Axon Enterprise – Public Safety Technology Leader

Deep Dive into $AXON: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Axon Enterprise: Company overview

About the Company

Axon Enterprise Inc., headquartered in Scottsdale, Arizona, is a global leader in public safety technology. Founded in 1993 as TASER International, the company evolved from developing energy weapons into an end-to-end law enforcement technology provider. The product ecosystem includes TASER devices, body-worn cameras, in-car cameras, cloud-based digital evidence management (Axon Evidence), and real-time operations tools. Axon serves law enforcement agencies, private security firms, and public safety organizations worldwide, generating $2.08 billion in revenue over the trailing twelve months.

Company Mission

Axon's mission is to "protect life" by delivering technology-driven public safety solutions. The company aims to reduce gun-related fatalities between police and civilians by 50% within a decade while enhancing operational efficiency for law enforcement agencies. A focus on ethical technology use, transparency, and accountability drives innovation in AI-powered policing tools and digital evidence management solutions.

Sector

Axon operates in public safety technology, a market at the intersection of law enforcement, AI-driven analytics, and digital security. The company holds a 72.4% market share in body-worn cameras among major U.S. police departments and dominates digital evidence management with Axon Evidence. The client base includes federal, state, and local law enforcement agencies, with expanding penetration into private security and international markets.

Competitive Advantage

Axon maintains a 94% customer retention rate, supported by multi-year contracts and deep integration into agency workflows. The hardware-software synergy across TASERs, body cameras, and AI-powered evidence tools creates a sticky ecosystem with high switching costs. Continuous investment in R&D drives proprietary advancements, strengthening product differentiation. A strong brand reputation and trusted relationships with law enforcement agencies solidify Axon's leadership in public safety innovation.

Valuation

$AXON is trading at a Forward EV/Sales multiple of 15.37, above the median of 9.18 (since early 2022). In Q4 2024, the company's Forward EV/Sales multiple reached 21, its historical high. Although the multiple has corrected significantly, Axon still trades at a premium based on the Forward EV/Sales multiple.

$AXON trades at a Forward P/E of 89.77.

The EPS growth forecast for 2025 is 34.2%, with a 2025 PEG ratio of 2.6.

Based on the PEG multiple, the company appears expensive, but it is a high-growth company with revenue increasing over 30% YoY.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Analysts forecast $AXON's revenue growth at +25.2% in 2025. When comparing it to other SaaS companies, using the P/GP multiple is a more rational approach. Based on this forecast, Axon's valuation appears to be trading at a premium compared to other SaaS companies.

Next, let's assess whether the premium valuation of the $AXON stock is justified. We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue growth trends and the forecast for the next quarter, and identify factors that could help the company exceed expectations and drive future growth.

We'll examine the performance of key segments, the launch of new products and updates, the growth in customer acquisition, key financial metrics, the company's financial stability, and margin trends. Additionally, we'll assess the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions.

Economic Moat of $AXON

Axon’s competitive moat secures long-term revenue growth and stability. The five key factors driving its economic advantage include:

Economies of Scale: A large and expanding customer base allows Axon to spread fixed costs across R&D, manufacturing, and customer support, enhancing efficiency and pricing power.

Network Effect: Axon Evidence grows more valuable as more agencies use it, creating a self-reinforcing cycle that drives further adoption.

Brand Strength: Axon’s TASER devices and body cameras are industry standards, trusted by law enforcement agencies globally.

Intellectual Property: Axon holds multiple patents across TASERs, AI-powered software, and cloud security, ensuring product differentiation.

Switching Costs: Multi-year contracts (5–10 years) make switching providers costly and disruptive, keeping customers locked into Axon’s ecosystem.

This strong moat reinforces Axon’s market leadership, ensuring sustained revenue growth.

Revenue growth

$AXON's revenue growth continued to accelerate, reaching +33% YoY in Q4 2024. The company provided a full-year 2025 forecast above the initial 2024 guidance, reflecting management's optimism about future revenue growth. RPO and ARR are growing faster than revenue, at +41.5% and +36.7%, respectively. RPO growth accelerated in the last quarter.

