Financial Results:

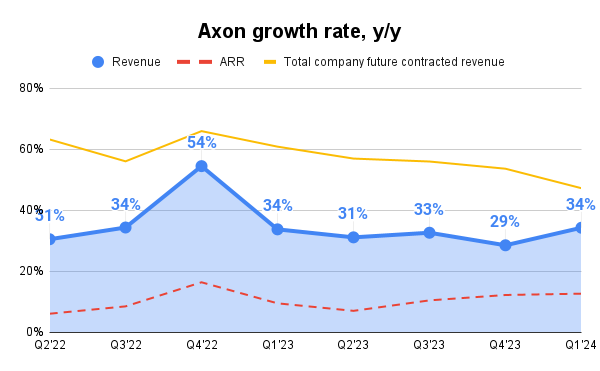

↗️$461M rev (+34.3% YoY, +28.6% LQ) beat est by 4.3%

↘️GM (56.4%, -3.1%pp YoY)

↗️GM* (63.2%, +3.4%pp YoY)

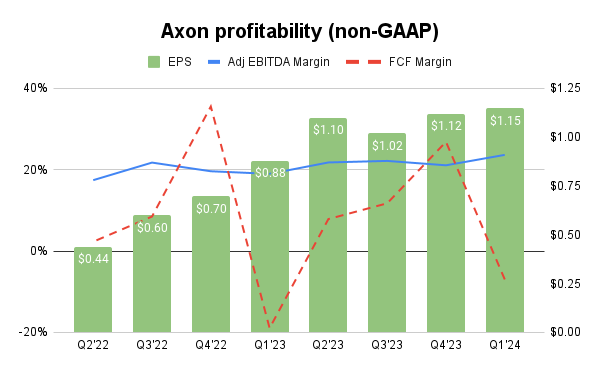

↗️Adj EBITDA Margin (23.6%, +4.7%pp YoY)

↗️FCF Margin (-7.0%, +12.0%pp YoY)

↗️Net Income Margin* (19.3%, +0.4%pp YoY)

↗️EPS* $1.15 beat est by 22.3%

*non-GAAP

Revenue By Segments

TASER

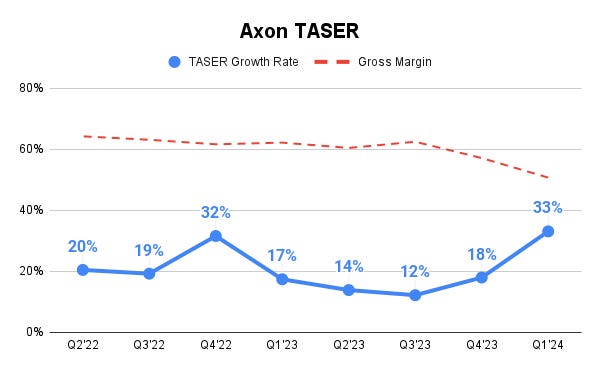

➡️$178.7M TASER rev (+33.1% YoY)

↘️GM (50.7%, -11.5%pp YoY)

Sensors and other

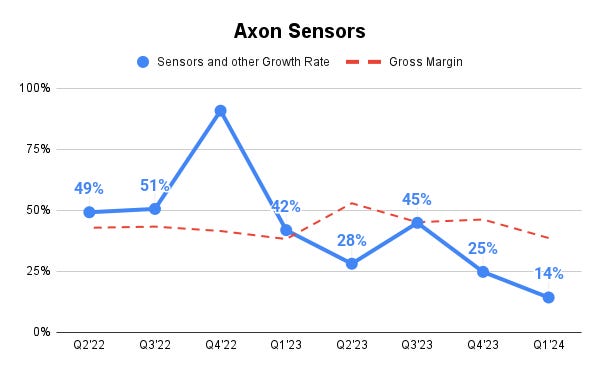

➡️$105.5M Sensors and other rev (14.3% YoY)

↗️GM (38.7%, +0.4%pp YoY)

Axon Cloud

↗️$176.5M Axon Cloud rev (+51.5% YoY)

↘️GM (72.8%, -0.4%pp YoY)

Key Metrics

➡️NRR 122% (122% LQ)

↗️Total company future contracted revenue $7.04B (+47.0% YoY)

↗️ARR $825M (+50.0% YoY)🟢

Operating expenses

↘️SG&M*/Revenue 28.1% (28.2% LQ)

↘️R&D*/Revenue 14.9% (15.3% LQ)

↘️Cost of product and service sales*/Revenue 12.7% (15.6% LQ)

↗️Net New ARR $93M ($80 LQ, +94.0% YoY)

Dilution

↗️SBC/rev 16%, +8.0%pp QoQ

↗️Share count up 4.4% YoY, +0.0%pp QoQ🟡

Guidance

↗️Q2'24$1,940.0 - $1,990.0M guide (+25.7% YoY) beat est by 1.8%

Key points from Axon’s First Quarter 2024 Earnings Call:

Drone Technology and Acquisition of Dedrone:

Axon is expanding into drones, robotics, and aerospace security, emphasizing the massive potential of Drone as a First Responder (DFR) programs. This aims to enhance response times and decision-making in emergencies.

