Atlassian Q2 2024 Earnings Analysis

Dive into $TEAM Atlassian’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

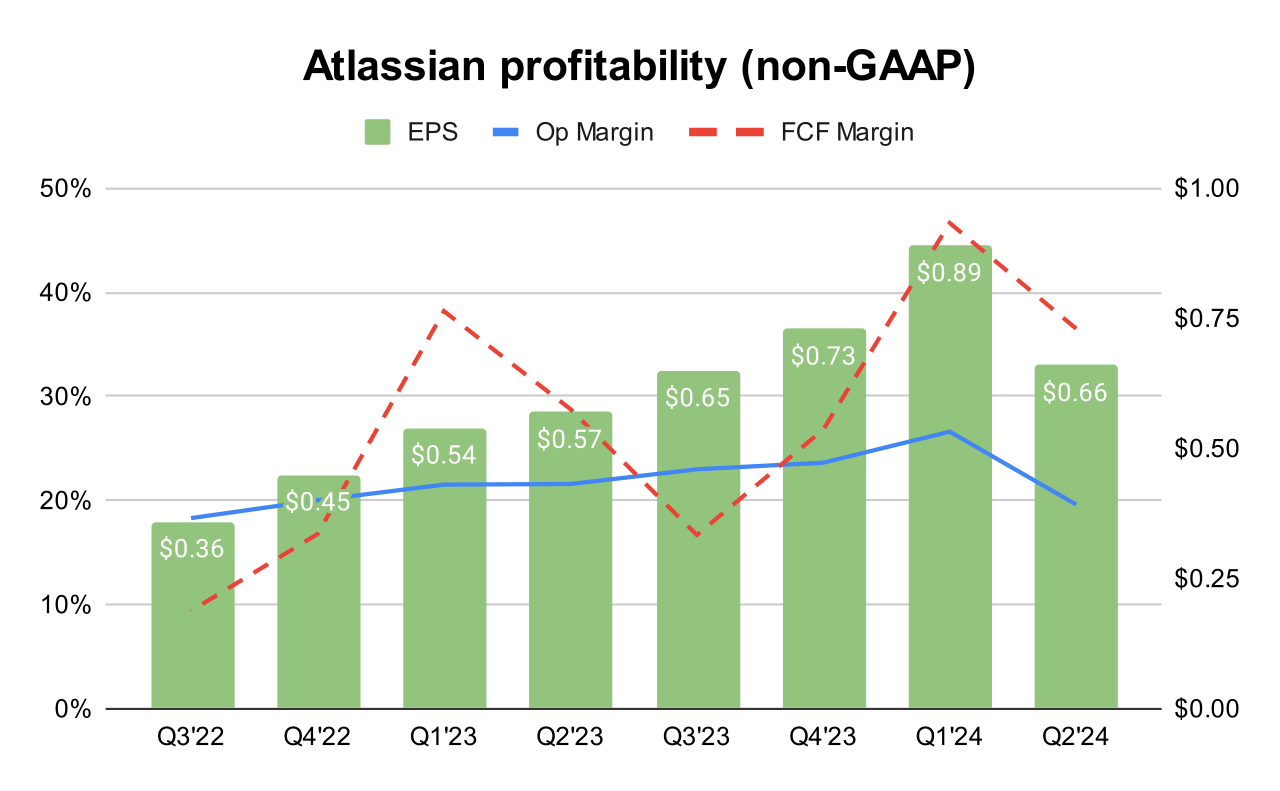

↗️$1,132M rev (20.5% YoY, +29.9% LQ) beat est by 0.1%

↘️GM* (83.4%, -1.0%pp YoY)

↘️Operating Margin* (19.6%, -2.0%pp YoY)

↗️FCF Margin (36.5%, +7.7%pp YoY)

↗️EPS* $0.66 beat est by 10.0%

*non-GAAP

Revenue By Type

↗️Subscription $1,069M rev (+33.7% YoY)

↘️Maintenance $0M rev (-100.0% YoY)🟡

➡️Other $63M rev (+17.3% YoY)🟡

Revenue By Deployment

↗️Cloud $738M rev (+31.0% YoY)

↗️Data Center $327M rev (+40.7% YoY)

