Amazon Q4 2024 Earnings Analysis

Dive into $AMZN Amazon’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$187.79B rev (+10.5% YoY, +11.0% LQ) beat est by 0.3%

↗️Operating Margin (11.3%, +3.5 PPs YoY)🟢

↘️FCF Margin, TTM ( 6.0%, -0.4 PPs YoY)🟡

↗️Net Margin (10.7%, +4.4 PPs YoY)

↗️EPS $1.86 beat est by 25.7%🟢

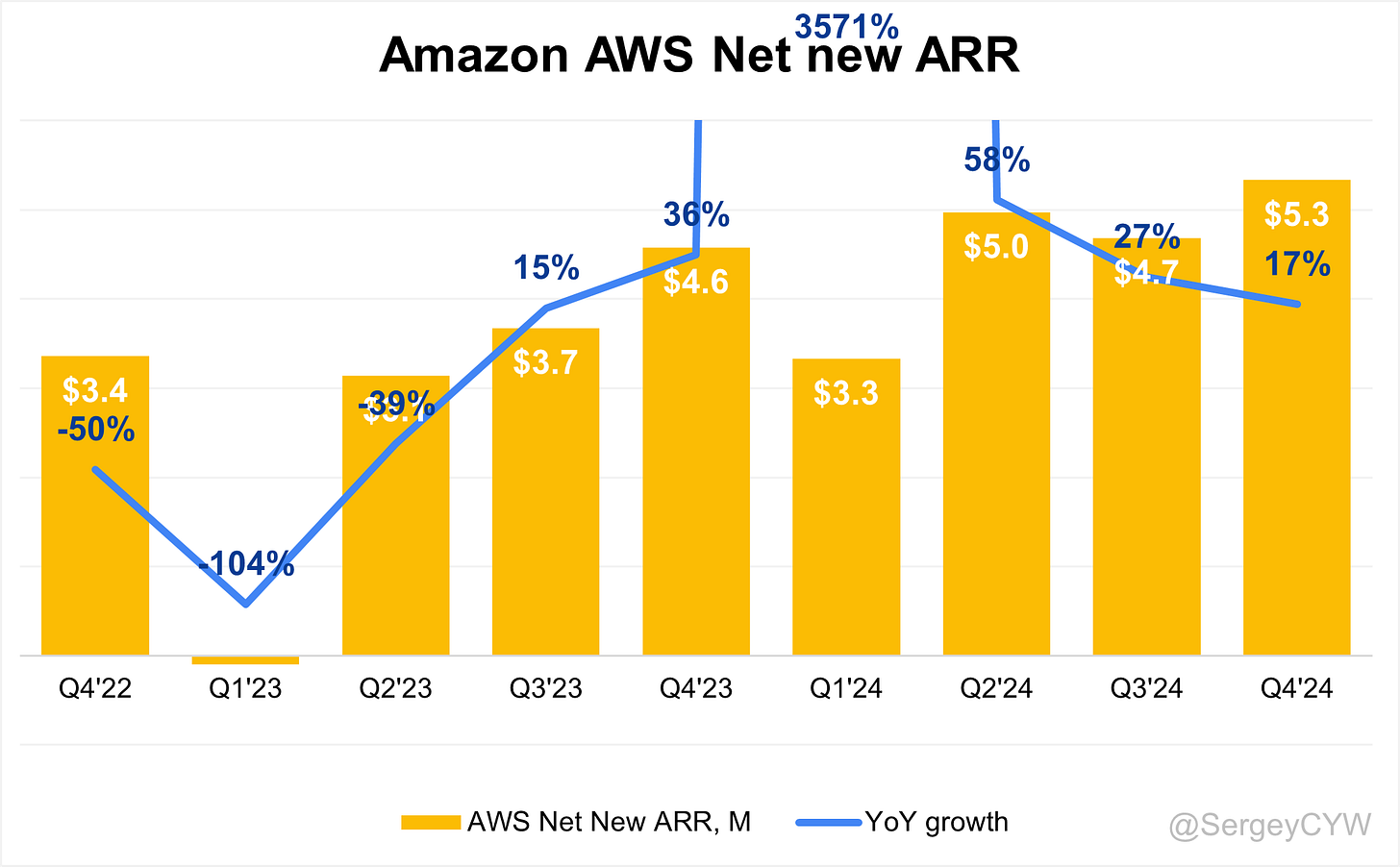

AWS

↗️AWS Revenue $28.8B rev (+18.9% YoY)

