Axon Enterprise: Building the Future of Public Safety

Deep Dive into $AXON: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Axon: Company overview

About Axon Enterprise

Axon Enterprise operates as a public safety technology company headquartered in Scottsdale, Arizona. Founded in 1993 by Rick Smith and Tom Smith as Air Taser Inc., the company has evolved from a conducted energy weapons manufacturer into a comprehensive public safety ecosystem provider. Axon employs approximately 4,970 people globally and generates $2.1 billion in annual revenue as of 2024. The company operates through two primary segments: Software and Sensors, which accounts for the majority of revenue, and TASER devices. Axon went public in 2001 as TASER International, raising $11.7 million in its IPO, before rebranding to Axon Enterprise in 2017 to reflect its expanded technology focus.

Company Mission

Axon's mission centers on a simple yet powerful statement: "Protect Life". The company's vision extends beyond immediate safety concerns, aiming to create "a world where bullets are obsolete, where social conflict is dramatically reduced, and where everyone has access to a fair and effective justice system". Axon has established ambitious long-term goals including cutting gun-related deaths between police and public by 50% in 10 years. The mission drives product development toward eliminating administrative burdens for officers, with plans to triple the time officers spend serving communities in the next decade by removing manual paperwork. Within 50 years, Axon aims to make bullets obsolete through technological innovation.

Sector

Axon operates within the Aerospace & Defense sector, specifically focused on public safety technology solutions. The company serves five primary customer categories: U.S. state and local governments, U.S. federal government, international governments, enterprises, and civilians. Revenue concentration remains highest within U.S. state and local law enforcement, where Axon estimates below 15% market penetration. The company's product portfolio spans conducted energy devices, body-worn cameras, digital evidence management systems, real-time operations software, and AI-powered solutions. Axon's 2024 revenue grew 33% to reach $2.1 billion, marking the third consecutive year of 30%+ annual growth.

Competitive Advantage

Axon maintains several key competitive advantages that create significant barriers to entry. The company's TASER devices hold substantial intellectual property and are recognized as the industry standard, providing first-mover advantage and strong brand loyalty. Axon's integrated ecosystem approach seamlessly connects hardware (TASER devices, body cameras) with cloud-based software platforms (Axon Evidence, Axon Records), creating powerful customer lock-in effects. The company benefits from economies of scale in manufacturing and an extensive network of law enforcement relationships built over 30 years. Axon's recurring revenue model generates $1.0 billion in annual recurring revenue with high customer retention rates. The company's commitment to innovation is evident through substantial R&D investments, with $114.5 million allocated in Q3 2024 alone, up from $76.9 million in the prior year.

Total Addressable Market (TAM)

Axon Enterprise’s total addressable market has expanded to $129 billion in 2025, a sharp increase from approximately $50 billion in 2023. The updated TAM reflects Axon’s evolution beyond U.S. law enforcement into international markets, enterprise verticals, and AI-driven applications.

Law enforcement still accounts for 50% of the TAM, but the largest expansion is coming from new verticals. International governments across 100+ countries and enterprise sectors—where frontline workers outnumber public safety professionals 20:1—offer untapped potential. AI-driven solutions under the AI Era Plan also contribute to the expanded opportunity.

Despite strong topline growth, Axon has captured less than 2% of its total addressable market. With $2.1 billion in 2024 revenue, the company still has significant headroom.

Penetration remains below 15% in the U.S. state and local law enforcement segment, the most mature part of the business. International adoption is in early stages, while enterprise markets like healthcare and transportation are largely untouched.

Key drivers of TAM expansion include AI integration into public safety, product innovation in drones, robotics, and VR training, and a growing base of recurring revenue. Axon now generates $1.0 billion in annual recurring revenue, reinforcing long-term visibility.

The TAM growth to $129 billion signals a structural shift—new products, new geographies, and new industries are opening up. Axon is no longer just a Taser and body cam company. It's building the digital infrastructure for global public safety.

