Amazon Q1 2025 Earnings Analysis

Dive into $AMZN Amazon’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$155.67B rev (+8.6% YoY, +10.5% LQ) beat est by 0.5%

↗️Operating Margin (11.8%, +1.1 PPs YoY)🟢

↘️FCF Margin ( -1.2%, -1.9 PPs YoY)🟡

↗️Net Margin (11.0%, +3.7 PPs YoY)

↗️EPS $1.59 beat est by 16.1%

AWS

↗️AWS Revenue $29.3B rev (+16.9% YoY)

↗️Operating Margin (39.5%, +1.8 PPs YoY)🟢

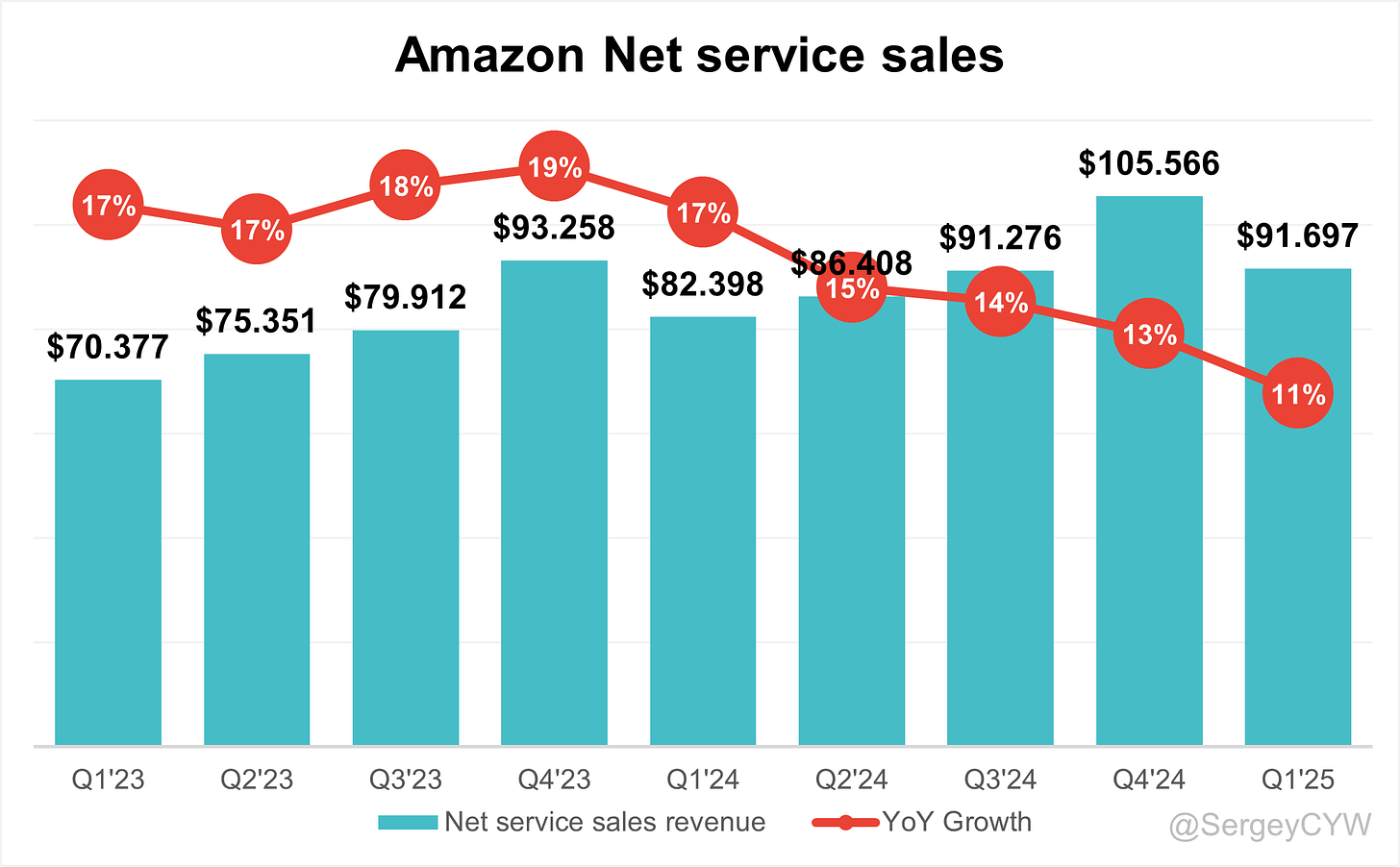

Revenue by Category

➡️Net product sales $64.0B rev (+5.0% YoY)🟡

↗️Net service sales $91.7B rev (+11.3% YoY)

Revenue by Segment

➡️Online stores $57.4B rev (+5.0% YoY)🟡

➡️Physical stores $5.5B rev (+6.4% YoY)🟡

➡️Third-party seller $36.5B rev (+5.5% YoY)🟡

↗️Advertising $13.9B rev (+17.7% YoY)

↗️Subscription $11.7B rev (+9.3% YoY)

↗️AWS $29.3B rev (+16.9% YoY)

