Financial Results:

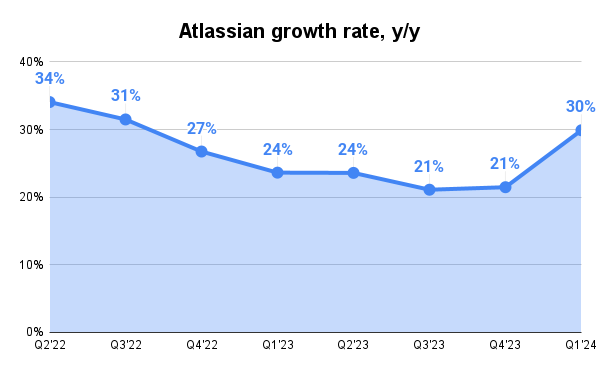

↗️$1,189M rev (+29.9% YoY, +21.5% LQ) beat est by 8.1%

↘️GM* (84.6%, -0.5%pp YoY)

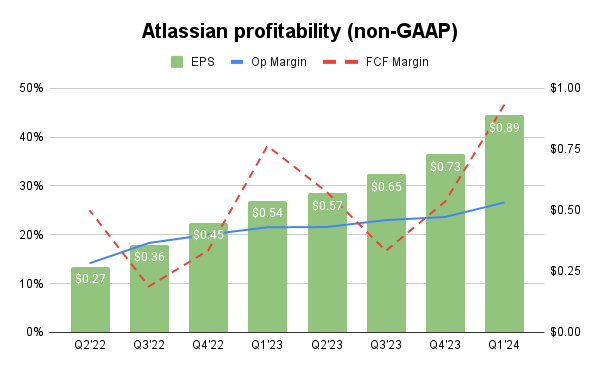

↗️Operating Margin* (26.6%, +5.1%pp YoY)

↗️FCF Margin (46.7%, +8.5%pp YoY)🟢

↗️EPS* $0.89 beat est by 43.5%🟢

*non-GAAP

Revenue By Type

↗️Subscription $1,071M rev (+40.8% YoY)🟢

↘️Maintenance $30M rev (-68.7% YoY)🟡

↗️Other $88M rev (+45.7% YoY)🟢

Revenue By Deployment

↗️Cloud $703M rev (+31.4% YoY)🟢

↗️Data Center $364M rev (+64.4% YoY)🟢

↘️Server $30M rev (-68.5% YoY)🟡

↗️Marketplace and services $92M rev (+42.7% YoY)🟢

Customers

➡️44,336 $10k+ customers (+19.0% YoY, +1472)

Operating expenses

↘️S&M*/Revenue 15.7% (16.9% LQ)

↘️R&D*/Revenue 32.5% (32.9% LQ)

↘️G&A*/Revenue 9.8% (10.6% LQ)

Quarterly Performance Highlights

↗️Net New ARR $557M ($321 LQ)

↘️CAC* Payback Period 4.6 Months (7.1 LQ)

Dilution

↘️SBC/rev 24%, -3.6%pp QoQ

↗️Basic shares up 1.1% YoY, +0.1%pp QoQ

↗️Diluted shares up 1.9% YoY, +0.9%pp QoQ

Guidance

↗️Q2'24 $1,120.0 - $1,135.0M guide (+20.1% YoY) beat est by 1.6%

Key points from Atlassian’s First Quarter 2024 Earnings Call:

Cloud Migration:

Atlassian has seen substantial growth in its cloud products, with over 300,000 customers and a significant increase in paid seats since announcing the winding down of server support 3.5 years ago. This includes a threefold increase in paid cloud seats since announcing the end of support for Server products.

The company continues to focus on facilitating the transition of its data center customers to the cloud, leveraging improvements in cloud services and incentives to ease the migration process.

Leadership Transition:

Scott Farquhar, Co-Founder and Co-CEO, announced he will be stepping down on August 31, 2024. He will remain active on the board and become a special advisor, while Mike Cannon-Brookes will continue as the sole CEO.

Enterprise and SMB Trends: While enterprise customers remain healthy and contribute to strong growth, the SMB segment continues to face challenges, particularly in cloud-based expansions.

AI-Driven Features and Efficiency:

Atlassian highlighted a specific case with a customer, FanDuel, who achieved significant operational efficiency by reducing tickets that require human intervention by 85% through the use of Atlassian's AI-driven features.

AI and the Atlassian Platform:

Atlassian is leveraging AI to enhance its platform's capabilities, particularly in terms of analytics, automation, and customer experience. The AI integrations are particularly focused on enhancing premium and enterprise editions of their products, making them more appealing and useful for large-scale operations.

Future Growth:

Atlassian is optimistic about its growth trajectory, driven by its strong cloud platform and the ongoing adoption of its cloud products by both new and existing customers.

The strategic focus will remain on expanding its enterprise market share, leveraging AI technology, and possibly exploring new pricing models that reflect the added value brought by AI and other advanced technologies. Despite the cloud focus, data center remains a key part of Atlassian's strategy.

Management comments on the earnings call.

Cloud Migration:

Scott Farquhar: "We migrated more paid seats to cloud than we initially projected, and our churn has been consistently lower than expected from our Server base. This speaks volumes about the mission critical role our products play, the value they deliver, and our customers' desire to realize the innovation in our cloud products."

Artificial Intelligence (AI):

Mike Cannon-Brookes: "AI is providing new and exciting opportunities, and our customers are increasingly choosing to consolidate around Atlassian."

Scott Farquhar: "I'm supremely confident of where Atlassian is at. We've got one of the best cloud platforms in the industry. Our point A in new products are gaining real traction with customers and revenue."

Future Growth:

Joe Binz: "We have a thoughtful plan in place to continue to drive durable revenue growth, and we feel really good about our agile-approach to appraise behind key strategic areas like enterprise NII, while driving leverage as we scale, and we couldn't be more excited about the future."

Mike Cannon-Brookes: "We also have huge opportunities ahead of us in both the enterprise transition and AI, where our unique team data and insights allow us to offer unique capabilities and unleash our customers' potential."

Joe Binz: "From a macro perspective, macro trends were very much in-line with what we saw in Q2 and in-line with our expectations. Enterprise was healthy across both cloud and data center and that drove the record billings, strong growth in annual multiyear agreements."