Valuation

$AXON is trading at a Forward EV/Sales multiple of 21.81, well above the sector median of 7.5. In Q4 2024, the multiple hit a historical high of 21, and that all-time high has now been surpassed, with the current Forward EV/Sales at a new ATH.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

$AXON trades at a Forward P/E of 125.0, with revenue growth of +31.0% YoY in the last quarter.

The EPS growth forecast for 2026 is 24.0%, with a P/E of 125.2 and a PEG ratio of 5.2.

The EPS growth forecast for 2027 is 17.2%, with a P/E of 100.9 and a PEG ratio of 5.8.

Based on the PEG multiple, the company appears expensive, but it is a high-growth company with revenue increasing over 30% YoY.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Analysts forecast $AXON's revenue growth at +30.1% in 2025 and +22.8% in 2026. When comparing it to other SaaS companies, using the EV/GP multiple is a more rational approach. Based on this forecast, Axon's valuation appears to be trading at a premium compared to other SaaS companies.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Economic Moats enable companies to remain stable during crises and support long-term revenue growth.

Economies of Scale

Axon Enterprise demonstrates strong economies of scale that create significant competitive advantages in the public safety technology market. The company's $2.1 billion in annual revenue as of 2024 allows it to spread substantial R&D investments across a large customer base. With $187.3 million invested in R&D during 2023, representing approximately 9% of total revenue, Axon can amortize these costs across 17,000+ public safety agencies it serves. The company's manufacturing scale enables cost efficiencies in producing TASER devices and body cameras, while its cloud infrastructure benefits from marginal cost advantages as more agencies utilize the platform. Axon's 67.4% gross margin in 2023 reflects the operational leverage achieved through scale. However, compared to pure software companies, Axon's hardware component limits the full realization of economies of scale benefits.

Network Effects

Axon exhibits very strong network effects through its integrated ecosystem approach. The Axon Network creates substantial value as more agencies join the platform, enabling seamless collaboration between police departments, first responders, public defenders, and prosecutors. Each additional user contributes value to existing users through enhanced data sharing capabilities and improved operational efficiency. The company's Axon Evidence platform demonstrates powerful network effects - the more agencies that use it, the more valuable it becomes for inter-agency collaboration and data sharing. With over 250 petabytes of cloud storage capacity and 18,000+ law enforcement agencies on the platform, the network effects strengthen continuously. The integration of devices, apps, and software creates a true network effect where each additional component makes the entire public safety ecosystem more valuable. This network effect is particularly strong in digital evidence management, where cross-agency collaboration becomes increasingly important.

Brand Strength

Axon possesses exceptionally strong brand recognition within the law enforcement technology sector. The company maintains a 94% customer retention rate among law enforcement agencies and has been recognized as a leader in Gartner's Public Safety Technology Magic Quadrant for three consecutive years. The TASER brand itself has become synonymous with conducted energy weapons, providing significant brand equity. Axon serves 95% of law enforcement agencies in the USA and holds a 72.4% market share in body-worn camera systems. The brand strength is reinforced by the company's mission to "Protect Life" and its commitment to reducing gun-related deaths between police and public by 50% in 10 years. This mission-driven approach resonates strongly with law enforcement professionals and creates emotional brand connection beyond functional benefits. The brand's association with reliability, security, and near-100% uptime makes it the preferred choice for mission-critical public safety applications.

Intellectual Property

Axon maintains strong intellectual property protection through an extensive patent portfolio and proprietary technologies. The company holds 378 active patents as of 2024, with 142 hardware technology patents and 236 software solution patents. The patent portfolio is valued at approximately $75 million and spans body camera technology, digital evidence management, and conducted energy weapon systems. Axon's patent litigation success rate of 92% demonstrates the strength and defensibility of its intellectual property. The company's proprietary Axon Evidence cloud platform and digital evidence management systems represent significant technological assets that are difficult to replicate. However, intellectual property in the public safety technology sector faces challenges from rapid technological advancement and the potential for competitors to develop alternative approaches that circumvent existing patents.