➡️Other $1.3B rev (+4.0% YoY)🟡

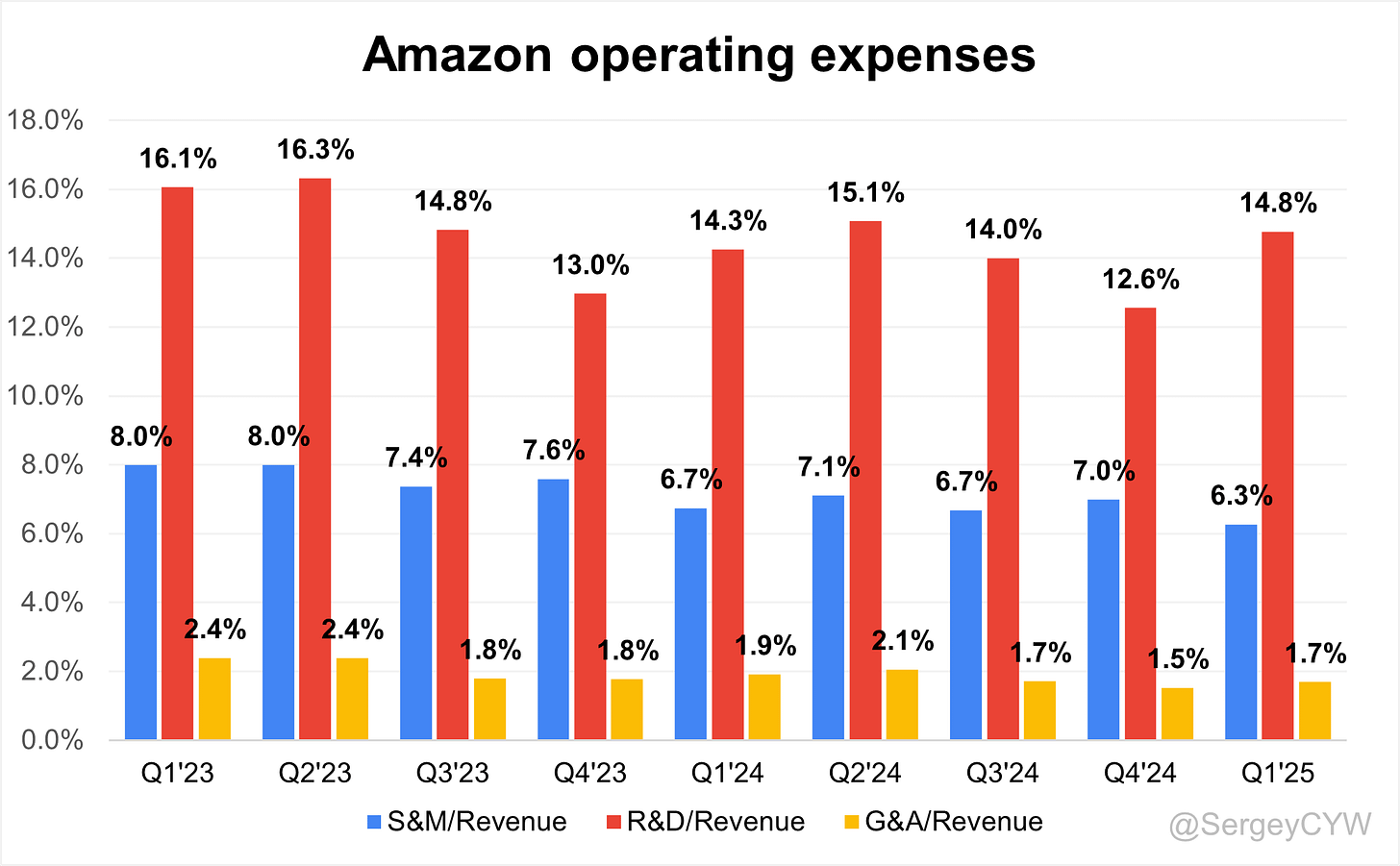

Operating expenses

↘️S&M/Revenue 6.3% (-0.5 PPs YoY)

↗️R&D/Revenue 14.8% (+0.5 PPs YoY)

↘️G&A/Revenue 1.7% (-0.2 PPs YoY)

Dilution

↘️SBC/rev 2%, -0.3 PPs QoQ

↗️Basic shares up 2.0% YoY, +0.1 PPs QoQ

↘️Diluted shares up 1.2% YoY, -0.4 PPs QoQ

Guidance

➡️Q2'25 $159.0 - $164.0B guide (+9.1% YoY) in line with est

Key points from Amazon’s First Quarter 2025 Earnings Call:

Financial Performance

Amazon reported $155.7B in revenue, up +10% YoY (+9% FXN) with a $1.4B FX headwind.

Operating income rose to $18.4B (+20% YoY), beating guidance by $400M.

Net income reached $17.1B, supported by a $3.3B non-operating gain from converting Anthropic convertible notes.

Free cash flow (TTM) totaled $25.9B.

North America revenue grew to $92.9B (+8% YoY) with $5.8B operating income and a 6.3% margin, or 7.2% excluding one-time charges.

International revenue was $33.5B (+8% YoY FXN) with $1.0B operating income and a 3% margin, or 3.7% ex-items.

Paid units rose +8% YoY, and the third-party mix remained at 61%.

AWS

AWS delivered $29.3B in revenue, up +17% YoY, with an annualized run rate over $117B.

Operating margin neared 40%, driven by infrastructure efficiencies and custom silicon (Graviton).

Backlog increased +20% YoY to $189B, with a 4.1-year average duration.

New customers included Adobe, Uber, Nasdaq, Ericsson, Cargill, GE Vernova, Booz Allen Hamilton, and Mitsubishi Electric.

Tranium 2, a custom AI training chip, offers 30–40% better price-performance than GPUs.

Capacity constraints still limit upside but are expected to ease in H2 2025.

AWS sees demand from both generative AI and infrastructure modernization, with migrations continuing as multi-year transformations.

Advertising

Ad revenue rose to $13.9B, up +19% YoY, with broad strength across retail media, Prime Video, Twitch, Amazon Music, IMDb, and Amazon DSP.

Amazon’s ad-supported U.S. audience now exceeds 275M.

Adoption of clean room attribution and bottom-funnel measurement is accelerating.

Advertiser demand remained strong through April despite macro pressures.

Prime & Consumer Engagement

Amazon achieved its fastest delivery speeds ever, with more same-day and next-day deliveries than any prior quarter.

Spring sale events saved customers over $500M globally, including campaigns across North America, Europe, and the Middle East.

Alexa Plus launched in the U.S. at $19.99/month for non-Prime users, with 100,000+ onboarded early.

