Apple Q1 2025 Earnings Analysis

Dive into $AAPL Apple’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

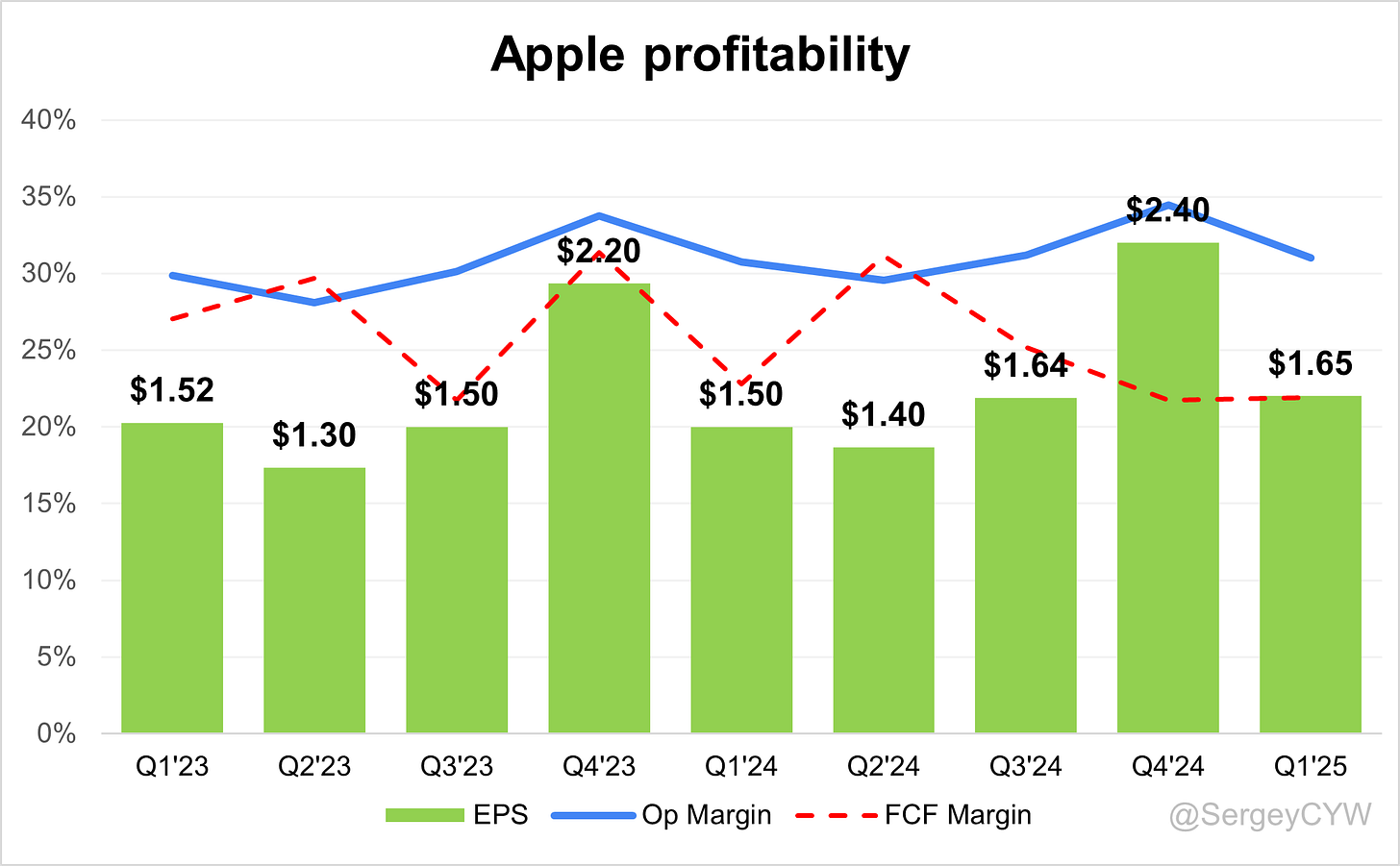

↗️$95,359M rev (+5.1% YoY, +4.0% LQ) beat est by 0.9%

↗️GM (47.1%, +0.5 PPs YoY)🟢

↗️Operating Margin (31.0%, +0.3 PPs YoY)

