Atlassian Q1 2025 Earnings Analysis

Dive into $TEAM Atlassian’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$1,357M rev (+14.1% YoY, +21.3% LQ) beat est by 0.5%

↗️Gross Margin* (86.1%, +1.5 PPs YoY)

↘️Operating Margin* (25.7%, -1.0 PPs YoY)🟡

↗️FCF Margin (47.0%, +0.4 PPs YoY)🟢

↘️Net Margin (-5.2%, -6.3 PPs YoY)🟡

↗️EPS* $0.97 beat est by 6.6%🟢

*non-GAAP

Revenue By Type

↗️Subscription $1,273M rev (+18.8% YoY)

↘️Other $84M rev (-5.0% YoY)🟡

Revenue By Deployment

↗️Cloud $880M rev (+25.2% YoY)

➡️Data Center $389M rev (+6.7% YoY)🟡

↘️Marketplace and services $88M rev (-4.8% YoY)🟡

Customers

➡️50,715 $10k+ customers (+14.4% YoY, +1266)

Revenue By Region

➡️Americas $637M rev (+12.9% YoY)🟡

↗️EMEA $572M rev (+14.3% YoY)

↗️APAC $148M rev (+18.5% YoY)🟢

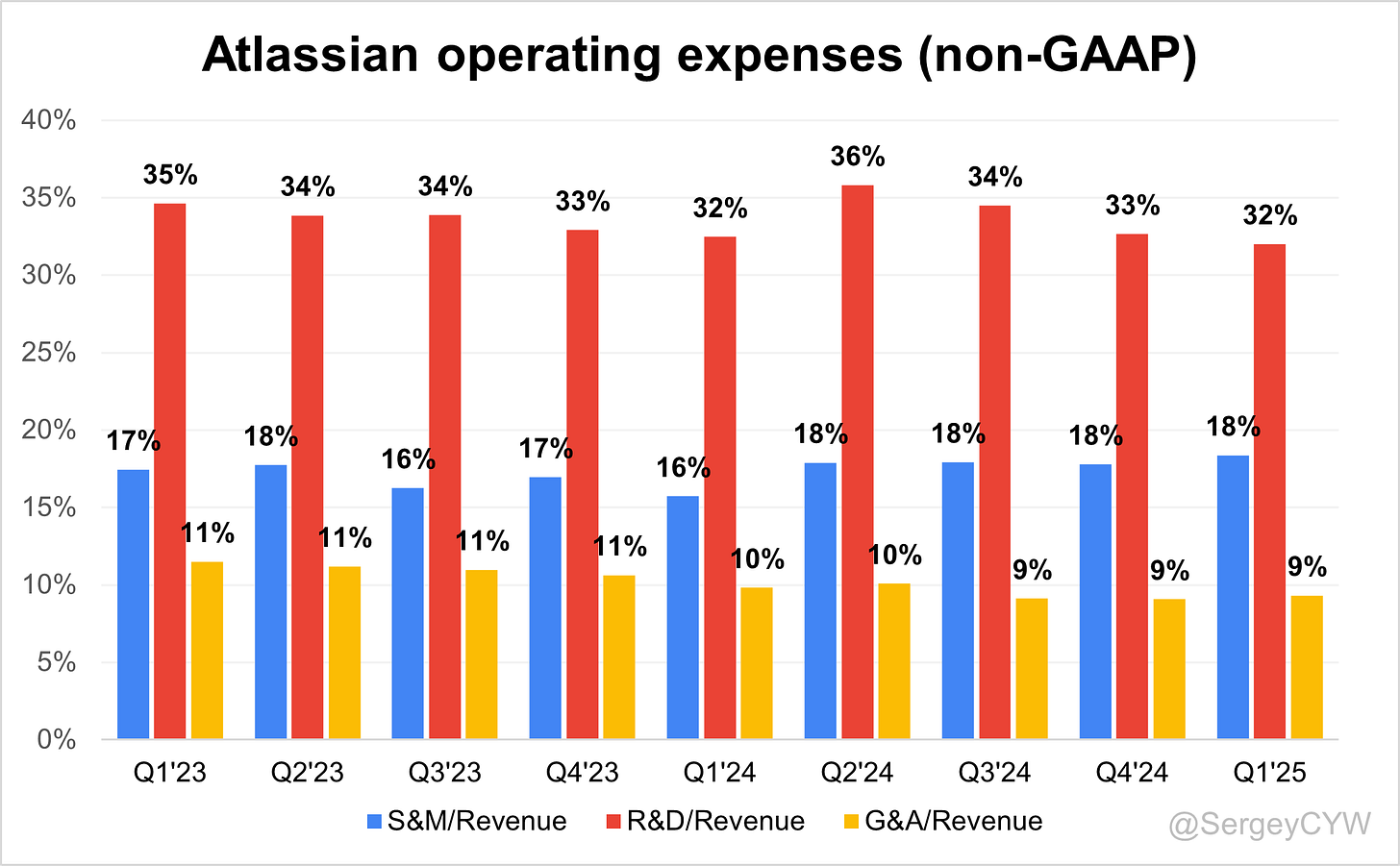

Operating expenses

↗️S&M*/Revenue 18.4% (+2.7 PPs YoY)

↘️R&D*/Revenue 32.0% (-0.5 PPs YoY)

↘️G&A*/Revenue 9.3% (-0.5 PPs YoY)

Quarterly Performance Highlights

↘️Net New ARR $239M (-57.1% YoY)

