Apple Q4 2024 Earnings Analysis

Dive into $AAPL Apple’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$124,300M rev (+4.0% YoY, +6.1% LQ) beat est by 0.2%

↗️GM (46.9%, +1.0 PPs YoY)🟢

↗️Operating Margin (34.5%, +0.7 PPs YoY)🟢

↘️FCF Margin (21.7%, -9.6 PPs YoY)🟡

↗️Net Margin (29.2%, +0.9 PPs YoY)🟢

↗️EPS $2.40 beat est by 2.6%🟢

Revenue by Category

↗️Products and Business Processes $97,960M rev (+1.6% YoY, 39.3% Gross Margin)🟡

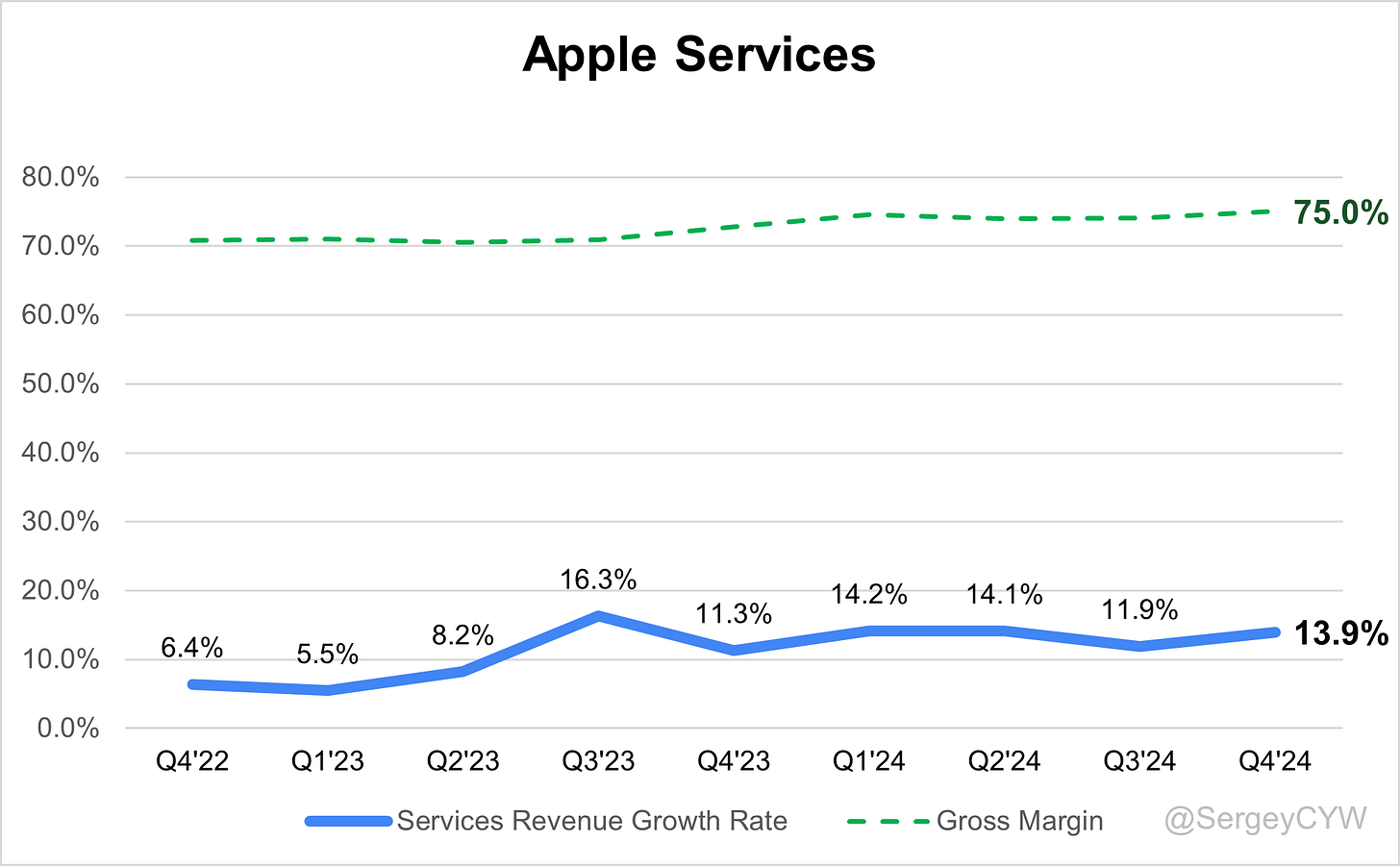

↗️Services $26,340M rev (+13.9% YoY, 75.0% Gross Margin)🟢

Revenue by Segment

↘️iPhone (-0.8% YoY)🔴

↗️Mac (+15.5% YoY)🟢

↗️iPad (+15.2% YoY)🟢

↘️Wearables, Home and Accessories (-1.7% YoY)🔴

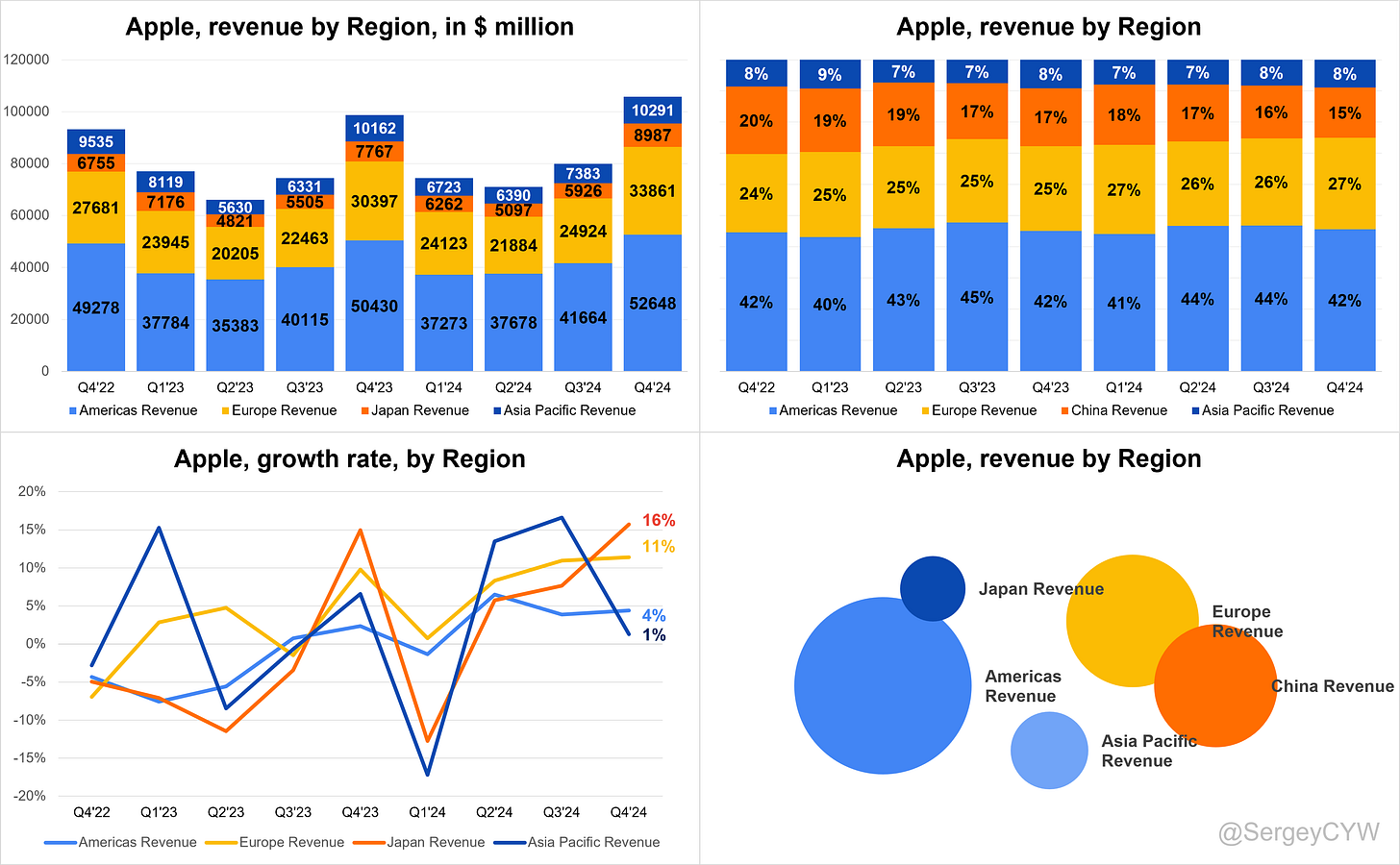

Regional Breakdown

↗️Americas $52.648B rev (+4.4% YoY, 42% of Rev)🟡

↗️Europe $33.861B rev (+11.4% YoY, 27% of Rev)🟢

↘️China $18.513B rev (-11.1% YoY, 15% of Rev)🔴

↗️Japan $8.987B rev (+15.7% YoY, 7% of Rev)🟢

↘️Asia Pacific $10.291B rev (+1.3% YoY, 8% of Rev)🟡

Operating expenses

↗️SG&A/Revenue 5.8% (+0.1 PPs YoY)

↗️R&D/Revenue 6.7% (+0.2 PPs YoY)

Dilution

