Financial Results:

⬆️$86,310M rev (+13.5% YoY, 2.6% LQ) beat est by 1.1%

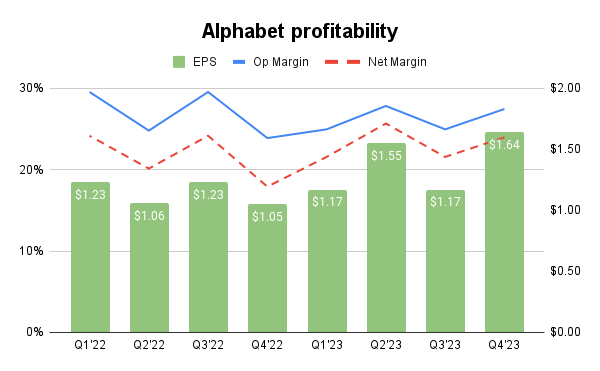

⬆️Operating Margin (27.5%, +3.6%pp YoY)

⬆️Net Margin 24.0%, +6.1%pp YoY)

⬆️EPS $1.64 beat est by 3.1%

Segment Revenue

➡️Google Services $76,311M rev (+12.5% YoY, 35.0% Op Margin)🟡

➡️Google advertising$65,517M rev (+11.0% YoY)🟡

➡️Google Search & other$48,020M rev (+12.7% YoY)🟡

⬆️YouTube ads$9,200M rev (+15.5% YoY)🟢

↘️Google Network$8,297M rev (-2.1% YoY)🟡

⬆️Google Cloud $9,192M rev (+25.7% YoY, 9.4% Op Margin)🟢

⬆️Other Bets $657M rev (+190.7% YoY, -131.4% Op Margin)🟢

Operating expenses

↘️S&M*/Revenue 8.9% (9.4% LQ)

↘️R&D*/Revenue 14.0% (16.4% LQ)

⬆️G&A*/Revenue 6.0% (5.4% LQ)

Dilution

↘️SBC/rev 7%, -1.0%pp QoQ)

⬆️Dilution at -3.2% YoY, +0.0%pp QoQ)🟢

Key points from Alphabet 's Q4 2023 Earnings Call:

1. AI Innovations:

Alphabet is focusing heavily on AI, particularly in improving its search and advertising services. They introduced the Gemini era, an advanced series of AI models, which enhances multimodal capabilities (combining text, images, audio, video, and code). Gemini is set to underpin the next generation of Alphabet's product advancements, starting with Search. AI has significantly reduced search latency and improved user satisfaction for more complex queries.

2. Subscription Growth:

Subscription services, led by YouTube Premium and Music, YouTube TV, and Google One, reached $15 billion in annual revenue, marking a 5x increase since 2019. Google One is close to hitting 100 million subscribers, and Alphabet plans to integrate more AI features into this service.

3. Cloud Expansion:

Google Cloud crossed $9 billion in revenues this quarter, driven by AI advancements and product leadership. The Cloud service offers AI Hypercomputer architecture and the comprehensive enterprise AI platform Vertex AI. Several big brands and companies are utilizing Google Cloud's AI capabilities, Notable partnerships include those with Hugging Face, McDonald's, Motorola Mobility, and Verizon.

4. Investments and Focus on Growth:

Alphabet is investing in data centers and computing infrastructure to support AI-powered services growth.

5. Pixel and Other Bets:

The Pixel 8 phone, using Gemini Nano AI models, has been well-received. Waymo (autonomous ride-hailing) and Isomorphic Labs (AI for treating diseases) are notable ventures in Alphabet's Other Bets portfolio. Duvet AI, designed for Google Workspace and Google Cloud Platform, has been adopted by thousands of companies.

6. YouTube Growth and Strategy:

YouTube's advertising revenue grew by 16%, with an emphasis on content creators and viewer engagement. YouTube TV and NFL Sunday Ticket are highlighted as successful ventures. AI is playing a significant role in enhancing YouTube's offerings, including creative tools for creators and advertisers.

Management comments on the earnings call.

Sundar Pichai on AI and Search:

"Our results reflect strong momentum and product innovation continuing into 2024."

"Last year brought new excitement around Gen AI and I'm proud of how we responded, responsibly with deep advances in foundation models."

"We closed the year by launching the Gemini era, a new industry-leading series of models."

“We're already experimenting with Gemini in search where it's making our Search Generative Experience or SGE faster for users... By applying generative AI to Search, we are able to serve a wider range of information needs and answer new types of questions...”

Philipp Schindler on Advertising Tools:

"AI has been at the core of our advertising products for a very long time."

"The recent advances are really allowing us to drive more value for advertisers across a large range of different areas: bidding, targeting, creative as well as our core advertiser and publisher experiences."

Philipp Schindler on Monetization Challenges:

"We built Shorts to respond to the huge demand from both creators and viewers for short-form video."

"Shorts monetization continues to progress nicely."

"YouTube ads revenue were up 16% year-on-year, driven by growth in both direct response and brand."

"We've rolled out CTV-first formats like 30-second non-skippable ads and pause experiences as well as an industry-first send-to-phone experience that lets people use a second screen to engage with ads."

Sundar Pichai on Google Cloud:

"Throughout 2023, we introduced thousands of product advances, including broad Gen AI capabilities across our AI infrastructure, our Vertex AI platform and our new Duvet AI agents."

Ruth Porat on CapEx Management:

"We do expect 2024 full year CapEx to be notably larger than 2023."