↗️CAC* Payback Period 13.5 Months (+8.9 YoY)🟡

↗️R&D* Index (RDI) 0.42 (-0.42 YoY)🟡

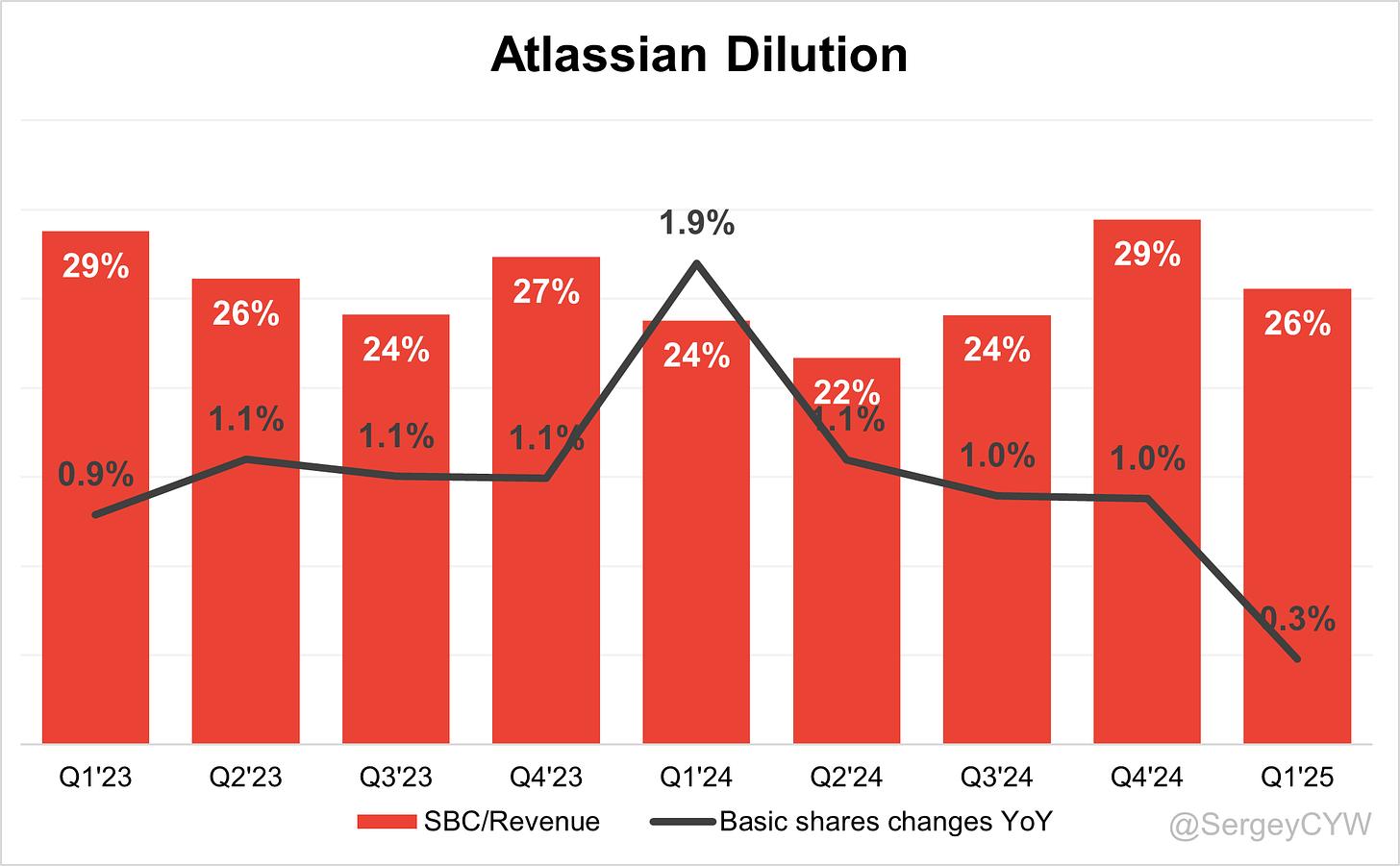

Dilution

↘️SBC/rev 26%, -3.9 PPs QoQ

↘️Basic shares up 0.3% YoY, -0.6 PPs QoQ🟢

↗️Diluted shares up 2.6% YoY, +1.6 PPs QoQ

Headcount

↗️13,370 Total Headcount (+12.3% YoY, +620 added)

Guidance

➡️Q2'25 $1,349.0 - $1,359.0M guide (+19.7% YoY) in line with est

Key points from Atlassian’s First Quarter 2025 Earnings Call:

Financial Performance

Atlassian reported $1.40B in total revenue, supported by 25% YoY cloud revenue growth. Free Cash Flow margin reached 47%, with gross margin at 86%, above guidance. Margin strength was driven by price increases, Premium edition upsells, and infrastructure efficiency. While enterprise deal delays affected revenue linearity, billings remained strong and are expected to be recognized in Q4.

Cloud Services

Cloud remained the core growth engine with 25% YoY growth, driven by >40% YoY adoption of Premium and Enterprise tiers. Growth was supported by seat expansion and cloud migrations. Gross margin improved due to engineering optimizations and scale. Atlassian launched Government Cloud after achieving FedRAMP Moderate Authorization, and Isolated Cloud for sensitive data workloads. Deal cycles lengthened due to enterprise complexity, impacting Q3 revenue timing.

Jira

Jira is central to the Teamwork Collection, bundled with Confluence and Loom to drive attach and upsell. With 10M+ active users, licensing simplification and required plan alignment boosted Premium adoption. Bundling also accelerates AI usage through native Rovo inclusion. Customers increasingly deploy Jira alongside other Atlassian products, expanding NRR and platform stickiness.

