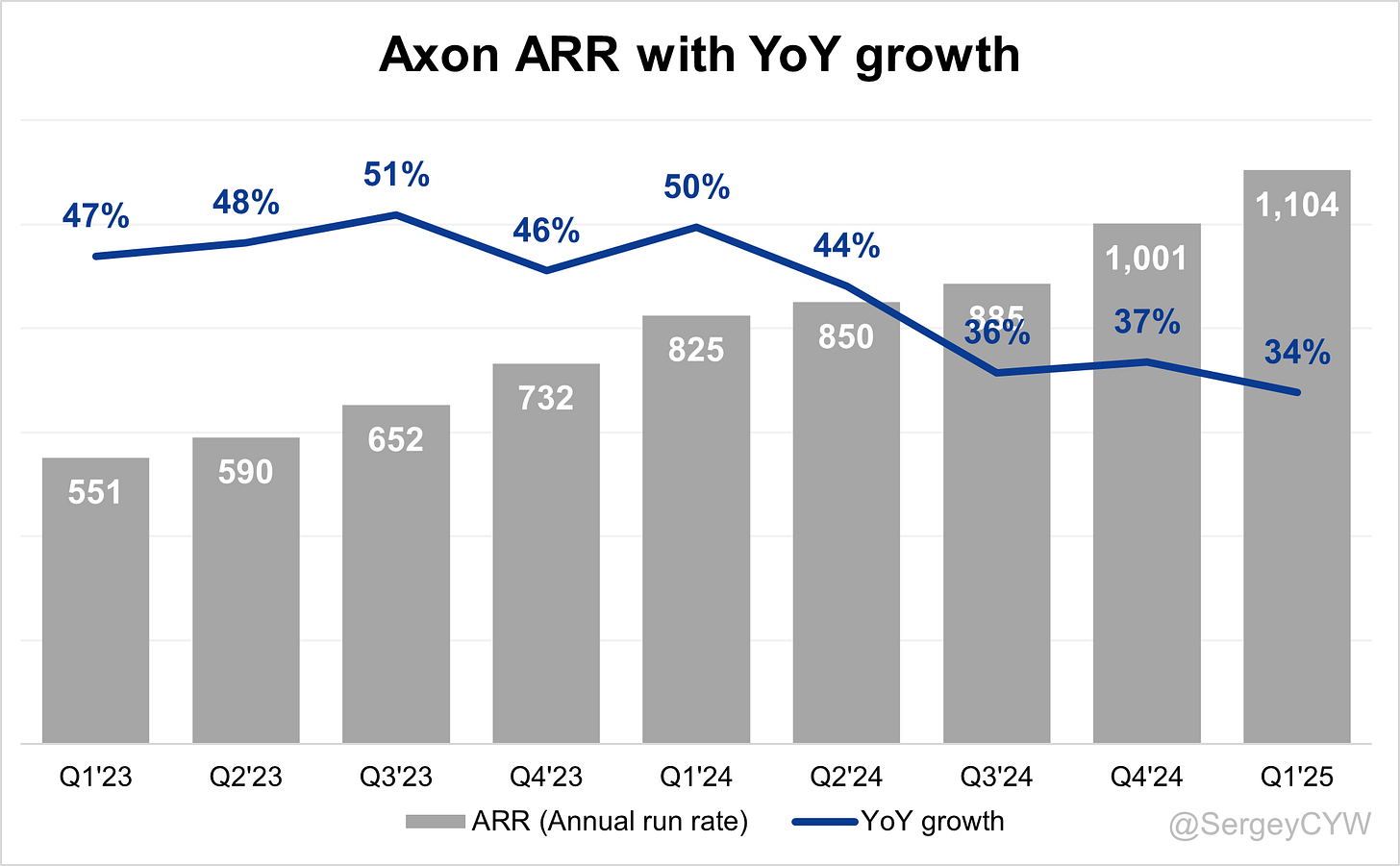

↗️ARR $1,104M (+33.8% YoY)

Operating expenses

↘️SG&A*/Revenue 25.2% (-2.9 PPs YoY)

↗️R&D*/Revenue 15.7% (+0.8 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $103M (+10.8% YoY)

