Amazon Q3 2024 Earnings Analysis

Dive into $AMZN Amazon’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$158.88B rev (+11.0% YoY, +10.1% LQ) beat est by 1.1%

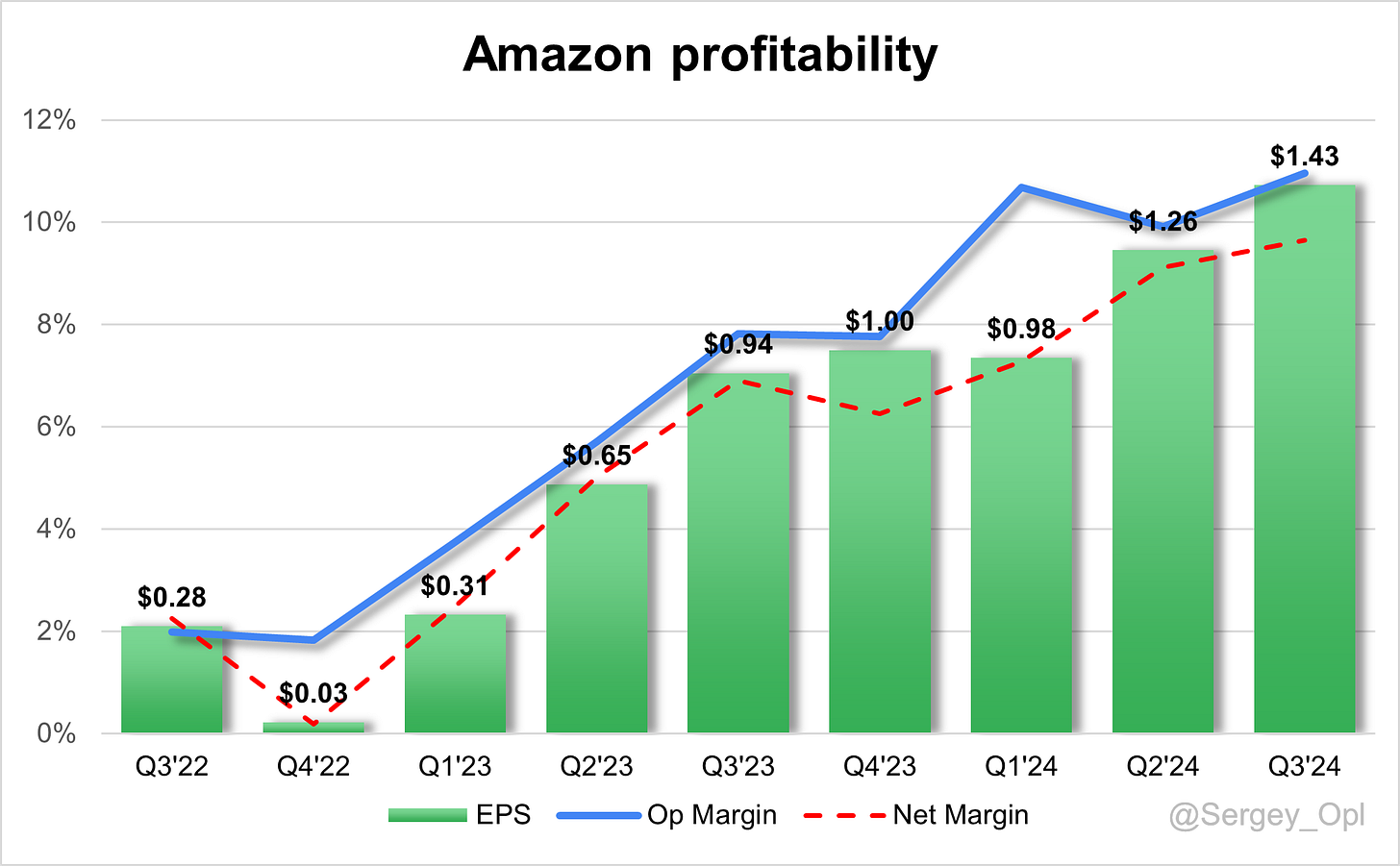

↗️Operating Margin (11.0%, +3.1 PPs YoY)🟢

↗️FCF Margin, TTM ( 7.7%, +3.8 PPs YoY)

↗️Net Margin (9.6%, +2.7 PPs YoY)

↗️EPS $1.43 beat est by 6.7%🟢

AWS

↗️AWS Revenue $27.5B rev (+19.1% YoY)🟢

↗️Operating Margin (38.1%, +7.8 PPs YoY)🟢

Revenue by Category

➡️Net product sales $67.6B rev (+7.0% YoY)🟡

↗️Net service sales $91.3B rev (+14.2% YoY)