*RPO - future contracted revenue

$AXON has several segments.

TASER includes conducted energy weapons used by law enforcement and military agencies. Continuous innovation in TASER technology enhances safety and effectiveness, driving global adoption.

Sensors covers body-worn cameras, in-car video systems, and automated license plate readers. Integration with Axon’s software ecosystem improves transparency and operational efficiency for public safety agencies.

Software & Services includes Axon Evidence, Axon Records, and AI-driven transcription tools. Cloud-based solutions streamline evidence management, enhance data security, and improve collaboration across agencies.

Cloud powers digital transformation in public safety. Scalable AI-driven tools automate processes, enhance analytics, and create a fully integrated ecosystem for law enforcement and enterprise clients.

$AXON Segment Performance in the Last Quarter

Axon Cloud remains the highest-margin segment, with its share increasing from 37% two years ago to 40% in Q4 2024, and continuing to rise. Revenue growth accelerated to +41% YoY, while gross margin improved to 74%.

TASER accounts for 38% of revenue, down from 41% two years ago. Revenue growth accelerated to +37% YoY. TASER 10 orders are outpacing TASER 7 by 2x, with strong demand from emerging markets and non-U.S. customers. Seven of the ten largest TASER 10 orders to date came from federal, international, and corrections agencies, rather than U.S. state and local law enforcement. Expanding TASER 10 deployment internationally is a priority, positioning it as a primary non-lethal weapon for global law enforcement. Investment in manufacturing capacity is a key focus to meet rising demand.

Sensors & Services contributed 21% of revenue, but revenue growth slowed to 15% YoY. Despite this, the segment is seeing strong adoption of connected technology, improving operational efficiency for customers. The integration of Fusus is strengthening Axon’s real-time operations platform, improving sensor connectivity and public safety transparency. Enterprise adoption is accelerating, with a major logistics provider signing the largest enterprise deal in Axon’s history. International bookings surged nearly 50% sequentially in Q4, following 40% sequential growth in Q3. Enterprise segment bookings tripled YoY, highlighting its potential as a major future growth driver.

Axon Cloud ARR reached $1 billion, growing +37% YoY. The company is experiencing rapid adoption of AI-powered solutions, with the AI Era Plan securing its first ten deals within weeks of launch. Over 100,000 incident reports have already been completed using AI-powered drafting tools, significantly reducing law enforcement’s administrative workload. The launch of real-time translation capabilities is expanding Axon’s cloud functionality, further increasing adoption.

Product innovations

Last quarter, $AXON released several important updates and reported some achievements:

Strategic acquisitions in drone technology, including Skydio and Dedrone, are expanding Axon’s capabilities in autonomous response and situational awareness. The integration of AI into body-worn cameras is transforming them into intelligent, real-time assistance tools. Axon is positioning itself to capitalize on increasing demand for AI-driven automation, with solutions that improve efficiency while reducing operational costs for customers.

Major Wins

$AXON Major Wins: Enterprise, International, and Federal Sector Growth

Landmark Enterprise Deal Axon secured its largest enterprise contract in Q4 2024 with a global logistics provider. The deal includes Axon body-worn cameras and Fusus for real-time crime center integration with Evidence.com. Rising enterprise demand for security and operational efficiency is driving adoption. Fusus enhances transparency, incident response, and employee safety. Enterprise adoption is expected to expand, making it a key growth driver.

International Expansion International bookings grew 50% sequentially in Q4, following a 40% increase in Q3. Seven of the top 10 TASER 10 orders came from international, federal, and corrections markets. The expanding product portfolio, including Fusus, Dedrone, and AI-driven solutions, is accelerating global adoption. Axon sees international expansion as a long-term revenue driver, strengthening market penetration and customer acquisition.

Federal Sector Growth Despite federal funding concerns, Axon remains optimistic. Federal contracts remain unaffected, with agencies continuing to adopt body-worn cameras and TASER devices. AI-powered solutions like Draft One are gaining traction, reducing administrative workloads. Axon is actively exploring broader AI applications to enhance operational efficiency in federal agencies. Increased AI adoption solidifies Axon's position as a key federal technology provider, with continued growth expected.