↗️Operating Margin (36.9%, +7.3 PPs YoY)

Revenue by Category

➡️Net product sales $82.2B rev (+7.2% YoY)🟡

↗️Net service sales $105.6B rev (+13.2% YoY)

Revenue by Segment

➡️Online stores $75.6B rev (+7.1% YoY)🟡

➡️Physical stores $5.6B rev (+8.3% YoY)🟡

➡️Third-party seller $47.5B rev (+9.0% YoY)🟡

↗️Advertising $17.3B rev (+18.0% YoY)

➡️Subscription $11.5B rev (+9.7% YoY)🟡

↗️AWS $28.8B rev (+18.9% YoY)

↗️Other $1.6B rev (+16.7% YoY)🟢

Operating expenses

↘️S&M/Revenue 7.0% (-0.6 PPs YoY)

↘️R&D/Revenue 12.6% (-0.4 PPs YoY)

↘️G&A/Revenue 1.5% (-0.2 PPs YoY)

Dilution

↘️SBC/rev 3%, -0.7 PPs QoQ

↗️Basic shares up 1.9% YoY, +0.2 PPs QoQ

↘️Diluted shares up 1.5% YoY, -0.2 PPs QoQ

Guidance

↘️$151.0 - $155.5B guide (+6.9% YoY) missed est by -3.3%🔴

Key points from Amazon’s Fourth Quarter 2024 Earnings Call:

Financial Performance

Amazon reported Q4 2024 revenue of $187.8 billion, up 10% YoY. Adjusted for FX fluctuations, revenue growth was 11% YoY, exceeding the upper end of guidance. The company faced a $700 million FX headwind.

Operating income surged 61% YoY to $21.2 billion, marking the most profitable quarter ever. The North America segment generated $115.6 billion in revenue (+10% YoY), while International revenue reached $43.4 billion (+9% YoY, FX-adjusted).

AWS revenue grew 19% YoY to $28.8 billion, contributing to an annualized run rate of $115 billion. Free cash flow over the trailing twelve months increased by $700 million YoY to $36.2 billion.

Amazon’s cost-optimization strategy led to margin expansion. North America’s operating margin rose to 8% (+190 basis points YoY), while International’s grew to 3% (+400 basis points YoY). AWS operating income reached $10.6 billion (+$3.5 billion YoY), driven by efficiency improvements.

Product Innovations

Amazon launched Amazon Haul, offering ultra-low-priced products. New brands like Clinique, Estee Lauder, Aura Rings, and Armani Beauty joined the platform.

Amazon Lens introduced computer vision to enhance product discovery via image recognition. AI-powered sizing recommendations improved clothing and footwear conversion rates.

AWS Expansion

AWS revenue grew 19% YoY despite supply constraints in GPUs, power availability, and server components. Management expects capacity constraints to ease in H2 2025.

New enterprise customers include Intuit, PayPal, Northrop Grumman, Reddit, Japan Airlines, Baker Hughes, Hertz, Chime Financial, and Asana. Generative AI is scaling at a triple-digit growth rate, driven by Tranium 2-based instances and AI software tools.

AWS continues to expand core services, adding Amazon Aurora D SQL, Amazon S3 Tables, and next-gen SageMaker AI services. DeepSeq’s R1 models launched on AWS, enhancing its frontier AI technology integration.

AWS Customer Success

Key customers expanding AWS usage:

Intuit – Scaling AI-driven financial solutions.

PayPal – Modernizing payment systems.

Northrop Grumman – Strengthening defense and aerospace applications.

Reddit – Enhancing real-time content processing.

Japan Airlines – Optimizing flight operations.

Baker Hughes – Utilizing AI for industrial automation.

Hertz Corporation – Supporting connected vehicle technologies.

Chime Financial – Securing digital banking infrastructure.

Asana – Expanding AI-driven project management solutions.

AWS AI Transformation

Amazon Q Transformation saved Amazon $260 million and 4,500 developer years by automating the migration of 30,000 applications. Enterprises are now using the framework to migrate .NET applications to Linux, VMware workloads to AWS EC2, and mainframes to cloud-native environments.

Advertising Revenue Growth

Amazon’s Q4 advertising revenue reached $17.3 billion (+18% YoY), an annualized run rate of $69 billion. Sponsored Products remain the dominant revenue source, with Prime Video ads gaining traction.