↗️CAC* Payback Period 25.6 Months (21.1 LQ)

Dilution

↗️SBC/rev 23%, 0.5 PPs QoQ

↗️Basic shares up 2.0% YoY, 0.31 PPs QoQ

↘️Diluted shares up 5.6% YoY, -0.8 PPs QoQ🟡

Guidance

➡️$2,550.0 - $2,650.0M FY guide (+24.7% YoY) in line with est

Key points from Axon’s First Quarter 2025 Earnings Call:

Financial Performance

Axon delivered Q1 2025 revenue of $604M, up 31% YoY, marking the 13th consecutive quarter of 25%+ growth. Software & Services revenue rose 39% YoY to $263M, driven by digital evidence management and premium add-ons. Connected Devices revenue increased 26% YoY to $341M, supported by strong demand for TASER 10 and body cameras. ARR reached $1.1B, up 34% YoY, with NRR holding at 123%. Adjusted EBITDA margin was 25.7%, aided by delayed hiring and operating leverage. Gross margin improved to 63.6%, up 40bps YoY, due to software mix.

TASER 10 and Apollo

TASER 10 is Axon’s fastest-growing product, with adoption pacing 2x faster than TASER 7. Agencies are accelerating upgrade cycles, moving from older models like X2 and X26P due to improved accuracy and range. The upcoming Apollo cartridge, expected in 2026, will improve performance through heavy clothing, enabling broader use in cold climates and international markets. In the U.S., where TASERs are widely adopted, Apollo will drive mission expansion, while global TAM expansion is expected from agencies adopting TASER as a standard issue. New channels are opening in enterprise security sectors such as cash logistics and casinos.

Cloud Business Momentum

Software & Services revenue rose 39% YoY to $263M, now contributing half of total software growth. ARR climbed 34% YoY to $1.1B. Approximately 70% of domestic users remain on basic plans, presenting a clear upsell path. Growth is driven by digital evidence solutions, body cam integrations, and adoption of AI-powered premium plans. Global cloud adoption is accelerating as international agencies adopt bundled solutions. Margins remain strong with cloud gross margins above 80%.

Draft One Adoption

Draft One, Axon's AI-powered report-writing tool, now has ~30,000 active users, doubling the adoption pace of previous launches. Five of the top 10 Q1 U.S. deals included OSP 10 Premium, and two included Draft One. The tool reduces paperwork and redirects officer time to field work, aligning with efficiency mandates. It is a key driver of AI Era Plan interest, with broader conversion expected in Q3–Q4 following budget approvals.

Axon Assistant Rollout

Axon Assistant, embedded in existing body cameras, offers real-time translation and contextual support. Currently in pilot and beta, it is receiving strong interest from law enforcement, especially in multilingual and border enforcement contexts. Commercialization is targeted for late 2025. Though early in deployment, Assistant is central to the AI Era Plan and is expected to support broader AI adoption.

FUSUS and Real-Time Integration

FUSUS continues as the core of Axon’s real-time crime center ecosystem, integrating camera networks and enabling live operational dashboards. The platform is nearing full FedRAMP certification, unlocking opportunities in federal and regulated markets. Agencies are layering drone, fleet, and fixed camera video into FUSUS for expanded situational awareness. Integration with third-party systems like Ring and Citizen supports full-stack deployments.

Fixed ALPR Cameras

Axon launched fixed ALPR and static cameras during Axon Week. Agencies are already discussing large-scale deployments. These cameras integrate with FUSUS and fleet platforms to deliver vehicle intelligence and real-time alerts. Initial trials begin mid-2025, with early shipments expected by Q4. Ubiquiti's light pole partnership streamlines installation, providing access to tens of millions of urban nodes without additional permitting.

Vehicle Intelligence Expansion

Vehicle Intelligence tools now identify make, model, color, damage, and custom indicators from video inputs. Embedded across Axon’s ecosystem, they power real-time alerts and support proactive policing. Use cases include incident response, license tracking, and automated threat detection. The capability is also being evaluated by enterprise and federal agencies, especially for border operations and critical infrastructure protection.