Flock Safety Partnership

Concerns Over $AXON and Flock Safety Partnership Termination

Axon ended its partnership with Flock Safety, shifting focus to FUSUS-based ALPR alternatives. The termination was due to data-sharing concerns, with Axon advocating greater transparency.

Axon is evaluating in-house ALPR solutions to enhance traffic enforcement, investigations, and surveillance.

The FUSUS acquisition strengthens real-time surveillance and crime center integrations, connecting public and private cameras, body-worn sensors, and monitoring tools into a single cloud-based platform.

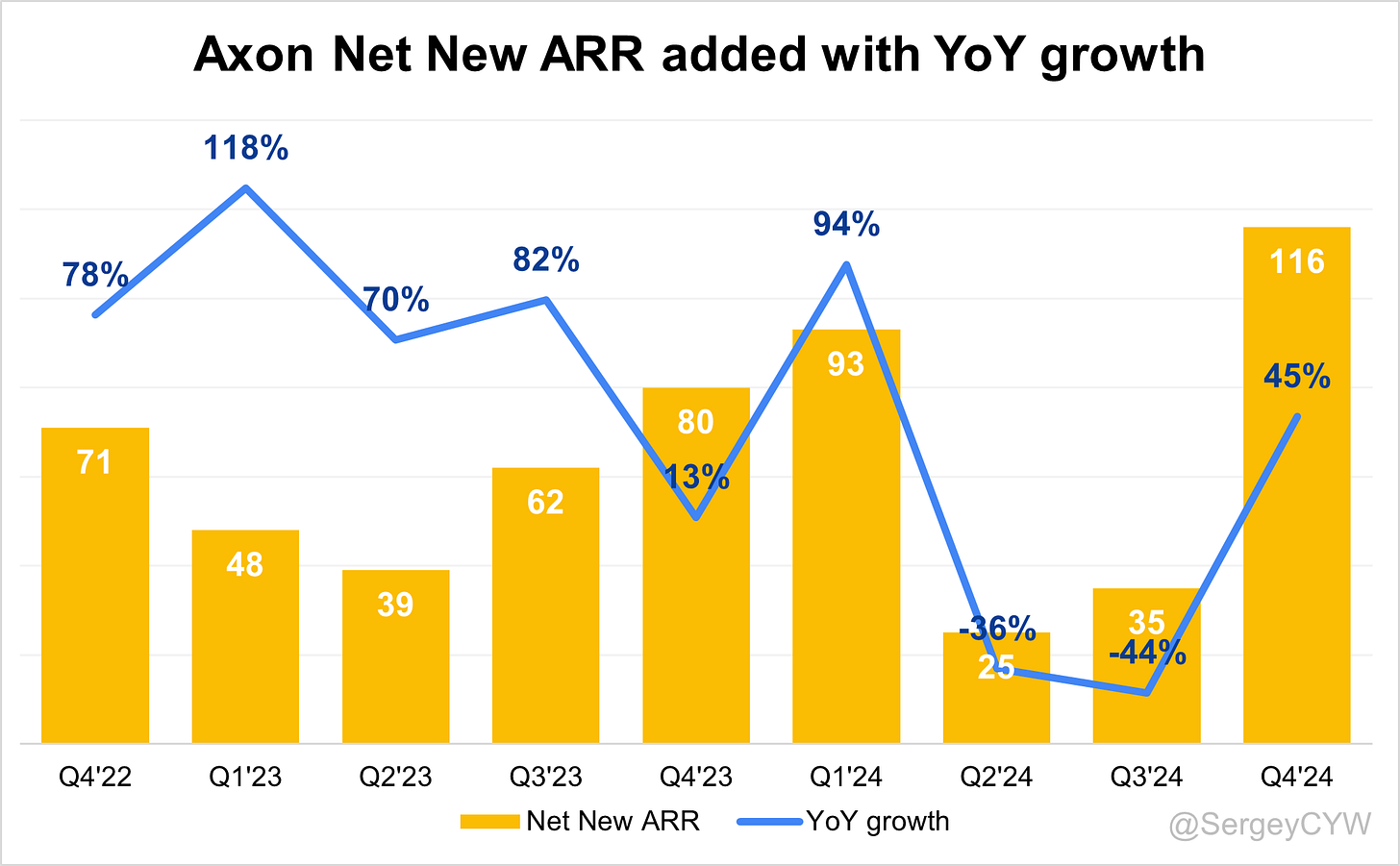

Net new ARR

$AXON added a record number of net new ARR in Q4 2024, increasing by +116, reflecting +45% YoY growth.