↘️SBC/rev 3%, -0.4 PPs QoQ

↘️Basic shares down -2.8% YoY, -0.0 PPs QoQ🟢

↗️Diluted shares down -2.7% YoY, +0.0 PPs QoQ🟢

Key points from Apple’s Fourth Quarter 2024 Earnings Call:

Financial Performance

Apple reported all-time high revenue of $124.3 billion for Q1 FY25, a 4% YoY increase. Net income reached $36.3 billion, with EPS at $2.40, up 10% YoY. Gross margin was 46.9%, with services gross margin at 75% and product gross margin at 39.3%. Operating cash flow stood at $29.9 billion, despite a $11.9 billion payment related to a state aid decision.

Product Innovations

Apple Intelligence introduced Image Playground, Genmoji, enhanced Siri, Cleanup, and Visual Intelligence, integrating AI across iPhone, iPad, and Mac. The M4-powered MacBook Pro, Mac Mini, and iMac support advanced AI workloads. The M4 iPad Pro offers a thin, ultra-portable design optimized for AI. Apple Vision Pro expanded globally, reinforcing Apple’s position in spatial computing.

Product Revenue

Product revenue reached $98 billion, up 2% YoY. Mac revenue grew 16% YoY to $9 billion, driven by demand for M4-powered MacBook Pro, iMac, and Mac Mini. iPad revenue increased 15% YoY to $8.1 billion, led by iPad Mini and iPad Air.

Wearables, home, and accessories revenue declined 2% YoY to $11.7 billion, facing a tough compare against the Apple Watch Ultra 2 launch in the prior year. Despite this, the Apple Watch installed base hit a record high, with over half of Q1 buyers being first-time customers.

Services Revenue

Services revenue reached a record $26.3 billion, growing 14% YoY. Paid subscriptions surpassed 1 billion, showing double-digit growth in both transacting and paid accounts.

Apple TV+ continued to scale, accumulating 2,500+ nominations and 538 awards. Key innovations included Find My’s new lost luggage tracking, expanding Tap to Pay to 20 markets, and continued growth in Apple Arcade, iCloud, and Payments.

iPhone Performance

iPhone revenue was $69.1 billion, flat YoY. Markets with Apple Intelligence saw higher demand, with the iPhone 16 series outperforming the iPhone 15 series. The upgrade cycle hit an all-time high, with strong adoption in India, Latin America, and South Asia.