AI Platform Strategy

Axon is scaling across hardware, SaaS, and AI by bundling innovations into the AI Era Plan, offering predictable pricing and streamlined deployment. Agencies gain access to new tools like Draft One, Assistant, real-time alerts, and ALPR through a single subscription, reducing procurement complexity. Product launches emphasize tight ecosystem integration and modular use case adoption.

Strategic Integrations

Axon integrated with Ring and Citizen to expand access to private and community video data while maintaining user control and privacy. The "Works with Axon" initiative supports ecosystem growth and positions Axon as the hub for real-time public safety collaboration. These integrations enhance value without requiring agencies to overhaul infrastructure.

International Expansion

International bookings hit a Q1 record, with contributions from Australia, Canada, Latin America, Asia, the UK, and Europe. Agencies are adopting not just TASERs, but also body cameras, cloud, and real-time tools. Execution improvements, leadership focus, and stronger product-market fit are accelerating growth.

Federal and Enterprise Opportunities

Federal bookings are limited by budget constraints, but DHS demand is rising for drones, counter-drone systems, translation tools, and surveillance solutions. dDrone is operational at borders and in executive protection. Enterprise interest continues to grow, especially in retail and logistics, following a major logistics win in Q4. Demand is driven by organized retail crime and a need for real-time deterrence.

Operational Challenges

Tariffs are projected to reduce 2025 EBITDA margin by 50bps. Axon is mitigating the impact through supply chain flexibility and cost controls, with no pricing increases planned. Drone hardware remains supply-constrained. Privacy concerns around AI and surveillance technologies are being addressed via transparent ethical frameworks.

2025 Outlook

Axon raised FY25 revenue guidance to $2.6–$2.7B, representing +27% YoY growth at the midpoint. Adjusted EBITDA is expected at $650–$675M, maintaining the 25% margin target. Growth drivers for H2 include AI plan conversions, fixed camera rollout, and international momentum. Axon continues to build toward its vision of an integrated AI-powered public safety platform.

Management comments on the earnings call.

Product Innovations

Rick Smith, Chief Executive Officer

"We are creating the power of deterrence to build a safer society. The AI Era Plan delivers predictable pricing and guaranteed access to transformative technologies like Axon Assistant and real-time alerts—shifting the value proposition from reactive policing to proactive safety."

Josh Isner, President

"We've built a product suite that allows agencies to pick what works best for them. The AI Era Plan is resonating because it provides optionality and a path to adopt innovation at their pace, while delivering value across a broad spectrum of tools."

TASER

Rick Smith, Chief Executive Officer

"TASER 10 plus the upcoming Apollo cartridge has the potential to displace lethal force in up to 40% of U.S. shooting scenarios. It’s not just an upgrade—it’s a moonshot aimed at making the firearm a second option rather than the first."

Josh Isner, President

"Through two years, TASER 10 orders continue to pace at twice the adoption rate of TASER 7. That’s not just a product win—it’s a signal that agencies see this as essential equipment, not an optional upgrade."

Axon Cloud

Brittany Bagley, Chief Financial Officer

"We continue to see growing adoption of our premium cloud plans. Approximately 70% of our domestic user base is still on basic subscriptions, giving us significant room for upsell and platform expansion."

Josh Isner, President

"Our ARR of $1.1 billion, up 34% year over year, reflects real momentum. This isn’t just from new customers—it’s from existing users buying more of what we’re building."

Axon Assistant

Rick Smith, Chief Executive Officer

"The Axon Assistant is a voice-driven AI tool that enhances safety and response on the frontlines. Real-time translation isn’t just a convenience—it’s mission-critical technology that allows an officer to engage confidently in any language context."

Josh Isner, President

"We’re seeing incredible interest in Assistant, particularly from agencies along the U.S. border and in diverse urban regions. It's another reason departments are excited about upgrading to our AI bundles."

DraftOne

Josh Isner, President

"Draft One is the fastest-adopted software product in our history, with nearly 30,000 active users one year in. Departments are recognizing that this technology doesn’t just save time—it redefines how officers spend their time."

Rick Smith, Chief Executive Officer

"Draft One and the AI Era Plan are changing how agencies think about value. We’re no longer talking about standalone tools—we’re talking about bundled platforms that improve safety, efficiency, and officer well-being."