CAC Payback Period

$AXON's return on S&M spending is 21.1, with the CAC Payback Period at a healthy level. However, only 40.8% of the company's revenue comes from the subscription model. When calculating the CAC Payback Period for Axon Cloud, the payback improved in the last quarter.

Retention

$AXON's Retention Rate (NDR) has been gradually increasing over the past two years, reaching 123% in the last quarter, which is a high level for SaaS companies.

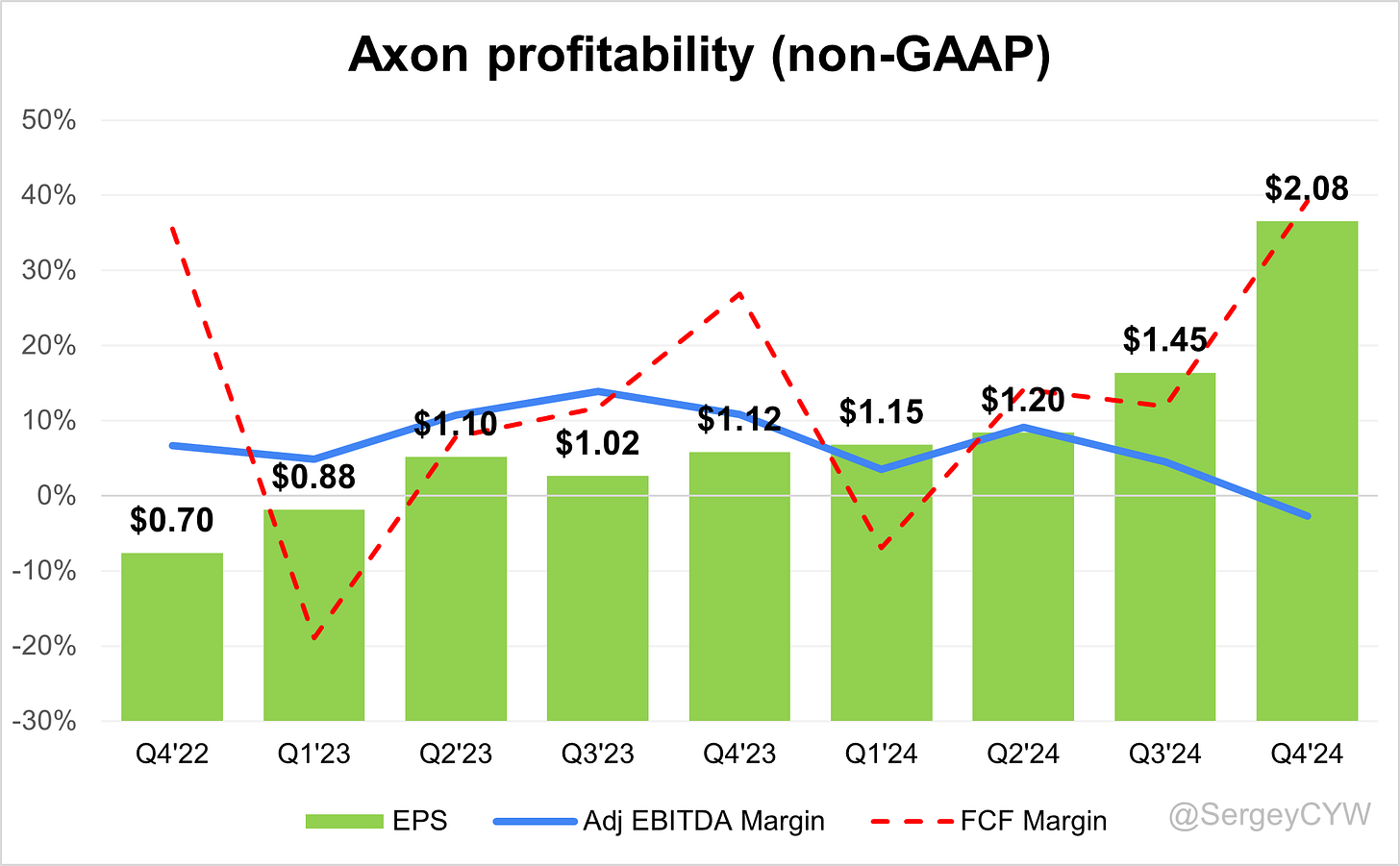

Profitability

Over the past year, $AXON's margins have changed:

Non-GAAP Gross Margin increased from 61.5% to 63.2%.

GAAP Operating Margin decreased from 10.8% to -2.7%, due to higher SBC expenses.

FCF Margin increased from 26.8% to 39.2%.

Operating expenses

$AXON's Non-GAAP operating expenses have decreased due to reduced SG&M spending, with SG&M expenses dropping from 29% two years ago to 27%. The R&D share remains high at 15% as the company actively invests in its future growth.

Balance Sheet

$AXON Balance Sheet: Total debt stands at $735M. The company's debt increased significantly in Q4 2022 following a major acquisition*. However, the balance sheet remains stable.

*In 2022 and 2023, Axon Enterprise made several strategic acquisitions to enhance its public safety technology offerings:

April 2022: Acquired Foundry, a company specializing in data integration and analytics, to bolster Axon's data management capabilities.

July 2023: Acquired a 48% stake in Sky-Hero, a Belgian company known for its tactical robotics and drone technology, aiming to improve situational awareness and response strategies.

February 2024: Announced the acquisition of a 34% stake in Fūsus, a provider of real-time crime center solutions, to enhance Axon's real-time operations capabilities.

May 2024: Acquired a 45% stake in Dedrone, a leader in smart airspace security solutions, to address emerging threats from unauthorized drones.

Dilution

$AXON Shareholders Dilution. Axon Enterprise's stock-based compensation (SBC) expenses have increased significantly in recent quarters. This rise in SBC has contributed to a 6% year-over-year increase in the weighted-average number of diluted common shares outstanding, leading to notable shareholder dilution.