↘️FCF Margin (21.9%, -0.9 PPs YoY)🟡

↘️Net Margin (26.0%, -0.1 PPs YoY)🟡

↗️EPS $1.65 beat est by 1.9%

Revenue by Category

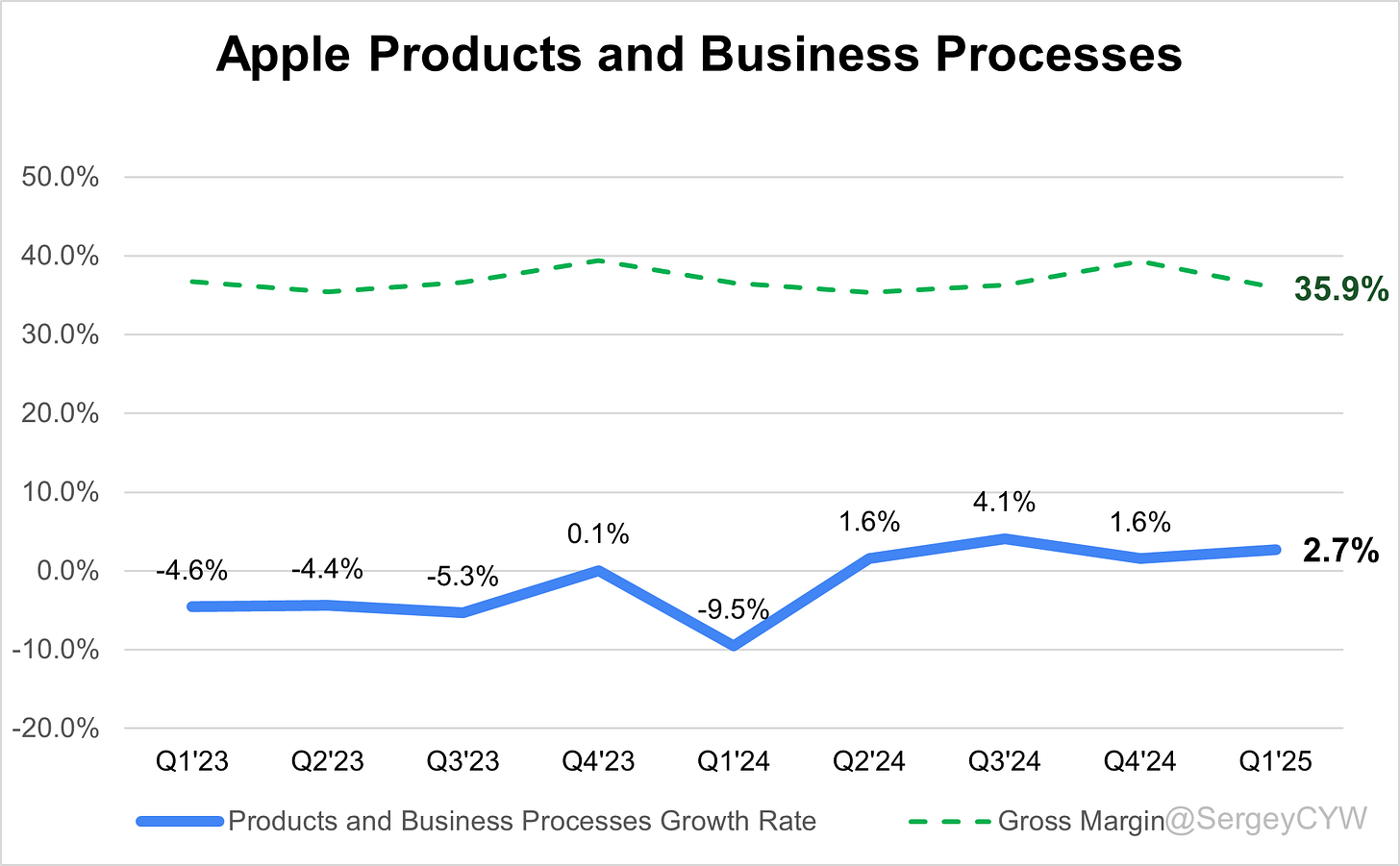