China revenue declined 11% YoY, impacted by lower channel inventory and macroeconomic factors. The installed base expanded, surpassing 2.35 billion active devices globally.

Apple Vision Pro

Apple Vision Pro expanded globally, strengthening its position in spatial computing. Enterprise adoption grew, with Cisco using Vision Pro for spatial meetings. Filmmakers, including Jon M. Chu (Wicked), highlighted its potential in immersive storytelling.

Wearables and Accessories

Wearables revenue declined 2% YoY. AirPods Pro 2 saw strong demand with new hearing health features, targeting an estimated 1 billion people with hearing issues.

Over half of Apple Watch buyers in Q1 were first-time customers. Sleep apnea detection and advanced health monitoring are expected to drive adoption. Apple Vision Pro’s global expansion is anticipated to boost demand in upcoming quarters.

AI Expansion

Apple Intelligence is rolling out to more languages in April, including French, German, Spanish, Chinese, Japanese, and Korean. AI-powered Siri, Image Playground, Cleanup, and Genmoji are enhancing engagement, leading to higher hardware adoption.

Apple’s privacy-first AI model combines on-device intelligence with Private Cloud Compute, differentiating it from competitors. AI-driven Mac adoption is accelerating, with M4-powered devices optimized for AI workloads.

Customer Engagement

Apple’s installed base reached 2.35 billion active devices, setting records across iPhone, Mac, and iPad. Customer satisfaction remains high, with iPhone at 96% in the U.S., Mac at 94%, and iPad at 96%.

Over half of Q1 iPad buyers were first-time customers, highlighting new market expansion. Retail expansion in India and the Middle East is expected to further drive growth, with four new stores opening in India and a new online store launching in Saudi Arabia.

International Growth

Revenue records were set in Americas, Europe, Japan, and Asia Pacific. Strong growth in India, Middle East, and Latin America offset China’s 11% decline, where national subsidies announced in January may provide support.

Apple is expanding retail presence in India with four new stores and launching a new online store in Saudi Arabia.

Share Buybacks and Capital Returns

Apple returned $30 billion to shareholders in Q1, including $23.3 billion in share repurchases (100M shares) and $3.9 billion in dividends. The company ended the quarter with $141 billion in cash and marketable securities, offset by $97 billion in total debt, resulting in $45 billion in net cash.

Challenges and Future Outlook

Foreign exchange headwinds reduced revenue growth by 2.5 percentage points. China remains a challenge, with lower channel inventory accounting for over half of the revenue decline.

Regulatory pressures on App Store policies and digital services continue, but strong engagement in Apple’s ecosystem mitigates risks.

For Q2, Apple expects low to mid-single-digit revenue growth, with services growing low double digits. The April Apple Intelligence language rollout is projected to drive further adoption.

Emerging markets, AI-driven device upgrades, and expanding services revenue remain key growth drivers for the coming quarters.

Management comments on the earnings call.

Product Innovations

Tim Cook, Chief Executive Officer

"Apple Intelligence is already transforming the way users experience iPhone, iPad, and Mac, with powerful tools like Image Playground, Genmoji, and enhanced Siri making everyday tasks smarter and more intuitive. We are working hard to take Apple Intelligence even further, expanding its capabilities and reach globally."

Tim Cook, Chief Executive Officer

"The new Mac lineup, powered by the M4 family of chips, delivers breathtaking performance, enabling users to take full advantage of AI and computational workloads. From the ultra-portable MacBook Air to the high-performance MacBook Pro, we are setting new industry standards."

Tim Cook, Chief Executive Officer

"Apple Vision Pro is redefining spatial computing, delivering immersive experiences that go beyond entertainment. We are seeing adoption across creative industries and enterprise applications, with major companies like Cisco leveraging its capabilities for spatial meetings."