↘️Server $0M rev (-100.0% YoY)🟡

➡️Marketplace and services $67M rev (+16.4% YoY)🟡

Customers

↗️45,842 $10k+ customers (+18.0% YoY, +1506)

Operating expenses

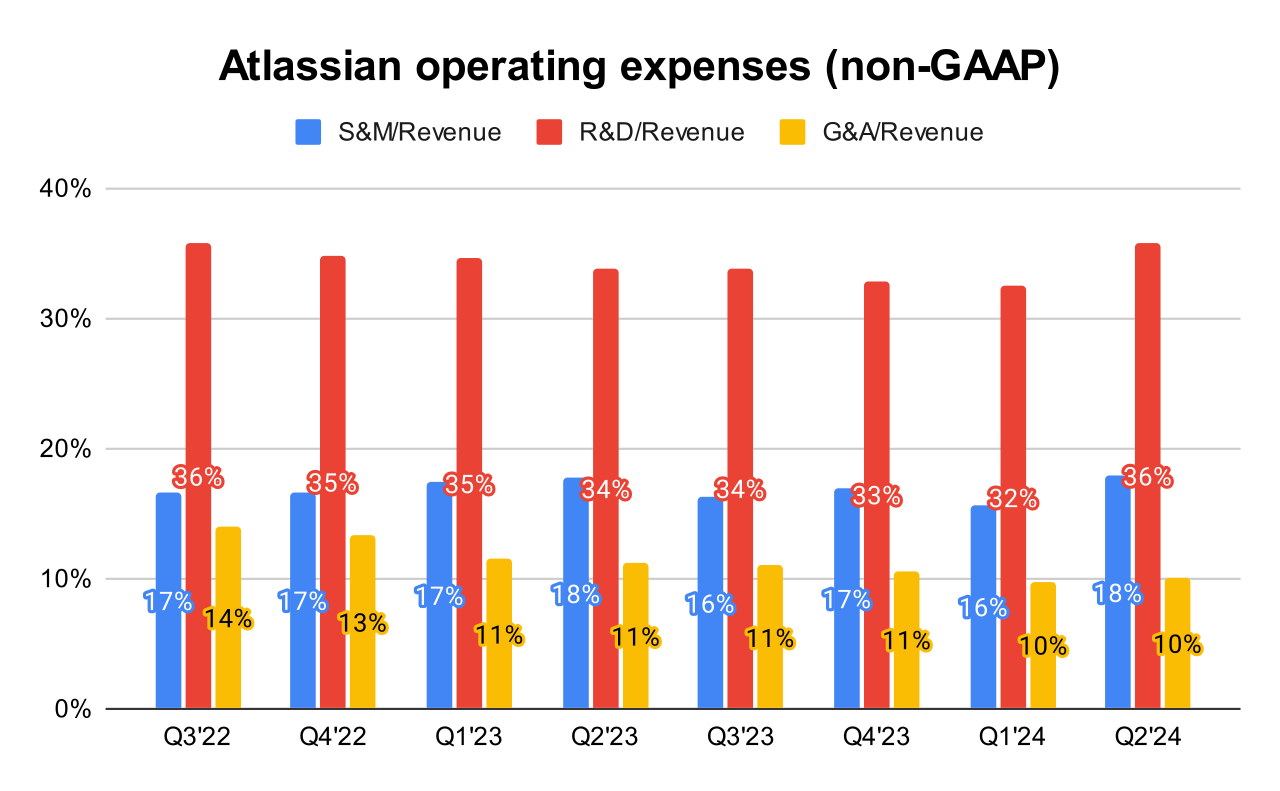

↗️S&M*/Revenue 17.9% (15.7% LQ)

↗️R&D*/Revenue 35.8% (32.5% LQ)

↗️G&A*/Revenue 10.1% (9.8% LQ)

Quarterly Performance Highlights

↘️Net New ARR -$10M ($557 LQ)

↘️CAC* Payback Period -270.5 Months (4.6 LQ)

Dilution

↘️SBC/rev 22%, -2.1%pp QoQ

↘️Basic shares up 1.1% YoY, -0.8%pp QoQ

↘️Diluted shares up 1.2% YoY, -0.6%pp QoQ

Headcount

➡️12,157 Total Headcount (+13.0% YoY, +255 added)

Guidance

↘️Q3'24 $1,149.0 - $1,157.0M guide (+17.9% YoY) missed est by -0.6%🔴

Key points from Atlassian’s Second Quarter 2024 Earnings Call:

Financial Performance:

Atlassian generated $4.4 billion in revenue and over $1.4 billion in free cash flow for FY24.