Revenue by Segment

➡️Online stores $61.4B rev (+7.2% YoY)🟡

➡️Physical stores $5.2B rev (+5.4% YoY)🟡

➡️Third-party seller $37.9B rev (+10.3% YoY)🟡

↗️Advertising $14.3B rev (+18.8% YoY)

➡️Subscription $11.3B rev (+10.9% YoY)🟡

↗️AWS $27.5B rev (+19.1% YoY)🟢

➡️Other $1.3B rev (+7.1% YoY)🟡

Operating expenses

↘️S&M/Revenue 6.7% (-0.7 PPs YoY)

↘️R&D/Revenue 14.0% (-0.8 PPs YoY)

↘️G&A/Revenue 1.7% (-0.1 PPs YoY)

Dilution

↘️SBC/rev 3%, -1.2 PPs QoQ

↗️Basic shares up 1.7% YoY, +0.2 PPs QoQ

↘️Diluted shares up 1.7% YoY, -0.8 PPs QoQ

Guidance

➡️Q4'24 $181.5 - $188.5B guide (+8.8% YoY) in line with est

Key points from Amazon’s Third Quarter 2024 Earnings Call:

Financial Performance

Amazon’s Q3 2024 results demonstrated solid growth, with revenue reaching $158.9 billion, up 11% year-over-year, excluding foreign exchange impacts. Operating income surged 56% to $17.4 billion, marking Amazon’s highest quarterly operating income to date. The North America segment generated $95.5 billion in revenue, reflecting a 9% increase, while International revenue grew by 12% to $35.9 billion. Operating margins improved in both segments, driven by cost efficiencies and streamlined fulfillment. North America’s operating margin rose by 100 basis points to 5.9%, while the International segment continued its profitability trend with a 3.6% margin.

AWS Performance

Amazon Web Services (AWS) reported revenue of $27.5 billion, up 19.1% year-over-year, pushing its annualized revenue run rate to $110 billion. Operating income for AWS rose to $10.4 billion, supported by adjustments in server life estimates, which added 200 basis points to margins. Demand for cloud and generative AI services fueled this growth, with AWS’s AI revenue expanding at a triple-digit rate. Amazon plans to meet this demand with investments in AI and cloud infrastructure, maintaining AWS’s competitive edge through enhanced capacity and performance. Significant advancements include the Trainium 2 chip, optimized for AI workloads, and expanded foundational model offerings via Amazon Bedrock.

Generative AI

Amazon is positioning generative AI as a cornerstone of AWS’s growth strategy. This segment is experiencing rapid expansion, with revenues increasing at a rate three times faster than AWS’s early growth. Amazon’s custom silicon, including Trainium for AI training and Inferentia for inference, provides cost-effective performance for complex AI workloads. AWS’s generative AI solutions cater to a variety of needs, from foundational model creation to fully managed services, helping businesses across sectors integrate AI into their operations. This AI initiative is projected to become a multi-billion-dollar revenue stream for AWS.

Amazon Bedrock

Amazon Bedrock offers a comprehensive platform for businesses to incorporate foundational models into applications, simplifying the deployment of AI across diverse use cases. Bedrock’s offerings include models from providers like Anthropic and Meta, allowing customers to customize models for specific needs. With features that streamline model orchestration and manage inference costs, Bedrock is appealing to enterprises scaling their AI use. Its security and cost-efficiency features further differentiate it in the enterprise AI landscape.

Amazon Q

Amazon Q is AWS’s generative AI-powered development assistant designed to streamline code generation, saving both time and resources. With industry-leading code acceptance rates, Q supports multi-line code suggestions and advanced training capabilities. Amazon Q has already delivered substantial cost savings and productivity gains within Amazon, showcasing its potential for enterprise customers. Q’s features demonstrate Amazon’s commitment to leveraging AI for operational efficiency, appealing to businesses aiming to modernize their tech stack with practical AI solutions.

Project Kuiper

Project Kuiper is Amazon’s initiative to create a low Earth orbit satellite network, aiming to deliver broadband access to underserved regions worldwide. Set for initial launches in early 2025, Project Kuiper seeks to expand Amazon’s global reach, especially in emerging markets, while supporting AWS customers in areas with limited broadband access. This project positions Amazon as a competitive player in satellite internet, with promising test results suggesting robust connectivity capabilities.