Bedrock & AI Models

Amazon Bedrock now offers models from Anthropic (Claude 3.7 Sonnet), Meta (LLaMA 4), Mistral, DeepSeek, and Amazon Nova.

The Nova Premier model launched in Q1 with early adopters like Slack, Siemens, FanDuel, Sumo Logic, Glean, and Blue Origin.

NovaSonic, a speech-to-speech model, improved accuracy and expressiveness.

DeepSeek R1 and Mistral PixelLM were made available as fully managed services.

Bedrock innovations target developers building high-performance, cost-efficient generative AI apps.

Developer Tools

Amazon Q, a generative AI assistant, introduced a new command-line interface (CLI) for agentic workflows.

Integrated into GitLab Duo, Q enables automated code reviews, unit tests, and version upgrades.

Adoption is expanding internally and externally, improving engineering productivity and workflow automation.

Robotics & Logistics

Amazon redesigned its inbound logistics architecture, enabling more products to be stocked closer to customers.

This improved units per package, lowered last-mile delivery cost, and reduced travel distances.

Automation and robotics were expanded across fulfillment centers, particularly in same-day hubs.

The company is scaling rural delivery infrastructure to close geographic coverage gaps.

Inventory efficiency remains a focus as forward buying by sellers in Q1 risks capacity strain.

Amazon aims to avoid overstocking while maintaining delivery speed and cost discipline.

Everyday Essentials & Brands

Everyday essentials accounted for 1 in 3 U.S. units sold, growing 2x faster than the rest of the business.

New brands launched include Oura Rings, Michael Kors, The Ordinary, and curated luxury via Saks.

Luxury offerings expanded with Dolce & Gabbana, Balmain, and Jason Wu.

Alexa & Generative Interfaces

Alexa Plus executes complex tasks like controlling smart homes, booking reservations, and managing ambiance without repeat commands.

NovaAct, a browser-native agent, enables reliable multistep action workflows with >90% accuracy.

Voice-based AI saw a leap with NovaSonic, which outperforms peers on speech expressiveness and error rate.

Project Kuiper

First satellites launched in Q1, with service set to begin later in 2025.

Pre-commercial launch costs are expensed and reflected in Q2 CapEx guidance.

Tranium 2

Tranium 2, Amazon’s second-generation AI chip, is in full deployment.

It delivers 30–40% better price-performance over GPU instances, essential for reducing AI inference costs and scaling generative use cases.

Retail Execution

Regional fulfillment hubs and SKU-level stocking lowered cost per package and enabled record delivery speed.

Focus remains on packing density, inventory optimization, and cost minimization.

Everyday essential demand and fulfillment productivity helped buffer macro uncertainties.

Amazon executed forward-buying strategies ahead of tariff changes. No significant impact on pricing yet, but the company remains cautious.

Inventory congestion is a risk if Q3 and Q4 volumes exceed fulfillment capacity.

International Growth

International revenue grew to $33.5B (+8% YoY FXN) with $1B in operating income.

Excluding one-time costs, margins reached 3.7%, a recovery from prior loss-making quarters.

Localized events in Europe, Middle East, and Asia boosted engagement.

Essential goods and grocery demand tracked U.S. trends, aided by SKU diversity and logistics localization.

Adoption of automation and robotics across international centers drove cost leverage.

Headwinds include FX volatility, tariff exposure, and regulatory variation.

CapEx

Q1 CapEx was $24.3B, with investment focused on AWS infrastructure, Tranium AI chips, and robotic logistics upgrades.

Spending will continue in H2 for Kuiper launches, warehouse automation, and fulfillment speed enhancements.

Outlook

Q2 revenue guidance: $159B–$164B (+~9.1% YoY at midpoint).

Operating income guidance: $13B–$17.5B, factoring in seasonal SBC increases and Kuiper launch costs.

Retail focus is on low pricing, broad selection, and delivery speed.

AWS is expected to see capacity ramp and AI monetization acceleration in H2 2025.

Management comments on the earnings call.