Switching Costs

Axon benefits from exceptionally strong switching costs that create powerful customer retention advantages. Switching costs for digital evidence management platforms range between $1.2 million to $3.7 million per agency, with data migration expenses of $650,000 to $1.8 million. The company's integrated ecosystem approach means agencies face substantial integration costs, training requirements, and operational disruption when considering alternative providers. Enterprise software switching costs average $14,000 per user, which for large law enforcement agencies can represent millions in total switching expenses. Axon's virtually zero churn among large clients demonstrates the effectiveness of these switching costs. The complexity of migrating years of digital evidence, retraining personnel on new systems, and ensuring compliance with regulatory requirements creates formidable barriers to switching. The company's full-stack approach integrating hardware, software, and cloud services means customers would need to replace multiple interconnected systems simultaneously, significantly increasing switching complexity and costs.

Axon Enterprise possesses a wide economic moat with a GuruFocus Moat Score of 7/10, primarily anchored by exceptionally strong switching costs and network effects. The company's integrated ecosystem approach creates multiple reinforcing competitive advantages that make it extremely difficult for competitors to displace Axon once agencies are embedded in the platform. The combination of high switching costs, powerful network effects, and strong brand recognition creates formidable barriers to entry in the public safety technology market.

Revenue growth

$AXON's revenue growth has slightly slowed but remains at a very high level, up +31% YoY in Q1 2025. Management did not provide quarterly guidance for the next quarter, and the full-year outlook was not raised, which is worth noting.

However, RPO and ARR are both growing faster than revenue, at +40.7% and +33.8%, respectively—a strong signal of future revenue visibility and demand.

*RPO - future contracted revenue

Segments and Main Products

TASER includes conducted energy weapons used by law enforcement and military agencies. Continuous innovation in TASER technology enhances safety and effectiveness, driving global adoption.

Sensors covers body-worn cameras, in-car video systems, and automated license plate readers. Integration with Axon’s software ecosystem improves transparency and operational efficiency for public safety agencies.

Software & Services includes Axon Evidence, Axon Records, and AI-driven transcription tools. Cloud-based solutions streamline evidence management, enhance data security, and improve collaboration across agencies.

Cloud powers digital transformation in public safety. Scalable AI-driven tools automate processes, enhance analytics, and create a fully integrated ecosystem for law enforcement and enterprise clients.

Main Products Performance in the Last Quarter

$AXON Axon has revised its segment reporting, now breaking down total revenue into just Connected Devices and Software & Services, replacing the previous segmentation of Axon Cloud, TASER, and Sensors & Services.

Connected Devices revenue growth slowed to +26% YoY in Q1, while gross margin improved to 50%. This segment now accounts for 56% of total revenue.

Software & Services grew +39% YoY, with a high gross margin of 74%. It now represents 44% of total revenue, up from 41% a year ago.

Connected Devices

Connected Devices revenue reached $341 million, up 26% YoY, driven by strong performance across TASER 10, Axon Body 4 (AB4), Fleet, VR, and counter-drone systems. Growth is being supported by broader adoption across verticals, including state and local governments, enterprise, and international markets. Segment saw acceleration from bundled platform solutions, including ALPR hardware and real-time crime center integrations. Minor headwinds may surface later in the year due to tariff-related impacts, partially mitigated by strategic inventory investments and U.S.-based manufacturing.

TASER 10

TASER 10 continues its record-breaking adoption trajectory. Orders are pacing at 2x the adoption rate of TASER 7, making it the fastest-adopted TASER product to date. Five of the top ten Q1 U.S. deals included OSP10 Premium, which features TASER 10. The Apollo cartridge was introduced as a new technology to enhance deployment efficacy through thick clothing and cold environments, especially relevant for international expansion. Product is now considered mission-critical in both domestic and global markets, pushing Axon closer to replacing lethal force as a first-option defense.