Advertising Performance

Amazon’s advertising segment continued to perform strongly, generating $14.3 billion in revenue, an 18.8% increase year-over-year. Growth was driven by Amazon’s full-funnel advertising options, which offer brands reach from awareness to purchase. Sponsored Products showed substantial growth, and newer offerings like Prime Video ads and AI-powered creative tools gained traction. Amazon sees advertising as a long-term growth driver, with plans to enhance ad relevance and optimization.

Robotics and Fulfillment Innovations

Amazon has launched its 12th-generation fulfillment center, featuring advanced robotics to optimize stowing, picking, packing, and shipping. The Shreveport, Louisiana facility marks a new phase in Amazon’s fulfillment strategy, expected to reduce processing times by up to 25% and lower operating costs. This facility allows faster and more cost-effective deliveries, with plans to scale this model across Amazon’s network. Robotics remains central to Amazon’s strategy to improve delivery speed, cost-efficiency, and workplace safety.

Prime Membership and Consumer Behavior

Amazon’s Prime membership base continues to grow, boosted by enhanced benefits such as unlimited grocery delivery and fuel discounts. Prime member growth accelerated this quarter, driven by successful events like Prime Day. Amazon observed a shift toward lower average selling price (ASP) items in categories like Everyday Essentials, appealing to budget-conscious consumers. Increased order frequency and larger basket sizes underscore Prime’s resonance with members, positioning Amazon to capture more daily shopping needs.

Stores Business

Amazon’s stores business achieved 9% revenue growth in North America and 12% internationally in Q3 2024, driven by successful Prime member events and strong engagement in Everyday Essentials. Amazon remains focused on lowering its cost to serve, implementing inventory placement improvements, and expanding its same-day delivery network. The company’s use of robotics and outbound regionalization further enhances delivery speed and cost-efficiency, supporting Amazon’s commitment to customer convenience and growth.

Challenges

Amazon faces several challenges, particularly in meeting the demand for AI services, which is constrained by chip availability in its data centers. AWS’s capital requirements for generative AI and data center expansion have increased, as AI-focused hardware is more costly than standard infrastructure. In retail, Amazon is adapting to consumer preferences for lower-priced items, impacting ASPs and unit economics. Despite these pressures, Amazon’s operational efficiencies and increased volume are helping to offset some of these challenges.

Future Outlook

Amazon’s strategic investments indicate a strong growth trajectory across core businesses. For AWS, Amazon plans to increase capital expenditures in 2025 to meet generative AI demand, with partnerships like NVIDIA and custom silicon developments (Trainium 2) enhancing AWS’s competitive position. In retail, Amazon is focused on expanding same-day delivery and fulfillment capabilities, targeting further cost reductions and faster service. With a significant portion of retail still conducted in physical stores, Amazon aims to capture market share as the shift toward e-commerce accelerates, supported by innovations in logistics, AI, and customer engagement strategies.

Management comments on the earnings call.

Product Innovations

Andy Jassy, CEO

“Automation and robotics in our fulfillment network allow us to ship more quickly, cost-effectively, and improve conditions for our fulfillment teammates. With new advancements, we’re improving inventory placement, delivery speed, and overall operational efficiency.”

AWS

Brian Olsavsky, CFO

“Our focus on expanding AWS’s core cloud offering and AI services responds to the demand we see across the market. By aligning infrastructure investments with customer growth, we’re continuing to deliver both operating income and free cash flow, creating long-term value in cloud services.”

Generative AI

Andy Jassy, CEO

“Generative AI represents a transformative opportunity that we’re pursuing aggressively, from foundational model creation to full-scale deployment. With triple-digit growth in our AI business, we’re committed to bringing scalable, high-performing AI solutions to our customers as they innovate in the cloud.”

Advertising

Andy Jassy, CEO

“Our advertising platform’s growth is driven by its full-funnel capabilities, allowing brands to engage customers from awareness through to purchase. We see considerable upside in this segment as we improve ad relevance and offer further optimization tools.”

International Growth

Brian Olsavsky, CFO

“Our international segment is improving profitability through streamlined cost structures, enhanced inventory placement, and growing local market demand. We’re seeing strong performance from our established markets and healthier growth in emerging countries.”

Challenges

Andy Jassy, CEO

“Meeting the increasing demand for generative AI is limited by chip supply constraints, which impacts capacity. As we expand our infrastructure, managing both upfront capital investment and operational margins remains key to balancing growth and profitability.”

Future Outlook

Andy Jassy, CEO

“We’re poised to capture market opportunities across e-commerce and cloud services by focusing on the technologies and efficiencies that improve the customer experience. With strategic investments in AI and same-day delivery capabilities, we’re well-positioned for long-term growth as we expand our offerings and improve our cost to serve.”