The acquisition of Dedrone is seen as a strategic move to overcome FAA limitations on drone operations, allowing drones to operate in low visibility without human observers.

Artificial Intelligence Innovations:

The company introduced "Draft One," an AI-powered tool designed to produce police reports from body camera footage. This is intended to reduce the time officers spend on administrative tasks, thereby improving efficiency.

TASER:

The TASER 10 has shown robust demand, driving a 33% year-over-year growth in the TASER segment. The focus is on ramping up capacity to meet demand while navigating the balance between capacity expansion and cost-down initiatives.

Sensors:

Revenue from sensors grew 14% year-over-year, primarily driven by the adoption of the Axon Body 4 camera. This growth was slightly offset by a normalization in fleet revenue following a previous surge.

Axon Cloud:

Revenue from cloud and services grew by 51.5% year-over-year, fueled by increases in both user base and premium product add-ons.

Market Expansion and Future Guidance:

The acquisition of Dedrone is expected to expand Axon's total addressable market (TAM) by $14 billion, bringing it to $77 billion.

Axon raised its full-year 2024 revenue guidance, anticipating continued strong demand, especially for its TASER 10 product and new AI applications.

The leadership emphasized the importance of continued innovation across various fronts, including virtual reality (VR) training and real-time operation solutions, which are essential for modernizing public safety operations.

Leadership:

Axon welcomed Cameron Brooks as the new Chief Revenue Officer, enhancing the team with his experience from Amazon Web Services. His expertise is expected to drive cloud adoption and support international expansion.

Challenges:

Despite strong financial performance, there are challenges such as navigating the regulatory environment for drone operations and integrating acquisitions like Dedrone.

Management comments on the earnings call.

TASER

Josh Isner: "TASER 10 is a monster, it's the most popular TASER device we have ever brought to market. It's out cycling the TASER 7 demand by double."

Sensors

Brittany Bagley: "Sensors and other revenue grew 14% year-over-year with the adoption of Axon Body 4 driving camera revenue, somewhat offset by lapping the big catch-up in fleet revenue from Q1 last year as we're now at more normalized deployment levels."

Axon Cloud

Brittany Bagley: "Our ARR for the quarter is $825 million, up almost 50% year-over-year and it now includes Fusus and our TASER warranty revenue."

Future Outlook

Josh Isner: "Looking ahead, I see many opportunities for continued growth. We believe our domestic state and local law enforcement customers are eager to adopt the new products that we have brought to the market and we are seeing our emerging markets become more meaningful contributors to our results."

Dedrone

Rick Smith: "The planned combination of Dedrone with Axon is a natural extension of our strategy with several tangential applications already deployed in the field, including stadium, aerospace security, along with robust military, critical infrastructure and other civilian protection applications."

Draft One

Rick Smith: "Draft One leverages AI to produce police reports from body camera, audio and video... This is valuable time they could be spending in their communities, with their families, in training or on their own well-being."

Leadership

Josh Isner: "We have spent the last two years fortifying and rebuilding our leadership team and we are ready-to-move faster than ever. We are focused on the right areas to continue delivering in the quarters and years to come, both on our financial commitments and on our mission."

Challenges

Rick Smith: "But limitations exist that today have hindered the use of DFR at-scale. Namely, current FAA requirements mandate the presence of a human virtual observer standing on a rooftop to ensure each drone remains in a direct line-of-sight."

Thoughts on Axon Enterprise ER $AXON:

🟢 Pros:

+ Revenue accelerates to +34.3% YoY.

+ FY 2024 guidance increased by 2.6%.

+ Axon Cloud revenue growth rate accelerates to +51.5% YoY.

+ Dollar-Based Net Retention (DBNR) is stabilizing at 122%.

+ Annual Recurring Revenue (ARR) and Total company future contracted revenue are growing faster than revenue.

+ Recorded a record number of net new ARR.

+ The company is increasing margins and profitability.

+ TASER 10 has shown robust demand.

+ The company introduced "Draft One," which leverages AI to produce police reports from body cameras.

🟡 Neutral:

+- SBC/rev increased to 16%.

+- Gross Margin dropped to 56.4% due to increased stock-based compensation. Adjusted gross margin for the quarter was 63.2%, up from 61.5% in Q4.