Product Innovations

Andrew R. Jassy, Chief Executive Officer

“We’re just starting to roll out Alexa Plus in the U.S., and people are really liking it so far. It’s meaningfully smarter, more capable, and can take real action—everything from setting the mood for dinner to making restaurant reservations.”

Andrew R. Jassy, Chief Executive Officer

“When you have experiences like Alexa opening the shades, setting the temperature, and choosing the right music with a single request, it becomes very clear how much more useful she’s become.”

AWS

Andrew R. Jassy, Chief Executive Officer

“Our AI business is already at a multibillion-dollar annual revenue run rate and growing triple digits year over year. As fast as we land new capacity, it’s being consumed.”

Andrew R. Jassy, Chief Executive Officer

“More than 85% of global IT spend is still on-premises. Before this generation of AI, we believed AWS could be a multi-hundred-billion-dollar business. Now we think it could be even larger.”

Brian T. Olsavsky, Chief Financial Officer

“We’re continuing to see strong growth in both generative AI and traditional cloud workloads. AWS operating income reached $11.5 billion, supported by cost efficiencies and investments in custom silicon like Graviton.”

Advertising Business

Brian T. Olsavsky, Chief Financial Officer

“Advertising remains an important contributor to profitability, with revenue up 19% year over year. We’re seeing strong adoption across our full-funnel offerings.”

Andrew R. Jassy, Chief Executive Officer

“Our advertising tools now reach over 275 million ad-supported users in the U.S., across platforms like Prime Video, Twitch, and Amazon Music.”

Prime Membership Expansion

Andrew R. Jassy, Chief Executive Officer

“In the first quarter, we delivered more same-day or next-day items than in any other quarter in our history. This is a direct result of regionalizing our fulfillment network.”

Brian T. Olsavsky, Chief Financial Officer

“Our improved inventory placement and expanded delivery sites have enabled record Prime delivery speeds while reducing fulfillment costs.”

AI

Andrew R. Jassy, Chief Executive Officer

“We’re not dabbling in AI. We’re intentionally building capabilities at every layer of the AI stack to make it as cost-effective and expansive as possible for builders.”

Andrew R. Jassy, Chief Executive Officer

“We’ve launched NovaSonic, a speech-to-speech foundation model, and Nova Act, which performs action sequences in web browsers. Our vision is to enable agents that go far beyond Q&A and handle multistep, real-world tasks.”

Competitors

Andrew R. Jassy, Chief Executive Officer

“When tariffs rise, many retailers simply rebrand and resell Chinese-made products at a markup. Amazon, by contrast, offers direct access to global sellers, which can reduce the impact of tariffs on customers.”

Andrew R. Jassy, Chief Executive Officer

“We’re not mostly selling high average selling price items. Everyday essentials are now one out of every three units sold in the U.S., growing over twice as fast as the rest of our business.”

Customers

Andrew R. Jassy, Chief Executive Officer

“When environments are uncertain, customers tend to go with the provider they trust most. We’ve historically exited periods like these with greater market share, and we’re optimistic we’ll do so again.”

Andrew R. Jassy, Chief Executive Officer

“We’ve signed new AWS agreements with Adobe, Uber, Nasdaq, Ericsson, Cargill, and many others—enterprises are not just experimenting, they’re scaling.”

Strategic Partnerships

Andrew R. Jassy, Chief Executive Officer

“We recently launched GitLab Duo with Amazon Q. Developers can now use AI agents for complex tasks like feature creation, code reviews, and test generation—directly within the GitLab platform.”

Brian T. Olsavsky, Chief Financial Officer

“Our investment in Anthropic resulted in a $3.3 billion pre-tax gain this quarter, following the conversion of convertible notes into preferred equity.”

International Growth

Brian T. Olsavsky, Chief Financial Officer

“International segment revenue grew 8% year over year excluding FX, and operating income reached $1 billion. We’re seeing strong performance in regions where we’ve expanded logistics and fulfillment capabilities.”