Axon Cloud

Software & Services revenue grew 39% YoY to $263 million, with Annual Recurring Revenue (ARR) reaching $1.1 billion, up 34% YoY. Growth is coming from new user additions and higher premium add-on adoption, each contributing ~50%. Net Revenue Retention (NRR) remained strong at 123%, reflecting both upsells and strong retention. Cloud solutions are being widely deployed across state, local, enterprise, and international markets, with new products like Draft One and AI features accelerating demand.

AI Platform

Axon's AI momentum is building through Draft One and the broader AI Era Plan. Adoption in Q1 was strong, with Draft One reaching nearly 30,000 active users, doubling any prior product at this stage. AI features like real-time translation and Axon Assistant are now integrated into frontline workflows. AI-related bookings are expected to accelerate materially in Q3 and Q4, as more city councils approve deployments and budget plans. Pricing certainty and value bundling via the AI Era Plan help reduce friction during procurement cycles.

Axon Evidence

Digital Evidence Management remains a key driver behind the 34% ARR growth. Continued expansion into premium software tiers and growing device integration has created a more unified cloud ecosystem. Evidence.com remains a cornerstone of the Axon platform, tightly integrated into TASER, bodycams, fleet, and fixed surveillance infrastructure.

Axon Records

While not called out independently in financials, Axon Records continues to benefit from cross-sell opportunities via OSP10 and AI integrations. New features from the AI Era Plan are enhancing officer efficiency by automating record creation and classification.

Draft One

Fastest-growing software product in company history. Adoption surpassed 30,000 users, with 2 of the top 10 Q1 U.S. deals including Draft One. Pipeline is growing rapidly into Q3 and Q4, especially with the product now bundled into AI Era Plans. Significant momentum among U.S. state and local governments. Seen as a key value driver in Axon's strategy to automate workflows and reduce administrative load.

Fusus

Fusus drove record Q1 international bookings, contributing to growth in Australia, Canada, Asia, UK, Latin America, and Europe. Now FedRAMP recommended and pending final certification, unlocking full U.S. federal market access. Fusus anchors Axon’s Real-Time Crime Center strategy, now expanded with integrations into fixed cameras, ALPR, and partner platforms like Ring and Citizen. Product performance is increasingly mission-critical in U.S. urban deployments.

Axon Assistant

New voice-driven AI assistant embedded into officer workflows. Delivers real-time insights and situational awareness through existing hardware. Axon Assistant integrates voice commands and Draft One functionality, giving officers hands-free access to records, alerts, and language translation. Broad deployment is expected in the second half of 2025 as beta testing progresses.

Product Innovations and Updates

Axon is expanding its product stack with Fixed ALPR, Lightpost, and Outpost hardware. These products support license plate recognition, real-time alerts, and vehicle intelligence, filling in gaps across fixed and mobile surveillance. Partnerships with Ubicquia accelerate hardware deployment via access to 450M+ global streetlights, enabling one-minute installations without permits.

On the drone side, Axon is scaling Drone as First Responder (DFR) programs through partnerships with Skydio and Dedrone. FAA waivers are becoming easier to obtain, especially under 200 feet, driving adoption in public safety and border security. Dedrone technology is also seeing use in executive protection, military, and federal applications.

Axon also launched integrations with Auror to combat retail theft, positioning itself in the enterprise vertical. With rising organized crime and retailer pullouts from city centers, Axon’s ecosystem now directly supports loss prevention and real-time threat response.

ARR (Annual Recurring Revenue)

$AXON Axon ARR reached $1.104 billion, growing +34% YoY. The company is experiencing rapid adoption of AI-powered solutions, with the AI Era Plan securing its first ten deals within weeks of launch.