Atlassian Intelligence:

A new offering aimed at enhancing data-driven decision-making capabilities within Atlassian tools.

Compass:

Introduced as a tool to guide users in navigating complex data environments, improving workflow and project management.

Virtual Agents for Jira Service Management: Aimed at automating routine tasks and providing smarter, faster customer service.

Integration of Loom:

Loom, a video communication platform, was brought into the Atlassian product family. This integration is expected to enhance asynchronous communication across teams, fitting well with remote and hybrid work models.

Introduction of Rovo:

Presented as a new era for Jira, focusing on enhancing usability and adding advanced features to one of Atlassian’s flagship products.

Platform Upgrades:

The completion of the 3.5-year transition from Server to Cloud and Data Center platforms was highlighted as a significant upgrade, aimed at consolidating users onto more modern and scalable platforms.

Improvements were made to data residency capabilities in six new regions, which helps meet local data handling regulations and improves performance by localizing data.

Scalability of Jira was increased to support up to 50,000 users on a single instance, targeting enterprise-level deployment and usability.

Security and Compliance:

Achieved FedRAMP In Process designation to support the U.S. public sector. This is critical for ensuring that Atlassian products meet strict U.S. government security and compliance standards.

Cloud Migration:

Atlassian completed a 3.5-year journey of migrating from Server to Cloud and Data Center platforms, which is a strategic move to consolidate users on more scalable and modern infrastructure.

End of Server Maintenance Revenue:

With the server support ending, there was an anticipated decrease in server-related revenues. This was expected as the company had already been preparing for a shift in their revenue model from server to cloud and data center solutions, which is more aligned with long-term growth strategies and current technology trends.

Customer Growth:

Atlassian reported surpassing the 300,000-customer milestone, indicating robust growth and market penetration.

Over 500 customers now spend more than $1 million annually, highlighting strong enterprise adoption and the potential for further expansion within this segment.

Leadership Transition:

Co-founder Scott Farquhar announced this earnings call as his last, transitioning to a role as a board member and special advisor.

Challenges:

The guidance for FY25 revenue growth at 16% reflects a conservative approach due to macroeconomic uncertainties and the potential impact on customer spending and expansion.

The variability in the pace of data center migrations was noted, with the complexity of these migrations presenting challenges in terms of customer readiness and adaptation to cloud environments.

Increase in operating expenses

R&D: Atlassian has seen growth in operational expenses primarily due to its strategic investments in cloud infrastructure, product development, and expansions in service offerings aimed at enhancing customer experience and supporting larger scale operations.

S&M: There is also a significant focus on evolving the go-to-market strategies, especially in transitioning towards serving larger enterprise customers more effectively. This includes investments in sales and customer support teams to enhance direct engagement with large enterprises.

Future Outlook:

Atlassian reaffirmed its confidence in achieving over 20% compounded annual growth rate over the next three years.

This confidence is based on a $67 billion addressable market opportunity, continued migration to cloud, and expanded product offerings.

Management comments on the earnings call.

Competitors:

Mike Brookes: "We see our competitors not just as challenges but as catalysts that push us to enhance our offerings and innovate faster."

Cloud Migration:

Scott Farquhar: "We've completed our migration from Server to Cloud and Data Center, which marks a significant milestone in our journey towards providing a more scalable and modern infrastructure for our customers."

Customers:

Mike Brookes: "Surpassing 300,000 customers is a testament to the trust and reliability that teams around the world place in our platforms. We're committed to solving our customers' toughest team collaboration challenges."

Challenges:

Joe Binz: "Despite the macroeconomic uncertainty and the execution risks related to the evolution of our go-to-market motion, we believe FY25 will set us up with a strong foundation to accelerate growth in FY26 and beyond."

Future Outlook:

Scott Farquhar: "As we continue to evolve and adapt as a business, I'm more bullish than ever about our strong position to grow and deliver unparalleled value to our customers."

Mike Brookes: "With the massive, serviceable, addressable market opportunity in front of us, we are more excited than ever to seize this opportunity and accelerate our path to surpass $10 billion in annual revenue."