↗️Products and Business Processes $68,714M rev (+2.7% YoY, 35.9% Gross Margin)🟡

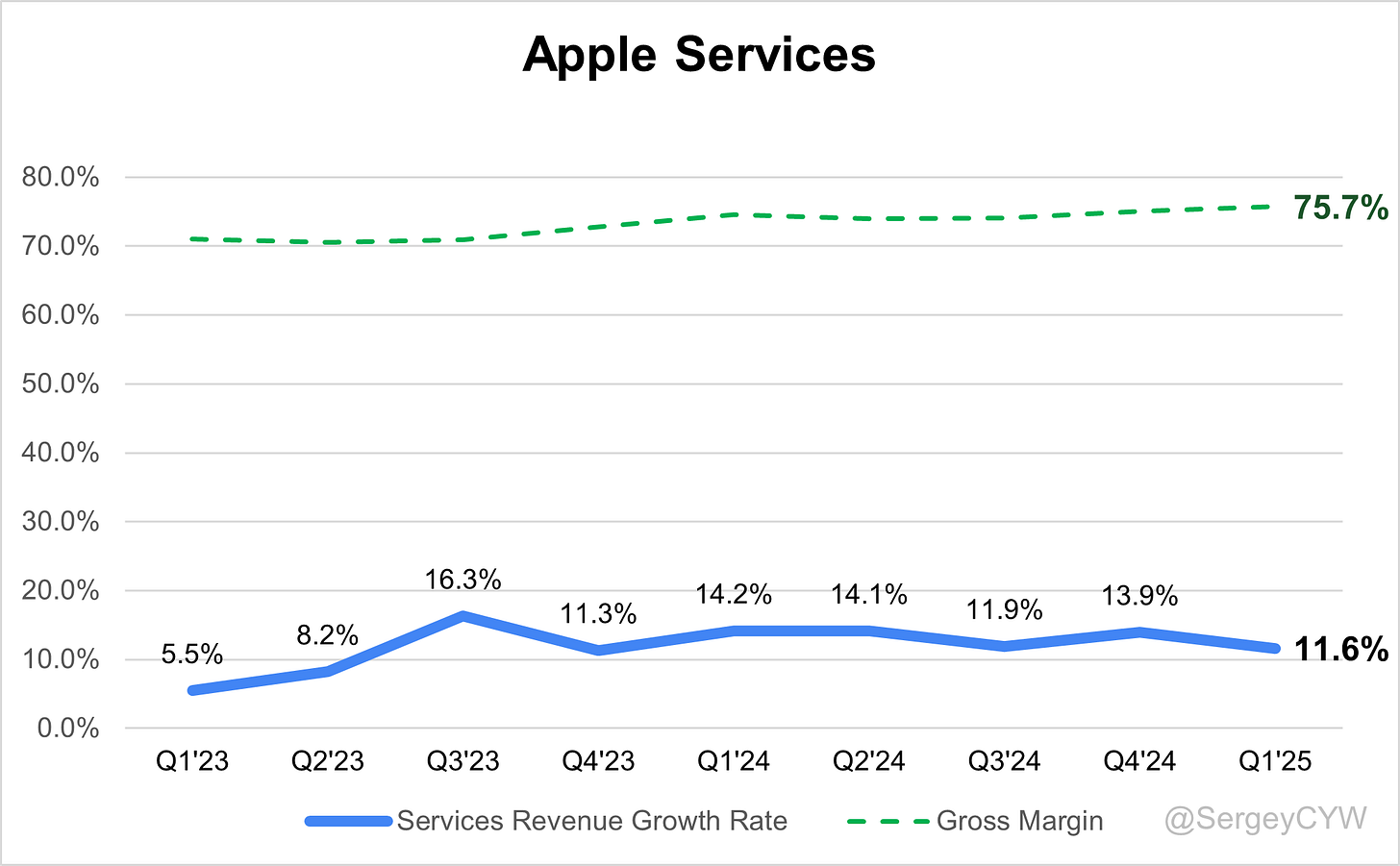

↗️Services $26,645M rev (+11.6% YoY, 75.7% Gross Margin)