AI and Rovo

Rovo now has 1.5M monthly active users, up from 1M last quarter. Embedded across all Premium and Enterprise plans, Rovo drives collaboration through agent-based task automation. It is SOC2 and ISO 27001 certified, embedded in tens of thousands of workflows, and supports human–AI interaction loops. AI credits introduced within Teamwork Collection signal a shift toward consumption-based monetization.

Data Center

Data Center revenue grew from pricing but declined sequentially due to a shift to annual-only contracts, reducing upfront recognition. Migration to cloud accelerated, particularly in regulated sectors. Retention and expansion trends remained strong. Management expects continued contribution in FY26, though at a slower pace as more customers shift to cloud.

Product Innovation

Team ’25 introduced key platform upgrades:

• Atlassian Government Cloud (FedRAMP Moderate certified)

• Isolated Cloud for single-tenant deployments

• Teamwork Collections to simplify buying and unify tools

• AI-first architecture with Rovo as a platform layer

Go-to-Market

Enterprise sales capability expanded under new CRO from SAP. Enterprise now contributes >40% of revenue, up from 15% in FY20. Larger, complex deals are driving longer cycles. The model combines PLG with strategic sales, enabling both self-serve velocity and high-value transactions. Q3 saw new enterprise wins in banking, semiconductors, and finance.

Customer Growth

Atlassian now serves 300K+ customers, including Mercedes, SAP, Workday, Xero. Premium and Enterprise cloud editions grew >40% YoY. Notable wins included a top global investment bank, a semiconductor leader, and a US–UK financial services firm, all consolidating on Atlassian Cloud.