Product Revenue

Kevin Perek, Chief Financial Officer

"Total product revenue reached $98 billion, reflecting a 2% year-over-year increase. We saw strong demand across the Mac and iPad segments, where both product lines achieved double-digit revenue growth."

Kevin Perek, Chief Financial Officer

"Mac revenue grew 16% year over year, with customers embracing our latest innovations in AI and computing power. The success of M4-powered MacBook Pro and Mac Mini reflects the increasing demand for high-performance devices optimized for AI workloads."

Kevin Perek, Chief Financial Officer

"The iPad segment delivered impressive results, growing 15% year over year to $8.1 billion. Strong demand for the iPad Mini and iPad Air highlights how consumers value versatility and power in a portable form factor."

Services Revenue

Kevin Perek, Chief Financial Officer

"Our services business set an all-time record of $26.3 billion in revenue, growing 14% year over year. We saw strength across all geographic segments, with broad-based growth in Apple TV+, Apple Arcade, iCloud, and Payment Services."

Tim Cook, Chief Executive Officer

"We are seeing record levels of customer engagement in services, with over 1 billion paid subscriptions across our platform. The growth of transacting and paid accounts continues to be a strong tailwind for this business."

Kevin Perek, Chief Financial Officer

"Services gross margin reached 75%, demonstrating the strength of our high-margin, recurring revenue business model. We expect continued expansion as more customers engage with our growing suite of digital offerings."

iPhone Performance

Tim Cook, Chief Executive Officer

"The iPhone 16 lineup is delivering strong results, with year-over-year performance exceeding that of the iPhone 15 in key markets where Apple Intelligence is available. The demand we are seeing underscores the appeal of our AI-powered innovations."

Kevin Perek, Chief Financial Officer

"We set an all-time record for upgraders this quarter, demonstrating that more customers than ever are choosing to refresh their iPhones. The installed base also reached a new all-time high, further reinforcing the strength of our ecosystem."

Tim Cook, Chief Executive Officer

"Emerging markets are playing a critical role in iPhone demand. In India, the iPhone was the top-selling model for the quarter, and we continue to see strong adoption in Latin America and South Asia."

Apple Vision Pro

Tim Cook, Chief Executive Officer

"We are expanding Apple Vision Pro into more international markets, allowing more customers to experience the future of spatial computing. Adoption is growing, particularly in enterprise applications where organizations are leveraging Vision Pro for collaboration and content creation."

Tim Cook, Chief Executive Officer

"We’re seeing creative professionals embrace Vision Pro in exciting ways. Director Jon M. Chu recently shared how he used its capabilities to bring the movie Wicked to life, highlighting its potential as a tool for storytelling and immersive content creation."

Artificial Intelligence (AI)

Tim Cook, Chief Executive Officer

"Apple Intelligence builds on years of innovation in hardware and software to deliver deeply personal AI experiences. Our hybrid approach, combining on-device intelligence with Private Cloud Compute, ensures best-in-class privacy while enabling powerful new capabilities."

Tim Cook, Chief Executive Officer

"The rollout of Apple Intelligence to additional languages in April will further expand its reach, bringing AI-powered features to more users around the world. This is just the beginning of what we believe will be a transformative era for Apple products."

Competitors

Tim Cook, Chief Executive Officer

"The smartphone market remains highly competitive, particularly in China. However, we continue to differentiate through innovation, ecosystem integration, and our unwavering commitment to privacy and security."

Tim Cook, Chief Executive Officer

"Apple Silicon provides a competitive advantage in AI and performance optimization, allowing us to deliver experiences that are deeply integrated across our hardware, software, and services ecosystem."

Customers and Engagement

Tim Cook, Chief Executive Officer

"Customer engagement with our ecosystem is stronger than ever, with our active installed base surpassing 2.35 billion devices worldwide. Across all product categories and regions, we continue to see record levels of satisfaction and loyalty."