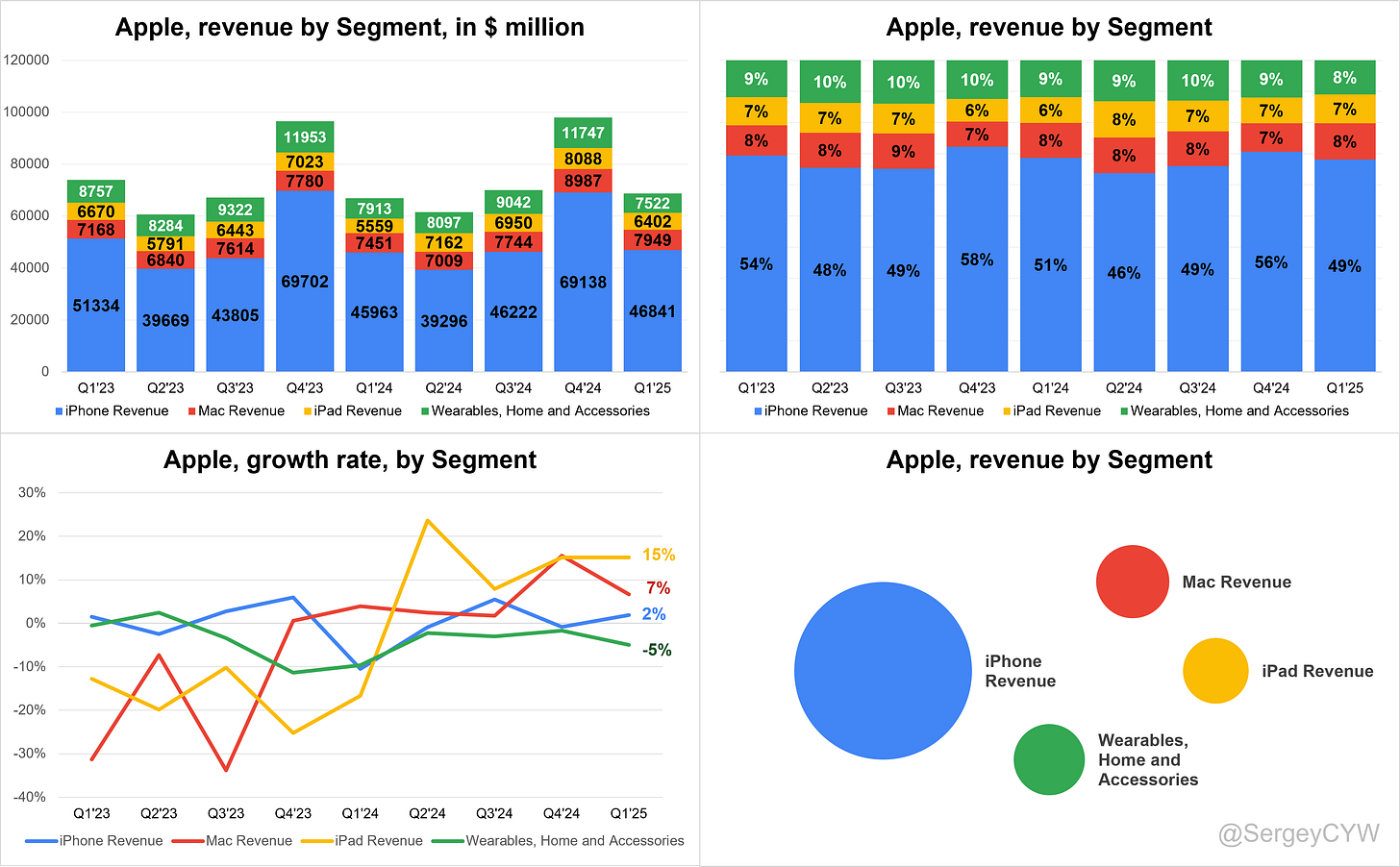

Revenue by Segment

➡️iPhone (+1.9% YoY)🟡

↗️Mac (+6.7% YoY)🟢

↗️iPad (+15.2% YoY)🟢

↘️Wearables, Home and Accessories (-4.9% YoY)🔴

Regional Breakdown

↗️Americas $40.315B rev (+8.2% YoY, 42% of Rev)🟢

↘️Europe $24.454B rev (+1.4% YoY, 26% of Rev)🟡

↘️China $16.002B rev (-2.3% YoY, 17% of Rev)🔴

↗️Japan $7.298B rev (+16.5% YoY, 8% of Rev)🟢

↗️Asia Pacific $7.290B rev (+8.4% YoY, 8% of Rev)🟢

Operating expenses

↘️SG&A/Revenue 7.1% (-0.1 PPs YoY)

↗️R&D/Revenue 9.0% (+0.3 PPs YoY)

Dilution

↗️SBC/rev 3%, +0.7 PPs QoQ

↗️Basic shares down -2.7% YoY, +0.1 PPs QoQ🟢

↗️Diluted shares down -2.6% YoY, +0.1 PPs QoQ🟢

Key points from Apple’s First Quarter 2025 Earnings Call:

Financial Performance

Apple reported $95.4B in revenue for Q2 FY25, up +5% YoY and at the high end of guidance. Foreign exchange was a –2.5 pp headwind. Gross margin was 47.1%, up +20bps QoQ. Diluted EPS reached a March quarter record of $1.65, up +8% YoY. Net income totaled $24.8B, with $24B in operating cash flow. Apple returned $29B to shareholders, including $25B in buybacks and $3.8B in dividends. Dividend per share increased +4% to $0.26. Net cash ended at $35B.

