Financial Results:

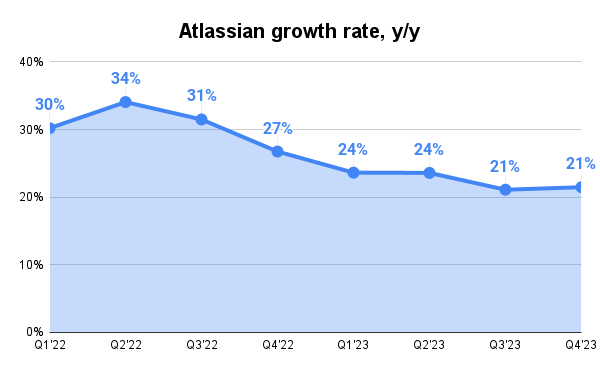

⬆️$1,060M rev (+21.5% YoY, +21.1% LQ) beat est by 3.9%

↘️GM* (84.1%, -0.8%pp YoY)

⬆️Operating Margin* (23.6%, +3.6%pp YoY)

⬆️FCF Margin 26.8%, +10.0%pp YoY)

⬆️EPS* $0.73 beat est by 17.7%🟢

*non-GAAP

Revenue By Type

⬆️Subscription $932M rev (+31.1% YoY)🟢

↘️Maintenance $69M rev (-34.8% YoY)🟡

➡️Other $59M rev (+6.0% YoY)🟡

Revenue By Deployment

⬆️Cloud $653M rev (+27.5% YoY)🟢

⬆️Data Center $275M rev (+41.4% YoY)

↘️Server $69M rev (-34.8% YoY)🟡

➡️Marketplace and services $63M rev (+5.1% YoY)🟡

⬆️42,864 $10k+ customers (+18.0% YoY, +2761)

Operating expenses

⬆️S&M*/Revenue 16.9% (16.3% LQ)

↘️R&D*/Revenue 32.9% (33.9% LQ)

↘️G&A*/Revenue 10.6% (11.0% LQ)

⬆️Net New ARR $167M ($145 LQ)

↘️CAC* Payback Period 17.2 Months (19.0 LQ)

Dilution

⬆️SBC/rev 27%, +3.2%pp QoQ)

↘️Dilution at 1.1% YoY, 0.0%pp QoQ)

Guidance

⬆️Q1'24 $1,105M guide (+20.7% YoY) beat est by 4.2%

Key points from Atlassian $TEAM Q4 2023 Earnings Call:

1. Milestones Achieved:

Atlassian crossed $1 billion in quarterly revenue, Jira Software hit $1 billion in Cloud Annual Recurring Revenue (ARR), and the customer count surpassed 300,000.

2. Cloud Focus:

Significant innovation in cloud with new launches like Compass, Virtual Agent in Jira Service Management, and AI capabilities. The company's strategy for the post-server era focuses on growth in cloud and data center segments, although they expect some deceleration in data center growth rates as migrations complete.They anticipate healthy revenue growth over the long term, despite the end of server sales.

3. Migration Continues:

Server end-of-life is near, but migrations to cloud will go on for years, especially from data center customers. Atlassian is removing migration blockers and investing in making the cloud more accessible.

4. Enterprise Growth:

Deepening relationships with large enterprises through cloud migrations and strategic discussions. Cloud offerings are expanding Atlassian's role as a strategic partner for large organizations. Cloud revenue grew by 27.5%, with migrations and enterprise sales exceeding expectations.

There was significant interest in Jira Service Management (JSM), marking it as a fast-growing segment with potential to rival Jira and Confluence in revenue contribution.

AI and machine learning, particularly Atlassian Intelligence, a suite of AI-powered features designed to improve work processes for technical and non-technical teams alike, are viewed as significant opportunities. These technologies are driving customer interest and are expected to play a key role in future growth.

Management comments on the earnings call.

Product Innovations, cloud AI:

Mike Cannon-Brookes: "AI and the excitement around customers who are excited to use our AI features, and then the new products that we are delivering in cloud are having great customer reception, though still very early days, I think that Jira Product Discovery is a great example we talked about where we're delivering innovation and value to these customers in cloud and they're picking it up and running with it."

Scott Farquhar: "We're also seeing that in AI and the excitement around customers who are excited to use our AI features, and then the new products that we are delivering in cloud are having great customer reception."

On Jira Service Management (JSM) and Its Growth:

Mike Cannon-Brookes: "We remain incredibly excited about JSM and the service management market broadly... It certainly has the potential to do that and we continue to see it being our fastest growth broad market that we have."

Scott Farquhar: "Jira Service Management... really goes together with our Jira Software, which is development teams and all the other products we've got there, work very closely with IT teams and increasingly so every single day and that's something that only we deliver in this market."

Customers and Cloud Migration:

Scott Farquhar: "For many of these customers who can't move to cloud, data center is a drop-in replacement that does not require many months of planning, and so customers can leave it the last minute and switch out to data center, and I expect to see a lot of that happen as we cross the end of server support threshold in the next few weeks."

Scott Farquhar: "Every customer I've talked to... all of them are telling me that cloud is the future... they either need time to plan a migration if they've got tens of thousands of users, that is a chance not only to migrate to the product we have in cloud but expand your usage of Atlassian, look at other products that we can replace."

Challenges:

Joe Binz: "On the low end of the guide, that -- for the year, that does assume increasing macro headwinds and the impacts you're talking about and the related impact that would have not only on paid seat expansion but also areas of our business that have held up well to date, such as migrations and cross-sell and upsell."