Retention

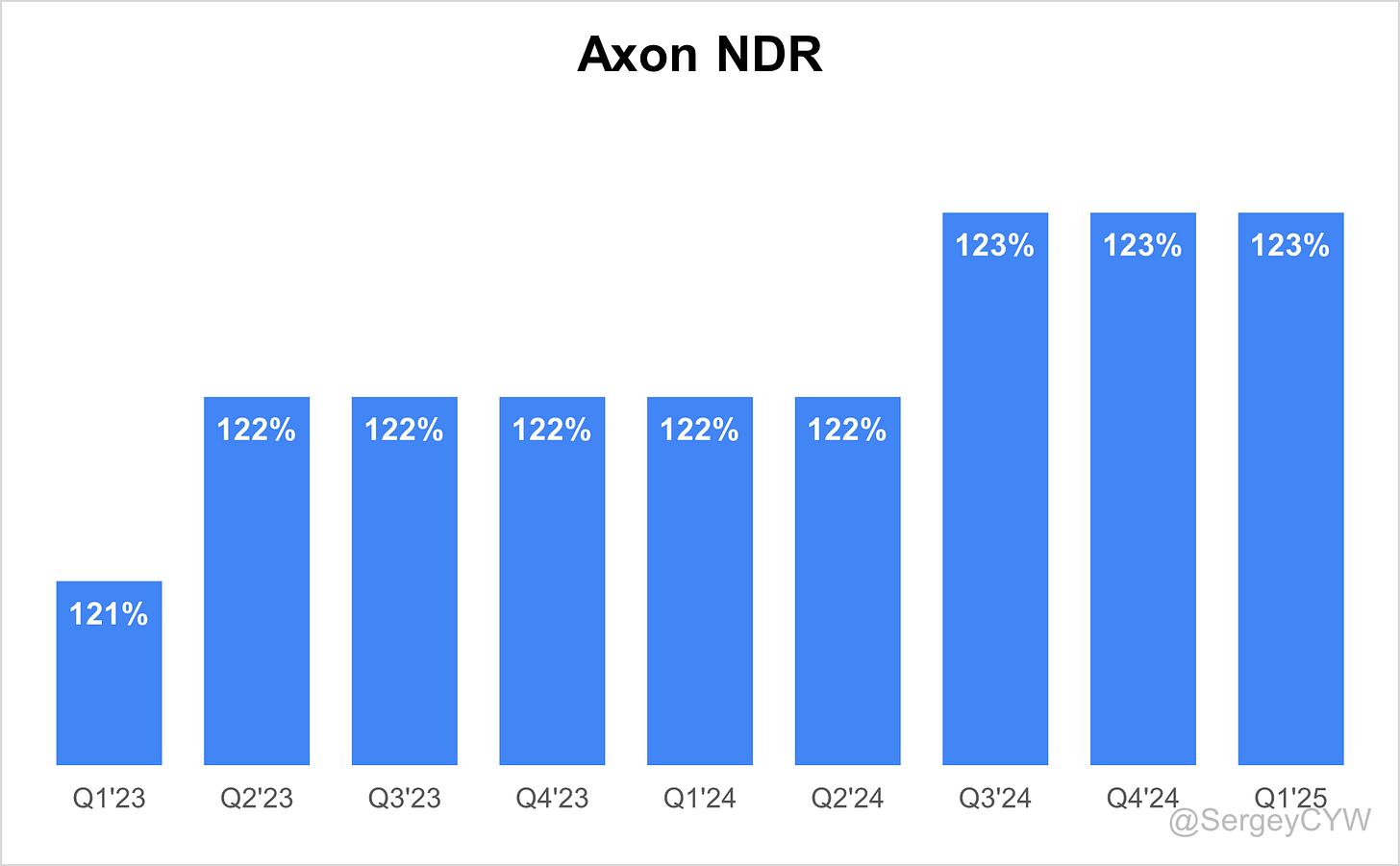

$AXON Retention Rate (NDR) has been gradually increasing over the past two years, reaching 123% in the last quarter, which is a high level for SaaS companies.