Breville migrated from 10 separate tools to Atlassian, highlighting suite consolidation and deployment efficiency. The platform's breadth continues to attract wall-to-wall deployments and deeper adoption across knowledge workers.

Public Sector Adoption

FedRAMP Moderate Authorization enabled entry into the U.S. federal sector. Several agencies are already onboard via early access. Isolated Cloud supports sensitive workloads in finance, defense, and manufacturing, expanding TAM in regulated industries.

Challenges

Q3 cloud revenue was impacted by delayed enterprise deals. Management attributed the delays to deal complexity, not macro weakness. Data Center revenue variability increased due to shorter contract terms and a decline in multiyear agreements. Marketplace revenue also introduced transactional variability.

Future Outlook

Atlassian reaffirmed its 20%+ revenue CAGR target through FY27. Migration contribution is expected to increase in FY26–27, offsetting lighter FY25 dynamics post-server sunset. Though blended gross margins may decline due to cloud mix, cloud gross margins are expected to rise YoY, supported by scale and efficiency.

Rovo will increase AI COGS near term, but management expects cost deflation over time due to vendor competition and internal optimization. Investments in AI and bundled growth strategies are designed to support long-term scaling toward the $10B+ revenue target.

Management comments on the earnings call.

Product Innovations

Mike Cannon-Brookes, Co-Founder and Co-CEO

“The next evolution of the Atlassian system of work is officially here as we've started making a shift from standalone products to a vision of apps and agents with Rovo at the center of everything.”

“We introduced two new cloud offerings, brought Rovo's incredible AI capability to the center of the platform, and continued to deliver innovation that transforms how teams work.”

Joe Binz, Chief Financial Officer

“Teamwork Collections are a powerful part of our strategy in transforming Atlassian. They simplify purchasing, drive attach rates, and strengthen our competitive position.”

Cloud Services

Joe Binz, Chief Financial Officer

“We did see deals fall more back-end loaded in the quarter than we expected. That did have an impact on the cloud revenue growth rate that we delivered in the quarter.”

“We delivered 25% year-over-year revenue growth in cloud, better than we expected. The core performance was similar to Q2, with better-than-expected seat expansion and data center migrations.”

Mike Cannon-Brookes, Co-Founder and Co-CEO

“We believe that cloud offers a fundamentally better experience for customers than Data Center, and every quarter we continue to help more customers upgrade.”

Jira

Mike Cannon-Brookes, Co-Founder and Co-CEO

“There’s an untapped attach opportunity to over 10 million Jira users. Teamwork Collections simplify how customers buy and grow with our offerings and unlock seat expansion across the organization.”

AI Agents & Rovo

Mike Cannon-Brookes, Co-Founder and Co-CEO

“We’ve already surpassed 1.5 million monthly active users of AI across our platform. We expect this number to continue growing strongly as more customers realize the power of Rovo.”

“The future of teamwork is going to be about iterative human–AI collaboration. We’re very forward-thinking in how we’re implementing this and we believe it enhances stickiness and promotes wall-to-wall adoption.”

Joe Binz, Chief Financial Officer

“We’re managing AI-related COGS well. Over time, we expect those costs to come down as vendors compete and as we optimize our infrastructure to support Rovo at scale.”

“Rovo strengthens our structural competitive position. We believe embedding it across Premium and Enterprise tiers is the right long-term move.”

Data Center

Joe Binz, Chief Financial Officer

“Growth in the quarter was primarily driven by pricing, partially offset by strong migrations to cloud and fewer multiyear agreements. Customer retention and renewal rates remained healthy.”

“When duration of Data Center agreements is shorter on average, we recognize less revenue. That dynamic impacted Q3 results and will influence revenue recognition going forward.”

Go-to-Market Evolution

Mike Cannon-Brookes, Co-Founder and Co-CEO

“Our enterprise customer contribution has grown from 15% in 2020 to over 40% in 2025. That reflects a massive shift in our go-to-market maturity.”

“We’re continually evolving our motion—from strategic sales to high-velocity, self-serve channels. With over 300,000 customers, different segments require different motions.”