Product Revenue

Product revenue rose to $68.7B, up +3% YoY, with growth in iPhone, iPad, and Mac across all regions. The active installed base reached all-time highs across all categories. Innovation drove performance, including launches of the M4 MacBook Air, M3 iPad Air, and Mac Studio with M4 Max and M3 Ultra, capable of handling LLMs with 600B parameters.

Over 50% of Mac and iPad buyers were new, indicating strong product adoption. Gross margin declined –70bps YoY and –340bps QoQ due to FX, seasonal loss of leverage, and a product mix shift to newer, high-cost devices.

Services Revenue

Services revenue hit a record $26.6B, growing +12% YoY, despite a –2 pp FX headwind. Services gross margin rose to 75.7%, up +70bps QoQ. Apple reported double-digit growth in paid accounts and subscriptions, now exceeding 1B total paid subscriptions.

Apple Pay hit an all-time high in active users, while Apple TV+ achieved record viewership. Management flagged potential risks to future growth from macro uncertainty and regulatory pressures, including the Epic ruling and Digital Markets Act in Europe.

iPhone

iPhone revenue reached $46.8B, up +2% YoY, led by the iPhone 16 family and the new iPhone 16e, powered by the A18 chip and Apple’s C1 modem. Active installed base hit a new high, and upgraders grew double digits YoY. iPhone remained the top-selling model in the U.S., China, Japan, UK, Germany, and Australia.

AI features contributed to outperformance in select markets, confirming early traction of Apple Intelligence. Apple is mitigating FX and tariff headwinds by shifting U.S.-bound production to India.

Wearables and Accessories

Revenue declined –5% YoY to $7.5B, due to tough comps against the prior-year launch of Vision Pro and Watch Ultra 2. Despite this, the Apple Watch install base hit a new high, with over 50% of buyers new to the product.

Product innovation included AirPods 4 with active noise cancellation and expanded hearing health features. Apple reported millions of hearing tests completed and positive user feedback on the new hearing aid mode in AirPods Pro 2.

Product Innovations

Mac revenue rose to $7.9B (+7% YoY), supported by the new M4 MacBook Air, MacBook Pro, and Mac Studio with enhanced AI performance. iPad revenue reached $6.4B (+15% YoY), led by the M3 iPad Air, paired with Apple Pencil Pro and new tools like Image Wand and Cleanup.

AI Expansion

Apple Intelligence now supports French, German, Spanish, Japanese, Korean, and Simplified Chinese. Key AI features include Genmoji, Image Playground, smart replies, and AI photo search. Tasks are handled on-device via Apple Silicon or via Private Cloud Compute, maintaining privacy standards. Select queries integrate with ChatGPT, reflecting a hybrid AI architecture.

Software

iOS 18.4 expanded Apple Intelligence across more languages and regions. Feature set includes writing tools, priority notifications, CleanUp, Visual Intelligence, and AI-generated content creation. More advanced Siri features are delayed but under development. VisionOS 2.4 added AI to Vision Pro and launched the Spatial Gallery for immersive content.

Customer Engagement

Apple’s active device install base reached record levels across all segments. Paid accounts and transacting users both hit all-time highs. Paid subscriptions exceeded 1B, with Apple Pay growing double digits YoY in active users.

Satisfaction remained high in the U.S.: iPhone 97%, iPad 97%, Mac 95%, and Apple Watch 95%. More than 50% of Mac, iPad, and Watch buyers were new customers. AI-driven tools like Genmoji, Cleanup, and Smart Replies deepened user engagement.

China

Greater China revenue fell –2% YoY, but was flat after FX adjustments, improving from a –11% YoY decline in Q1. iPhone was a top 2 smartphone in urban China, and iPad held a top 2 tablet position.