Conclusion

$AXON remains an innovative company, maintaining high R&D spending while increasing the share of high-margin Axon Cloud revenue as a percentage of total revenue.

Axon is strengthening its competitive position and has raised its TAM estimate for drones and robotics to $20 billion, reflecting growing demand for automated situational awareness.

International growth accelerated, with bookings increasing 50% sequentially in Q4, following a 40% rise in Q3. The company also secured a landmark enterprise deal in Q4 2024 with a global logistics provider, marking its largest enterprise contract to date.

The termination of the Flock Safety partnership raises some concerns, but management attributes the decision to a push for greater transparency and a shift in focus to FUSUS-based ALPR alternatives, following the recent FUSUS acquisition.

Leading Indicators

ARR growth of +36.7% and RPO growth of +41.5% exceed revenue growth, with RPO growth accelerating in Q4.

Record Net New ARR was added in Q4, increasing +45% YoY.

Key Indicators

Net Dollar Retention (NDR) remains high for a SaaS company, with growth sustained over the past two years.

The CAC Payback Period is strong, particularly for Axon Cloud, where payback on S&M improved last quarter.

The valuation based on P/GP multiples appears reasonable compared to other SaaS companies, given high revenue growth and stability. However, Axon is not a pure SaaS company, with subscription revenue accounting for 40% of total revenue.

Relative to its historical Forward EV/Sales and Forward P/E multiples, Axon trades at a premium, though valuation has declined from late 2024 highs.

A key concern is rising SBC/Revenue, which has increased to 23%. It would be preferable for the company to gain better control over this expense.

Currently, my $AXON position is 7.8% of my portfolio. I increased my position after a strong Q4 earnings report. My conviction in Axon remains very high.

Excellent write up! Solid company! Happy to be in it