Net new ARR

$AXON added 103 net new ARR in Q1 2025, matching its record-level additions and reflecting +11% YoY growth.

CAC Payback Period

$AXON's return on S&M spending is 25.6, and the CAC Payback Period remains at a healthy level. In this case, it's important to focus less on the absolute number and more on the trend.

However, it's worth noting that only 44% of the company's revenue comes from the subscription model, which may limit recurring revenue visibility compared to pure SaaS peers.

Profitability

Over the past year, $AXON's margins have changed:

Non-GAAP Gross Margin increased from 56.4% to 63.6%.

GAAP Operating Margin decreased from 3.5% to -1.4%, due to higher SBC expenses.

FCF Margin decreased from 28.9% to 14.8%.

Operating expenses

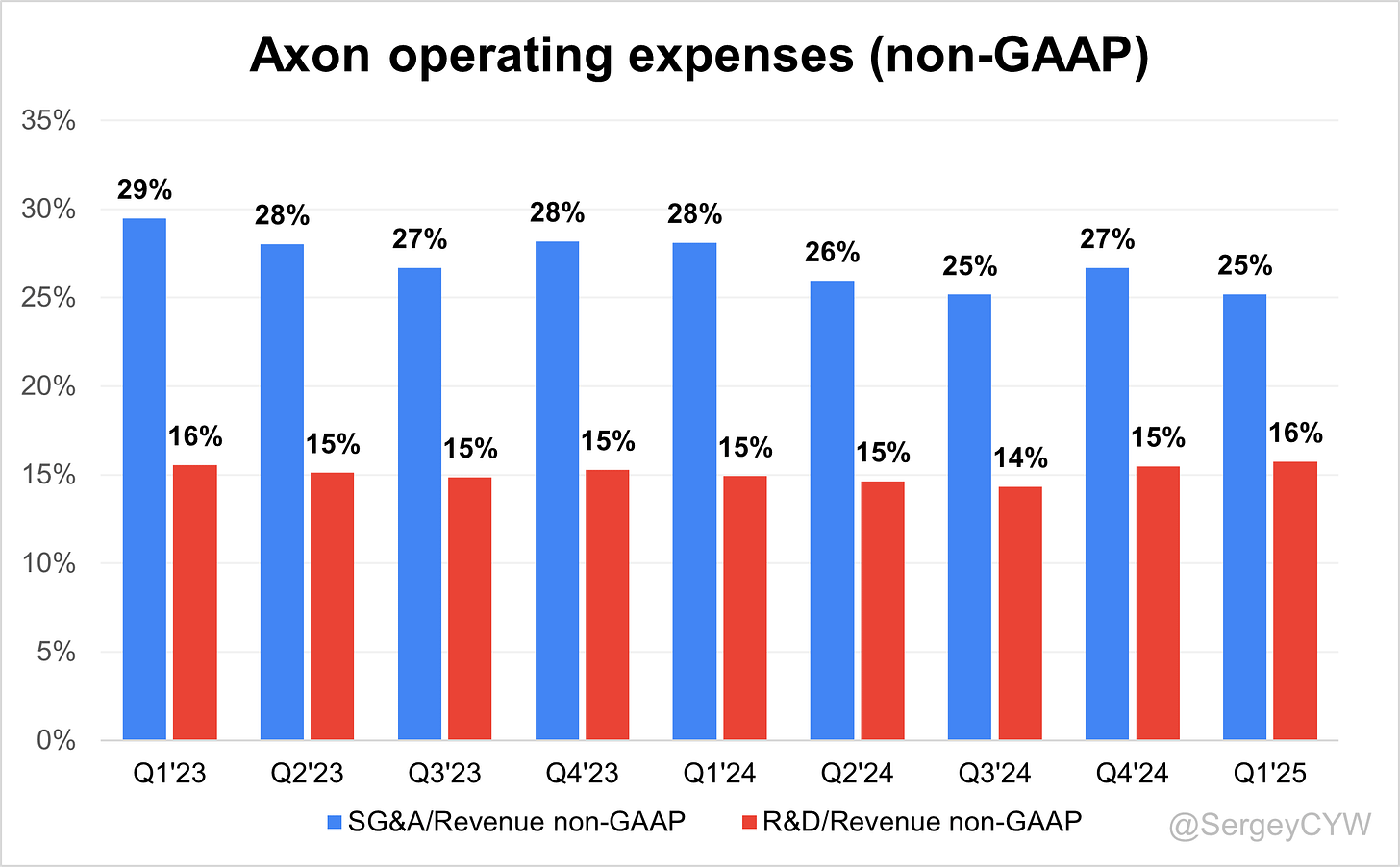

$AXON's Non-GAAP operating expenses have decreased due to reduced SG&M spending, with SG&M expenses dropping from 29% two years ago to 25%. The R&D share remains high at 16% as the company actively invests in its future growth.

Balance Sheet

$AXON Balance Sheet: Total debt increased to $2047M, while Axon holds $2,367M in cash and cash equivalents, exceeding total debt and ensuring a healthy balance sheet.

In 2022 - 2024, Axon Enterprise made several strategic acquisitions to enhance its public safety technology offerings:

April 2022: Acquired Foundry, a company specializing in data integration and analytics, to bolster Axon's data management capabilities.

July 2023: Acquired a 48% stake in Sky-Hero, a Belgian company known for its tactical robotics and drone technology, aiming to improve situational awareness and response strategies.

February 2024: Announced the acquisition of a 34% stake in Fusus, a provider of real-time crime center solutions, to enhance Axon's real-time operations capabilities.

May 2024: Acquired a 45% stake in Dedrone, a leader in smart airspace security solutions, to address emerging threats from unauthorized drones.