Amazon Marketing Cloud (AMC) expanded multi-touch attribution models, enabling advertisers to track brand awareness to conversion performance.

Advertising Success

Major brands increased spending on Amazon’s retail media network, leveraging first-party shopper data and AI-driven targeting tools. Higher ROAS (return on ad spend) reinforced Amazon’s leadership in performance-based digital marketing.

Prime Membership Expansion

Prime membership grew with faster delivery and new benefits. Same-day and one-day delivery expanded to 140 metro areas, with 9 billion units delivered globally in 2024.

New perks introduced:

$0.10 per gallon fuel discount at BP, AMPM, and Amoco.

Free Grubhub+ membership for unlimited delivery.

Unlimited grocery delivery on orders over $35 from Whole Foods & Amazon Fresh.

Ad-free listening to 100 million songs on Amazon Music.

Expanded Prime Video library, including live sports.

Amazon maintained its pricing leadership. Profitero’s pricing study ranked Amazon 14% cheaper than competitors, making it the lowest-priced online retailer for the 8th consecutive year.

Generative AI Expansion

Amazon is heavily investing in AI-driven productivity across AWS, e-commerce, fulfillment, and advertising. AI-powered customer service chatbots improved customer satisfaction by 500 basis points.

AI-enhanced inventory forecasting led to 10% better demand predictions and 20% improved regional stocking accuracy. AI personalization boosted customer engagement through Amazon Rufus, Amazon Lens, and AI-powered size recommendations.

Amazon Bedrock & AI Models

Amazon Bedrock now includes models from Anthropic, Luma AI, and DeepSeq, enabling custom AI-powered applications. Amazon Nova models offer 75% lower inference costs than competitors, attracting Palantir, SAP, Fortinet, and Trellix.

Anthropic is building its next-gen AI models on AWS, leveraging Tranium 2-based AI clusters, reducing reliance on NVIDIA GPUs.

Amazon Q & AI Developer Tools

Amazon Q, AWS’s AI assistant, is streamlining software development and automation. Features include:

Q Transformation – Accelerating cloud migrations and modernization.

Automated migration of .NET to Linux & VMware to AWS EC2.

AI-powered coding assistance, similar to GitHub Copilot.

Retail Growth & Third-Party Sellers

Third-party sellers accounted for 61% of total units sold, an all-time high.

Amazon Haul attracted budget-conscious shoppers. AI-driven pricing optimization and personalized recommendations improved conversion rates.

Robotics & Fulfillment Efficiency

Amazon’s robotics and AI-driven fulfillment network reduced global per-unit fulfillment costs for the second year in a row.

In Shreveport, Louisiana, Amazon tested a fully automated fulfillment center with AI-driven robotics, with expansion planned in 2025.

Tranium 2 & AI Compute

AWS’s Tranium 2 AI chips deliver 30-40% better price/performance than existing GPU-based instances. Adobe, Databricks, and Qualcomm are among early adopters.

AWS is building "Project Right Near," an AI training cluster powered by Tranium 2 in partnership with Anthropic.

Logistics & Cost Reduction

Optimized transportation, packaging, and inbound inventory improved cost efficiency. Higher package consolidation rates and regional inventory stocking further reduced cost-per-unit fulfillment.

International Growth

Amazon’s International segment revenue grew 9% YoY (FX-adjusted), with operating margin expanding 400 basis points. FX headwinds cost $700M in Q4, but investments in localized fulfillment and Prime expansion are expected to sustain long-term growth.

CapEx & Investment Priorities

Amazon spent $26.3 billion in CapEx in Q4. Annualized CapEx rate is ~$100 billion for 2025, primarily allocated to:

AI infrastructure (AWS, generative AI, cloud computing).

Logistics & fulfillment (same-day facilities, rural coverage, automation).

Robotics and AI-driven cost optimizations.

Challenges & Guidance

Amazon faces:

Foreign exchange fluctuations ($2.1 billion expected impact in Q1 2025).

AI-related CapEx intensity, with longer monetization cycles.

AWS supply constraints, expected to ease in H2 2025.

Future Outlook

Amazon remains focused on AI-driven growth, cloud expansion, and fulfillment efficiency. AWS AI & generative computing represent the most significant long-term revenue drivers, while fulfillment automation continues to drive cost savings.

Management comments on the earnings call.