Andrew R. Jassy, Chief Executive Officer

“Our global events like Spring Deal Days and the Ramadan/Eid sale in the Middle East helped customers save over $500 million and drove high engagement across international markets.”

CapEx

Brian T. Olsavsky, Chief Financial Officer

“Our Q1 CapEx totaled $24.3 billion. The majority is going toward AWS infrastructure, AI-related silicon like Tranium, and enhancements in fulfillment and delivery speed.”

Brian T. Olsavsky, Chief Financial Officer

“Kuiper satellite launch costs are expensed until commercialization. With our first launch complete, we’ll continue scaling throughout the year.”

Challenges

Andrew R. Jassy, Chief Executive Officer

“No one knows where tariffs will settle or when. We've seen some early buying in response to potential changes, but average retail pricing hasn’t moved significantly yet.”

Brian T. Olsavsky, Chief Financial Officer

“We recorded one-time charges in Q1 tied to pre-tariff inventory and historical customer returns. These temporarily impacted segment margins but were necessary to protect customer pricing.”

Future Outlook

Andrew R. Jassy, Chief Executive Officer

“Looking ahead, we're focused on better inventory placement, robotics, and expanding our rural delivery network—all of which contribute to lower costs and better service.”

Brian T. Olsavsky, Chief Financial Officer

“Our Q2 guidance reflects cautious optimism. We’ve widened our range to account for macro uncertainty but are encouraged by strong trends in April, including ad performance and early consumer demand.”

Thoughts on Amazon Earnings Report $AMZN:

🟢 Positive

Revenue grew to $155.7B (+8.6% YoY, +10.5% QoQ), beating estimates by 0.5%

EPS reached $1.59, exceeding expectations by 16.1%

Operating income rose to $18.4B (+20% YoY); Operating margin expanded to 11.8% (+1.1pp YoY)

AWS revenue climbed to $29.3B (+16.9% YoY); operating margin improved to 39.5% (+1.8pp YoY)

Ad revenue increased to $13.9B (+17.7% YoY)

Net income hit $17.1B, supported by a $3.3B gain from Anthropic investment

Free cash flow (TTM) stood at $25.9B

Paid units rose +8% YoY, with 61% third-party mix maintained

New AWS clients: Adobe, Uber, Nasdaq, Ericsson, GE Vernova, Booz Allen, Mitsubishi

Bedrock adoption by major clients (Slack, Siemens, FanDuel, Blue Origin); expanded AI model portfolio

Alexa Plus launched with over 100K users onboarded, enabling multistep automation

Everyday essentials made up 1 in 3 U.S. units sold, growing 2x faster than average

Prime delivery set new speed records; >$500M customer savings from global events

International revenue up +8% YoY FXN; $1B operating income; ex-items margin reached 3.7%

S&M/Revenue decreased to 6.3% (-0.5pp YoY); G&A/Revenue fell to 1.7% (-0.2pp YoY)

Stock-based comp declined to 2% of revenue (-0.3pp QoQ)

🟡 Neutral

Q2 revenue guidance: $159B–$164B, in line with estimates (+~9.1% YoY midpoint)

Q2 operating income: $13B–$17.5B, includes Kuiper launch costs and SBC seasonality

Net product sales: $64.0B (+5.0% YoY); Third-party seller revenue: $36.5B (+5.5% YoY)

Subscription revenue: $11.7B (+9.3% YoY)

Online store revenue: $57.4B (+5.0% YoY); Physical stores: $5.5B (+6.4% YoY)

Operating expenses rose for R&D (14.8% of revenue, +0.5pp YoY)

Free Cash Flow Margin declined to -1.2% (-1.9pp YoY)

🔴 Negative

Diluted shares increased +1.2% YoY, though down 0.4pp QoQ

Ongoing capacity constraints in AWS; AI demand outpacing infrastructure availability

Risk of inventory congestion from forward-buying ahead of tariff uncertainty

FX headwinds impacted revenue by $1.4B

Exposure to tariff volatility, macro uncertainty, and regulatory differences in international markets

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.