Financial Results:

⬆️$170M rev (+13.9% YoY, +12.6% LQ) beat est by 2.3%

⬆️Operating Margin (7.8%, +5.9%pp YoY)

⬆️FCF Margin (TTM) 6.4%, +8.7%pp YoY)🟢

⬆️Net Margin 6.3%, +6.1%pp YoY)

⬆️EPS $1.00 beat est by 25.0%

Segment Revenue

➡️Net product sales $77M rev (+8.8% YoY)🟡

⬆️Net service sales $93M rev (+18.5% YoY)🟢

AWS

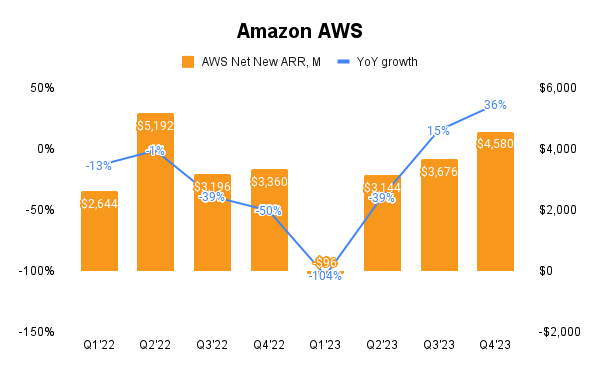

↘️AWS Revenue$24M rev (+13.2% YoY)🟡

⬆️Operating Margin (29.6%, +5.3%pp YoY)

Dilution

↘️SBC/rev 4%, -0.4%pp QoQ)

⬆️Dilution at 1.3% YoY, +0.0%pp QoQ)

Guidance

⬆️Q1'24 $143.0M guide (+12.3% YoY) beat est by 0.6%

Key points from Amazon $AMZN Q4 2023 Earnings Call:

1. Revenue and Operating Income Growth:

Amazon reported a notable increase in revenue to $170 billion, up 13% year-over-year, excluding foreign exchange impacts. Operating income saw a dramatic rise to $13.2 billion, marking a 383% increase from the previous year.

2. Customer Experience Enhancements:

The focus on selection, price, and convenience attracts customers, with billions saved through deals, reinforcing Amazon's commitment to value.

3. Expanding Retail Selection and Convenience:

Amazon highlighted its broad retail selection, adding millions of new items across various categories. Delivery speeds hit record highs, with over 7 billion items delivered same or next day, illustrating efficiency and customer satisfaction.

4. Cost-to-Serve Reductions:

For the first time since 2018, Amazon successfully reduced its global cost-to-serve on a per-unit basis, partly due to strategic regionalization and the expansion of same-day facilities.

5. Advertising and AWS Growth:

Advertising revenue grew by 26% year-over-year, driven by sponsored ads. AWS continued its growth trajectory, with a 13% increase in revenue compared to the previous quarter, nearing an annualized revenue run rate of $100 billion.

6. Generative AI Initiatives:

Amazon is investing heavily in generative AI across three layers: custom AI chips for training and inference, a managed service for leveraging large language models, and developing applications that utilize these technologies. This includes customer-facing innovations like Rufus, an expert shopping assistant.

7. Project Kuiper and Prime Video:

Amazon achieved significant milestones with Project Kuiper, its satellite broadband initiative, and reported success with its Prime Video offerings, including Thursday Night Football, contributing to increased viewer numbers and ad sales.

Management comments on the earnings call.

AWS (Amazon Web Services):

Andy Jassy: "Revenue in the quarter grew 13% year-over-year in Q4 versus 12% year-over-year in Q3. And we're now approaching an annualized revenue run rate of $100 billion."

Andy Jassy: "While cost optimization continued to attenuate, larger new deals also accelerated, evidenced by recently inked agreements with Salesforce, BMW, NVIDIA, LG, Hyundai, Merck, MUFG, Axiata, Cafe, BYD, Arcore, Amgen, and SAIC."

Product Innovations, AI:

Andy Jassy: "2023 also was a very significant year of delivery and customer trial for generative AI or Gen AI in AWS."

Andy Jassy: "Gen AI is and will continue to be an area of pervasive focus and investment across Amazon, primarily because there are a few initiatives, if any, that give us the chance to reinvent so many of our customer experiences and processes, and we believe it will ultimately drive tens of billions of dollars of revenue for Amazon over the next several years."

Prime Video:

Andy Jassy: "We completed our second season of Thursday Night Football, which was a rousing success by all accounts... We have increasing conviction that Prime Video can be a large and profitable business on its own."

Advertising Revenue:

Andy Jassy: "Alongside our stores business, our advertising growth remains strong, up 26% year-over-year, which is primarily driven by our sponsored ads."

Amazon Prime:

"In 2023, Amazon delivered to Prime members at the fastest speeds ever... increases the number of occasions that customers choose Amazon." - Andy Jassy, CEO.