Product Innovations

Andy Jassy, Chief Executive Officer

"Our relentless pursuit of better selection, price, and delivery speed is driving accelerated growth in Prime membership. We continue to add to our broad range, giving customers choice across a variety of price points, and launched Amazon Haul to bring ultra-low-priced products into one convenient destination. It’s off to a very strong start."

Andy Jassy, Chief Executive Officer

"We've made significant improvements to our fulfillment network, optimizing inventory placement so that even more items are closer to end customers. These changes have reduced our global cost to serve on a per-unit basis for the second year in a row, while at the same time increasing speed, improving safety, and adding selection."

AWS

Andy Jassy, Chief Executive Officer

"AWS is a reasonably large business by most folks’ standards, and though we expect growth will be lumpy over the next few years as enterprises adopt and technology advancements impact timing, it’s hard to overstate how optimistic we are about what lies ahead for AWS’s customers and business."

Andy Jassy, Chief Executive Officer

"We continue to believe that the world will mostly be built on top of the cloud, with the largest portion of it on AWS. To best help customers realize this future, you need powerful capabilities across all three layers of the AI stack—chips, model-building services, and application-level AI. That’s exactly what we’re delivering."

Brian Olsavsky, Chief Financial Officer

"AWS continues to drive strong operating income, with a $10.6 billion contribution this quarter, up $3.5 billion year over year. Our focus on cost efficiency, improved infrastructure, and AI-driven innovations has strengthened our margins, and we remain committed to optimizing costs while scaling our capabilities."

Advertising Segment

Andy Jassy, Chief Executive Officer

"Advertising remains a high-growth, high-margin segment for us, with revenue reaching a $69 billion annualized run rate. Sponsored Products continue to be the largest portion of ad revenue, and we see a runway for even more growth with new streaming and AI-driven advertising solutions."

Andy Jassy, Chief Executive Officer

"With our new multi-touch attribution model, advertisers can better understand how various ad types contribute to sales. The strength of our advertising business is its direct connection to shopping, and we are continuously enhancing our capabilities to provide more value to brands."

Amazon Prime

Andy Jassy, Chief Executive Officer

"For just $14.99 a month, Prime members get unlimited free shipping, exclusive shopping events, premium video programming, and a growing list of valuable benefits. Compared to many other membership services that offer just one benefit at a comparable or higher price, Prime is a screaming deal."

Andy Jassy, Chief Executive Officer

"We have expanded the number of same-day delivery sites by more than 60% this year, now serving over 140 metro areas. This has resulted in over 9 billion units being delivered the same or next day worldwide. Our commitment to speed and efficiency is delivering real benefits to customers."

Generative AI

Andy Jassy, Chief Executive Officer

"While it may be hard for some to fathom a world where virtually every app is generative AI-infused, this is the world we are thinking about all the time. We continue to believe that AI will be a fundamental transformation for businesses, and we are investing heavily to lead in this space."

Andy Jassy, Chief Executive Officer

"With our custom silicon, Tranium 2, we are delivering 30-40% better price performance than other current GPU-powered instances available. As AI models become larger and more complex, enterprises need cost-effective, scalable solutions. That’s why companies like Anthropic are building their next-gen models on AWS infrastructure."

Competitors

Andy Jassy, Chief Executive Officer

"Most AI compute has been driven by NVIDIA chips, and we obviously have a deep partnership with them, but customers want better price performance. That’s why we built our own custom AI silicon, and why companies are now choosing Tranium 2 for their next-generation AI workloads."

Andy Jassy, Chief Executive Officer

"We’ve seen significant advances in AI model capabilities from competitors, but we continue to believe that customers will want access to multiple models, which is why we are integrating the best options—including our own models—into Amazon Bedrock."

Customers

Andy Jassy, Chief Executive Officer

"AWS signed new agreements with Intuit, PayPal, Norwegian Cruise Line, Northrop Grumman, Reddit, Japan Airlines, Baker Hughes, Asana, and many others this quarter. Enterprises recognize that moving to the cloud and adopting AI-driven solutions are critical to their future success."

Andy Jassy, Chief Executive Officer

"Our customers want more than just compute and storage—they need AI-powered applications that help them operate more efficiently and create new revenue streams. That’s why we are integrating AI across our entire ecosystem, from Amazon Bedrock to Amazon Q."

Strategic Partnerships

Andy Jassy, Chief Executive Officer

"Anthropic has chosen to build its next generation of foundation models on AWS, using our custom silicon. This is a testament to the price-performance advantages we offer and reinforces AWS’s position as a leading platform for AI innovation."