Competitors

Josh Isner, President

"We entered the fixed ALPR space because we believed we could provide best-in-class technology at a better value than existing vendors. Early customer reaction confirms that belief—agencies are coming to us with large-scale deployment requests right out of the gate."

Customers

Josh Isner, President

"Five of our top 10 Q1 domestic deals included OSP 10 Premium, and two included Draft One. That’s the strongest signal yet that our customers are not just adding—they’re upgrading."

Rick Smith, Chief Executive Officer

"What we’re hearing from agencies isn’t concern about over-reliance on Axon—it’s the opposite. They’re asking us to do more because they know it will work, and they trust us to integrate their tech ecosystems in ways others can't."

Strategic Partnerships

Rick Smith, Chief Executive Officer

"Ring integrating with Axon’s community request service is just the beginning. We’re building a coalition of public safety technologies that connect law enforcement and communities while maintaining privacy and choice."

Josh Isner, President

"Our partnership with Ubiquiti opens up millions of light poles for plug-and-play camera deployments. That dramatically reduces installation friction and speeds up time-to-impact for our fixed video products."

International Growth

Josh Isner, President

"We’re seeing strong demand globally—from Australia and Latin America to the UK and Asia. These are not just TASER orders anymore—they're multi-product deployments with cloud, video, and software bundled in."

Rick Smith, Chief Executive Officer

"With the appointment of a new CRO and sharper execution, our international teams are showing what’s possible when we treat those markets as core, not secondary."

Challenges

Brittany Bagley, Chief Financial Officer

"We expect a 50-basis point impact to adjusted EBITDA margin for the full year due to tariffs, but we’ve offset much of that through proactive supply chain decisions. We're not passing that cost to our customers at this point."

Josh Isner, President

"In the federal segment, the volume of opportunity is temporarily at a standstill due to budget reconciliation, but it doesn’t change our conviction. We’re focused on high-priority deals that can close once clarity returns."

Future Outlook

Brittany Bagley, Chief Financial Officer

"We’ve raised our 2025 revenue guidance to $2.6 to $2.7 billion, reflecting our confidence in the pipeline and the strength of Q1 bookings. At the same time, we’re holding our EBITDA margin target at 25%—even while ramping investment in R&D."

Rick Smith, Chief Executive Officer

"We are at the beginning of a long innovation cycle that will shape public safety for decades. The convergence of hardware, AI, and real-time intelligence puts us in a position to lead—not just compete."

Thoughts on Axon Earnings Report $AXON:

🟢 Positive

Revenue grew to $604M, up +31% YoY, beating estimates by +6.5%

Software & Services revenue rose +38.7% YoY to $263M, with 74.2% gross margin

Connected Devices revenue increased +26.1% YoY to $340.9M, with 50.1% gross margin

ARR reached $1.1B, up +33.8% YoY

Total future contracted revenue increased to $9.90B, up +40.7% YoY

Gross margin (non-GAAP) rose to 63.6%, up +0.4pp YoY

Net new ARR hit $103M, up +10.8% YoY

SG&A improved to 25.2% of revenue, down -2.9pp YoY

Draft One reached ~30K users in under 12 months

TASER 10 adoption pacing 2x faster than TASER 7

Axon Assistant and fixed ALPR cameras generated strong early agency demand

International bookings hit a Q1 record, with broad regional growth

NRR stable at 123%

EPS (non-GAAP) was $1.41, beating estimates by +0.7%

🟡 Neutral

Operating expenses: R&D rose to 15.7% of revenue (+0.8pp YoY)

CAC payback extended to 25.6 months from 21.1 in Q4

FY25 revenue guidance of $2.55–$2.65B (+24.7% YoY) was in line with estimates

FedRAMP approval for FUSUS is pending final certification

🔴 Negative

Operating margin fell to -1.5%, down -5.0pp YoY

Net margin declined to 14.6%, down -14.3pp YoY

SBC/revenue rose to 23%, up +0.5pp QoQ

Basic shares up +2.0% YoY; diluted shares up +5.6% YoY

Tariffs expected to reduce FY EBITDA margin by 50bps

Drone hardware remains supply-constrained

Federal bookings remain limited by budget delays