Subsidies supported results, particularly on products priced under RMB 6,000. Mac, iPad, and Watch segments saw high new-user share. Apple confirmed no channel inventory buildup. China continues to serve non-U.S. markets, while production for U.S. shifts to India and Vietnam.

Strategic Investment

Apple announced a $500B U.S. investment plan over four years, expanding operations in Texas, California, Arizona, Michigan, and other states. The plan includes a new advanced server manufacturing facility in Texas and scaling chip sourcing from TSMC’s Arizona fabs.

In 2025, Apple will source 19B chips from across 12 U.S. states, including advanced silicon. Domestic suppliers now exceed 9,000 vendors across all 50 states. New retail stores will open in India, UAE, and Saudi Arabia, alongside an online store launch in Saudi Arabia.

Supply Chain

Apple continues diversifying manufacturing away from China. For Q3, most U.S.-bound iPhones will be sourced from India, while iPads, Macs, Watches, and AirPods will come from Vietnam. China remains the hub for international supply. The strategy enhances margin stability and tariff insulation.

Tariff Impact

Apple estimates a $900M cost hit in Q3 from existing tariff regimes, primarily driven by 20% IEEPA tariffs and 145% tariffs on AppleCare/accessories exported to China. Apple built inventory ahead in Q2, visible in its manufacturing purchase obligations. Regulatory risks, including a Section 232 semiconductor probe, may escalate in H2.

Outlook

Apple projects low to mid-single-digit revenue growth in Q3 FY25. Gross margin is guided at 45.5%–46.5%, factoring in the $900M tariff impact. Operating expenses are forecast between $15.3B–$15.5B, with a 16% tax rate. Management reaffirmed its commitment to long-term innovation, privacy leadership, and capital discipline, while monitoring macro and trade volatility.

Management comments on the earnings call.

Product Innovations

Tim Cook, Chief Executive Officer

“We introduced significant new updates to our lineup. The world’s most popular laptop just got even better. The M4-powered MacBook Air delivers a massive boost in performance and now comes in a beautiful new sky blue color.”

Tim Cook, Chief Executive Officer

“The new Mac Studio is the most powerful Mac we’ve ever shipped. Equipped with M4 Max and our new M3 Ultra chip, it’s a true AI powerhouse capable of running large language models with over 600 billion parameters entirely in memory.”

iPhone Performance

Tim Cook, Chief Executive Officer

“iPhone revenue was $46.8 billion, up 2% from a year ago. During the quarter, we introduced iPhone 16e—a great new entry-level addition to our iPhone 16 lineup featuring our latest-generation A18 chip and the all-new Apple-designed C1 modem.”

Kevin Parekh, Chief Financial Officer

“The iPhone active installed base grew to an all-time high in total and in every geographic segment, and iPhone upgraders grew double digits year over year.”

Tim Cook, Chief Executive Officer

“In markets where we had rolled out Apple Intelligence, the year-over-year performance on the iPhone 16 family was stronger than those where Apple Intelligence was not available.”

Wearables and Accessories

Tim Cook, Chief Executive Officer

“Apple Watch Series 10 is an essential partner wherever you are on the health and fitness journey. AirPods 4 with active noise cancellation delivers an extraordinary experience in an open-ear design.”

Tim Cook, Chief Executive Officer

“The stories we received about the new hearing aid feature are deeply moving, showing how these innovations are making a real difference in people’s daily lives.”

Kevin Parekh, Chief Financial Officer

“The Apple Watch install base reached a new all-time high, with over half of customers purchasing an Apple Watch during the quarter being new to the product.”

AI Expansion

Tim Cook, Chief Executive Officer

“We built our own highly capable foundation models that are specialized for everyday tasks. We designed helpful features that are right where our users need them and are easy to use.”

Tim Cook, Chief Executive Officer

“Since we launched iOS 18, we’ve released a number of Apple Intelligence features—from helpful writing tools to Genmoji, Image Playground, Cleanup, Visual Intelligence, and a seamless connection to ChatGPT.”

Tim Cook, Chief Executive Officer

“Some of the queries that are being used by our customers are on device, and then others go to the private cloud where we’ve essentially mimicked the security and privacy of the device into the cloud.”

Software Strategy

Tim Cook, Chief Executive Officer

“With iOS 18.4, we brought Apple Intelligence to more languages, including French, German, Italian, Portuguese, Spanish, Japanese, Korean, and Simplified Chinese, as well as localized English to Singapore and India.”