Kevin Perek, Chief Financial Officer

"Customer satisfaction remains exceptionally high, with iPhone at 96% in the U.S., Mac at 94%, and iPad at 96%. These metrics reflect the strength of our brand and the deep connection customers have with our products."

Strategic Partnerships

Tim Cook, Chief Executive Officer

"We continue to strengthen our enterprise partnerships, with major organizations like Deutsche Bank and SAP expanding their Apple deployments. These collaborations reinforce the value of our ecosystem in the business sector."

Tim Cook, Chief Executive Officer

"Apple Vision Pro is seeing strong enterprise adoption, with companies like Cisco leveraging it for spatial meetings and remote collaboration. We expect enterprise use cases to expand as more organizations recognize its potential."

International Growth

Tim Cook, Chief Executive Officer

"We are seeing tremendous momentum in international markets, particularly in India, the Middle East, and Latin America. India set a December quarter record, and we are expanding our retail presence with four new stores opening in the region."

Tim Cook, Chief Executive Officer

"In Saudi Arabia, we are launching an online store this summer and preparing for our first flagship retail locations in 2026. These investments reflect our commitment to serving customers in high-growth markets."

Challenges and Risks

Tim Cook, Chief Executive Officer

"China remains a challenging market due to macroeconomic conditions and intense local competition. Over half of the revenue decline in China this quarter was driven by changes in channel inventory."

Tim Cook, Chief Executive Officer

"Foreign exchange headwinds impacted revenue growth by approximately 2.5 percentage points. Despite this, we delivered strong results across key regions and remain focused on executing our long-term strategy."

Future Outlook

Tim Cook, Chief Executive Officer

"Looking ahead, we expect continued momentum across our hardware, services, and AI initiatives. With Apple Intelligence expanding to new languages in April and sustained engagement in services, we are well-positioned for future growth."

Kevin Perek, Chief Financial Officer

"We expect total company revenue to grow low to mid-single digits in the March quarter, with services expected to grow low double digits. Despite FX headwinds, our gross margin guidance of 46.5% to 47.5% reflects our strong operational execution."

Thoughts on Apple Earnings Report $AAPL:

🟢 Positive

Revenue reached $124.3B, up 4% YoY and 6.1% QoQ, beating estimates by 0.2%.

EPS at $2.40, up 10% YoY, beating estimates by 2.6%.

Net margin increased 0.9 PPs YoY to 29.2%.

Gross margin rose 1.0 PPs YoY to 46.9%, with services at 75% and products at 39.3%.

Mac revenue grew 15.5% YoY to $9B, driven by M4-powered models.

iPad revenue increased 15.2% YoY to $8.1B, with strong demand for iPad Mini and iPad Air.

Services revenue hit a record $26.3B, up 13.9% YoY, with over 1B paid subscriptions.

Europe revenue surged 11.4% YoY to $33.9B.

Japan revenue rose 15.7% YoY to $9.0B.

Basic shares down 2.8% YoY, supporting EPS growth.

🟡 Neutral

Operating margin at 34.5%, up 0.7 PPs YoY.

Free cash flow margin declined 9.6 PPs YoY to 21.7%.

Americas revenue rose 4.4% YoY to $52.6B, 42% of total revenue.

Asia Pacific revenue grew 1.3% YoY to $10.3B, 8% of total revenue.

R&D expenses increased to 6.7% of revenue, up 0.2 PPs YoY.

SG&A expenses rose slightly to 5.8% of revenue, up 0.1 PPs YoY.

🔴 Negative

iPhone revenue declined 0.8% YoY, impacted by weak China demand.

China revenue fell 11.1% YoY to $18.5B, 15% of total revenue, with over half of the decline due to lower channel inventory.

Wearables, Home & Accessories revenue dropped 1.7% YoY to $11.7B, facing a tough YoY compare.

Foreign exchange headwinds reduced revenue growth by 2.5 percentage points.

Regulatory pressures on App Store and digital services remain a challenge.

Apple expects only low to mid-single-digit revenue growth in Q2, with services leading gains.