Joe Binz, Chief Financial Officer

“Larger, more complex deals are taking longer to close than expected. It’s a muscle we’re building as we scale in the enterprise and drive deeper customer engagement.”

Customers

Mike Cannon-Brookes, Co-Founder and Co-CEO

“More than 300,000 customers, including Mercedes, SAP, Workday, and Xero, rely on us to help their teams work better together and unleash enterprise knowledge.”

“We’re seeing customers consolidate dozens of tools onto Atlassian. For example, Breville moved from 10 different vendors to our platform—a powerful validation of our integrated approach.”

Strategic Partnerships

Mike Cannon-Brookes, Co-Founder and Co-CEO

“We closed cloud deals with one of the largest investment banks in the world, a global semiconductor leader, and a major financial services company. These are highly complex, strategic partnerships.”

International Growth

Mike Cannon-Brookes, Co-Founder and Co-CEO

“With the launch of Atlassian Government Cloud and the Isolated Cloud offering, we’re expanding into more regulated and security-conscious markets—including public sector and sensitive industries globally.”

Challenges

Joe Binz, Chief Financial Officer

“There was greater variability this quarter, particularly in Data Center and Marketplace. Multiyear deal mix, revenue recognition, and transactional nature added complexity to the revenue result.”

Mike Cannon-Brookes, Co-Founder and Co-CEO

“We’re in a healthy position and continue to grow, but we’re always aware of macroeconomic complexity and remain vigilant. We’ve built resilience over two decades of market cycles.”

Future Outlook

Joe Binz, Chief Financial Officer

“There’s nothing in the macro that changes our thinking. We remain confident in our ability to drive revenue growth in excess of a 20% CAGR through FY27.”

“We expect better migration contribution to cloud revenue growth in FY26 and FY27 as customers shift more workloads off Data Center and server environments.”

Mike Cannon-Brookes, Co-Founder and Co-CEO

“We’re investing today to scale to $10 billion in revenue and beyond. With Rovo, Teamwork Collections, and our cloud-first approach, we believe we’re on the right long-term trajectory.”

Thoughts on Atlassian Earnings Report $TEAM:

🟢 Positive

• $1,357M total revenue (+14.1% YoY, +21.3% QoQ), beat by 0.5%

• Cloud revenue $880M (+25.2% YoY), led by Premium & Enterprise adoption (+40% YoY)

• Subscription revenue $1,273M (+18.8% YoY), reflecting strong customer demand

• Free Cash Flow margin 47.0%, improved +0.4pp YoY, supporting profitability

• EPS $0.97, beat by 6.6%

• Gross margin 86.1%, up +1.5pp YoY, driven by pricing and scale efficiency

• EMEA revenue $572M (+14.3% YoY); APAC $148M (+18.5% YoY)

• 50,715 $10K+ customers, up +14.4% YoY

• Rovo AI adoption reached 1.5M monthly active users, up from 1M QoQ

• FedRAMP Moderate and Isolated Cloud launch opened regulated markets

• SBC/rev 26%, down -3.9pp QoQ, indicating improved capital discipline

🟡 Neutral

• Operating margin 25.7%, down -1.0pp YoY due to increased S&M investments

• Data Center revenue $389M, grew +6.7% YoY despite slower multiyear deal intake

• Americas revenue $637M, grew +12.9% YoY, below total company growth rate

• Other revenue $84M, declined -5.0% YoY, reflecting transactional softness

• Marketplace & Services revenue $88M, declined -4.8% YoY

• G&A/revenue 9.3%, improved -0.5pp YoY; R&D/revenue flat

• CAC payback period 13.5 months, increased +8.9 months YoY

• Q2’25 revenue guidance $1,349M–$1,359M, implies +19.7% YoY, in line with estimates

🔴 Negative

• Net margin -5.2%, down -6.3pp YoY, despite gross margin gains

• Net New ARR $239M, down -57.1% YoY, signaling a slowdown in expansion motion

• R&D Index 0.42, down from prior year, indicating deceleration in R&D intensity

• Diluted shares up +2.6% YoY, increasing shareholder dilution

• Delayed enterprise deals affected Q3 cloud revenue recognition

• Data Center impacted by shift to annual-only contracts, lowering upfront revenue recognition

• Marketplace and transactional segments remain volatile and under pressure

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.