Tim Cook, Chief Executive Officer

“With regard to the more personal Siri features we announced, we need more time to complete our work on these features so they meet our high quality bar. We are making progress, and we look forward to getting these features into customers' hands.”

Customer Engagement

Kevin Parekh, Chief Financial Officer

“Customer engagement across our services offerings continued to grow. Both transacting and paid accounts reached new all-time highs, with paid accounts growing double digits year over year.”

Kevin Parekh, Chief Financial Officer

“Apple Pay continues to help our customers with an easy, secure, and private payment solution, and we were pleased to see that our active users in Apple Pay reached an all-time record.”

Tim Cook, Chief Executive Officer

“From starting their morning with their podcast of choice to buying a coffee with Apple Pay to using their favorite app from the App Store, Apple services are enriching our users’ lives all throughout their day.”

International Growth

Tim Cook, Chief Executive Officer

“We set a number of quarterly records in countries and regions across the world, including the UK, Spain, Finland, Brazil, Chile, Turkey, Poland, India, and the Philippines.”

Kevin Parekh, Chief Financial Officer

“We also grew in every geographic segment and saw double-digit growth in both developed and emerging markets.”

Challenges and Tariff

Tim Cook, Chief Executive Officer

“For the June, currently we are not able to precisely estimate the impact of tariffs as we are uncertain of potential future actions prior to the end of the quarter. However, assuming the current global tariff rates, we estimate the impact to add $900 million to our costs.”

Tim Cook, Chief Executive Officer

“For the June, we do expect the majority of iPhones sold in the U.S. will have India as their country of origin and Vietnam to be the country of origin for almost all iPad, Mac, Apple Watch, and AirPods products sold in the U.S.”

Tim Cook, Chief Executive Officer

“The vast majority of our products are currently not subject to the global reciprocal tariffs that were announced in April. However, certain AppleCare and accessories businesses are now facing a total rate of at least 145%.”

Future Outlook

Kevin Parekh, Chief Financial Officer

“We expect our June total company revenue to grow low to mid single digits year over year. We expect gross margin to be between 45.5 and 46.5%, which includes the estimated impact of the $900 million of tariff-related costs.”

Tim Cook, Chief Executive Officer

“As we look ahead, we remain confident—confident that we will continue to build the world’s best products and services, confident in our ability to innovate and enrich our users’ lives.”

Thoughts on Apple Earnings Report $AAPL:

🟢 Positive

Revenue reached $95.4B, up +5.1% YoY, exceeding estimates by 0.9%

EPS was $1.65, up +1.9% vs. consensus, a March quarter record

Gross margin expanded to 47.1% (+0.5 pp YoY)

Services revenue hit an all-time high of $26.6B (+11.6% YoY), with 75.7% gross margin

iPad revenue increased +15.2% YoY, driven by the new M3 iPad Air

Mac revenue rose +6.7% YoY, supported by new M4/M3-powered models

Apple Pay and TV+ reached record engagement levels

Japan and Asia Pacific delivered strong regional growth: +16.5% and +8.4% YoY, respectively

Over 50% of Mac, iPad, and Apple Watch buyers were new customers

Dividend raised +4% to $0.26/share; $29B returned to shareholders

Paid subscriptions surpassed 1B, with strong double-digit growth

R&D spend increased to 9.0% of revenue (+0.3 pp YoY), indicating continued product investment

🟡 Neutral

iPhone revenue grew +1.9% YoY, supported by iPhone 16 family but below past growth rates

Europe revenue rose +1.4% YoY, slower than Americas and Asia

Net margin slightly declined to 26.0% (–0.1 pp YoY)

FCF margin slipped to 21.9% (–0.9 pp YoY)

SG&A/Revenue decreased marginally to 7.1% (–0.1 pp YoY)

SBC as % of revenue increased to 3%, up +0.7 pp QoQ

Personal Siri AI features delayed, though core Apple Intelligence features launched

🔴 Negative

Wearables, Home and Accessories revenue declined –4.9% YoY, due to tough comps from Vision Pro and Watch Ultra 2

China revenue fell –2.3% YoY, though flat after FX adjustment

$900M tariff-related cost impact expected in Q3

Product gross margin declined –70bps YoY, –340bps QoQ, impacted by FX and mix

Tariffs of 145% imposed on AppleCare/accessories exported to China

Ongoing regulatory risk from the Epic ruling and EU’s Digital Markets Act may pressure Services segment further

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.