Andy Jassy, Chief Executive Officer

"We are seeing strong adoption of Amazon Bedrock, with leading companies like Palantir, SAP, Fortinet, and Trellix already leveraging our AI models to enhance their businesses. Our ability to provide high-performing models with lower inference costs is resonating with enterprises."

International Growth

Brian Olsavsky, Chief Financial Officer

"Our International segment delivered 9% revenue growth year over year, excluding the impact of foreign exchange. This marks the eighth consecutive quarter of margin improvement as we continue to optimize operations globally."

Andy Jassy, Chief Executive Officer

"We are expanding our investments in international logistics and fulfillment to reduce costs and improve delivery speeds. Our global reach remains a key advantage in driving Prime adoption outside North America."

Challenges

Andy Jassy, Chief Executive Officer

"While we are seeing strong demand for AI-driven solutions, capacity constraints—particularly in GPUs and power availability—are moderating growth. We expect these constraints to ease in the second half of 2025, allowing us to accelerate adoption further."

Brian Olsavsky, Chief Financial Officer

"Foreign exchange fluctuations created a $700 million headwind in Q4, which was higher than anticipated. Additionally, we estimate that FX will be a $2.1 billion headwind in Q1 2025, impacting our revenue growth rate."

Soft Guidance

Brian Olsavsky, Chief Financial Officer

"For Q1 2025, we expect net sales to be between $151 billion and $155.5 billion, reflecting foreign exchange headwinds and the impact of the leap year in 2024. Despite these temporary factors, we remain confident in our long-term growth trajectory."

Future Outlook

Andy Jassy, Chief Executive Officer

"2024 was a very successful year across almost any dimension you pick, but we are far from done. We see opportunities to reduce costs further, improve fulfillment speed, and expand our AI-driven services. Our teams are energized to deliver even more in 2025."

Brian Olsavsky, Chief Financial Officer

"We continue to invest in AI, cloud infrastructure, fulfillment network optimizations, and robotics. These investments will support growth for many years to come while maintaining our commitment to efficiency and profitability."

Thoughts on Amazon Earnings Report $AMZN:

🟢 Positive

Revenue: $187.8B (+10.5% YoY, +11.0% QoQ), exceeding guidance.

Operating Income: $21.2B (+61% YoY), most profitable quarter ever.

Operating Margin: 11.3% (+3.5 PPs YoY), showing strong cost efficiency.

AWS Revenue: $28.8B (+18.9% YoY), maintaining $115B annualized run rate.

AWS Operating Margin: 36.9% (+7.3 PPs YoY), showing strong profitability.

Advertising Revenue: $17.3B (+18% YoY), solid growth with Prime Video ads contributing.

EPS: $1.86, beating estimates by 25.7%.

Subscription Revenue: $11.5B (+9.7% YoY), Prime continues to add value.

Third-Party Seller Services: $47.5B (+9.0% YoY), accounting for 61% of total units sold.

AI & Automation: Amazon Q saved $260M and 4,500 developer years by automating migration.

Robotics & Fulfillment: Reduced per-unit costs for the second consecutive year.

🟡 Neutral

Net Product Sales: $82.2B (+7.2% YoY), slower than service sales.

Online Stores Revenue: $75.6B (+7.1% YoY), growth in line with past quarters.

Physical Stores Revenue: $5.6B (+8.3% YoY), steady growth but minor segment.

Free Cash Flow Margin: 6.0%, down 0.4 PPs YoY, showing slight pressure.

Stock-Based Compensation (SBC): 3% of revenue, decreased 0.7 PPs QoQ.

International Revenue: $43.4B (+9% YoY, FX-adjusted), impacted by FX headwinds.

AI CapEx Intensity: Heavy investment in Tranium 2, AWS expansion, and Project Right Near.

🔴 Negative

Q1 2025 Revenue Guidance: $151B - $155.5B, below estimates by -3.3%.

Foreign Exchange Headwinds: -$700M in Q4, expected to be -$2.1B in Q1 2025.

Diluted Shares Outstanding: +1.5% YoY, slight dilution for investors.

AWS Supply Constraints: GPU shortages, power limitations, server component bottlenecks, expected to ease in H2 2025.

Fulfillment & Last-Mile Costs: Logistics expenses remain high despite cost optimizations.