Dilution

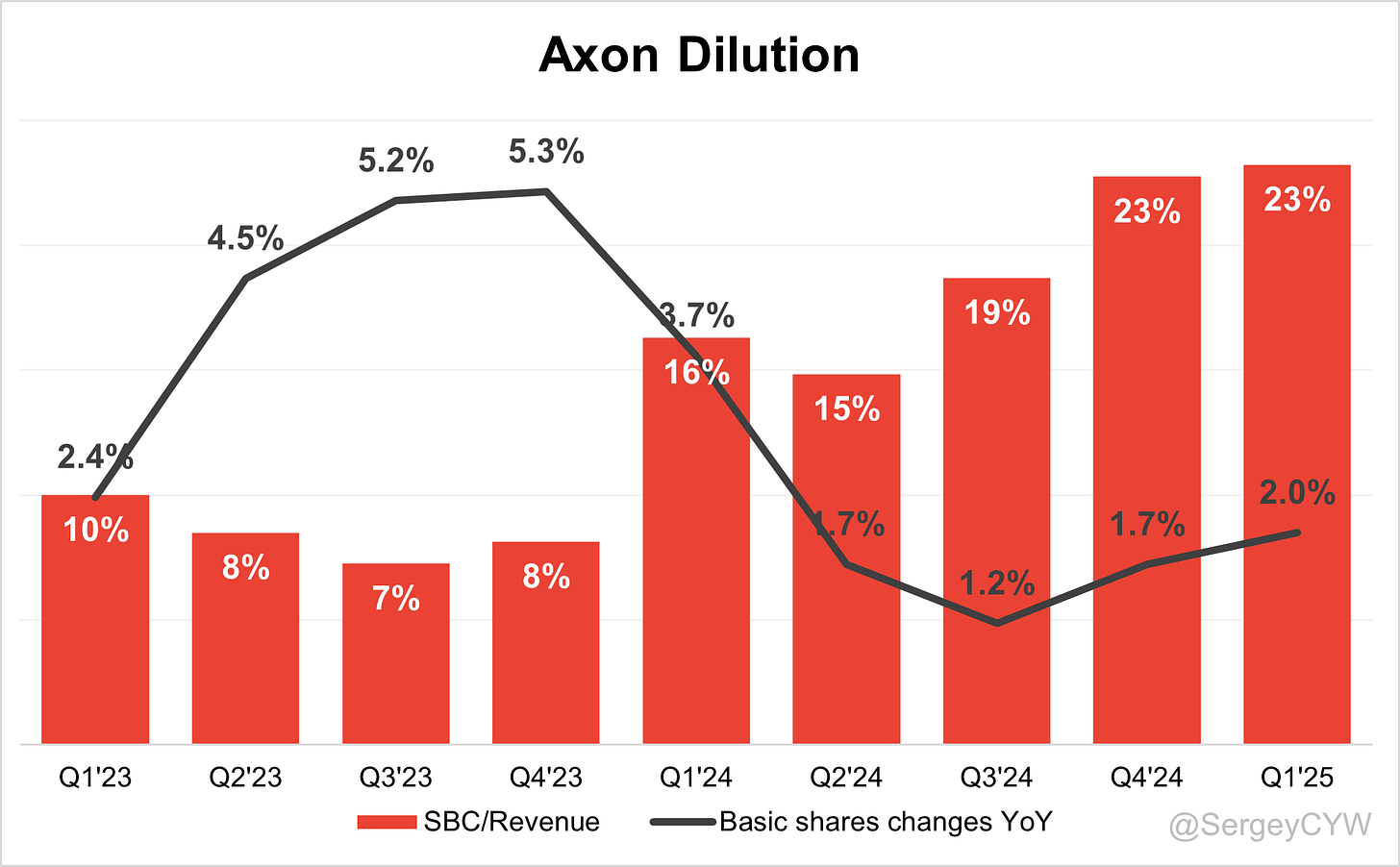

$AXON Shareholder Dilution: Axon’s stock-based compensation (SBC) expenses have risen significantly in recent quarters, now reaching 23% of revenue, which is relatively high.

Shareholder dilution remains under control, though it has been gradually increasing in recent quarters, with the weighted-average number of basic common shares outstanding up 2.2% YoY.

Conclusion

$AXON remains an innovative company, consistently maintaining high R&D investment while steadily growing the share of high-margin Software & Services, now accounting for a larger portion of total revenue.

Axon’s total addressable market expanded to $129 billion in 2025, up sharply from approximately $50 billion in 2023—reflecting the company’s aggressive push into new verticals.

The recent Fusus acquisition has been FedRAMP recommended and is pending final certification, which will unlock access to the full U.S. federal market. Fusus is now the core of Axon’s Real-Time Crime Center strategy.

Axon is also scaling its Drone as First Responder (DFR) programs through partnerships with Skydio and Dedrone, further strengthening its position in next-gen public safety solutions.

Leading Indicators

ARR growth of +33.8% and RPO growth of +40.7% exceed revenue growth.

Strong Net New ARR was added in Q1, increasing +10.8% YoY.

Key Indicators

Net Dollar Retention (NDR) remains high for a SaaS company, with growth sustained over the past two years.

The CAC Payback Period is strong, particularly for Software & Services.

The valuation based on P/GP multiples appears high compared to other SaaS companies, but it's important to note that Axon is not a pure SaaS business, with subscription revenue making up 44% of total revenue.

The key concern is the significantly elevated valuation. Axon currently trades at a premium relative to its historical Forward EV/Sales and Forward P/E multiples, with the Forward EV/Sales multiple at an all-time high.

That said, the underlying business is growing rapidly, profitability is improving, and management continues to take smart steps to strengthen Axon’s competitive position. The product remains highly sticky, supporting long-term customer retention.

Currently, my $AXON position is 6.3% of my portfolio. I trimmed the position in June 2025 following the sharp increase in valuation multiples.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.

I have few shares under $100 I think. Average price under $250, and 7 percent of my portfolio. Every time I trimmed, it went up.