Airbnb Q4 2024 Earnings Analysis

Dive into $ABNB Airbnb’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$2,480M rev (+11.8% YoY, +9.9% LQ) beat est by 2.4%

↗️GM (84.5%, 1.8 PPs YoY)

↘️Adj EBITDA Margin (31.0%, -2.3 PPs YoY)🟡

↗️FCF Margin (18.5%, 16.4 PPs YoY)

↗️Net Margin (18.6%, 34.3 PPs YoY)

↗️EPS $0.73 beat est by 23.7%

KPI

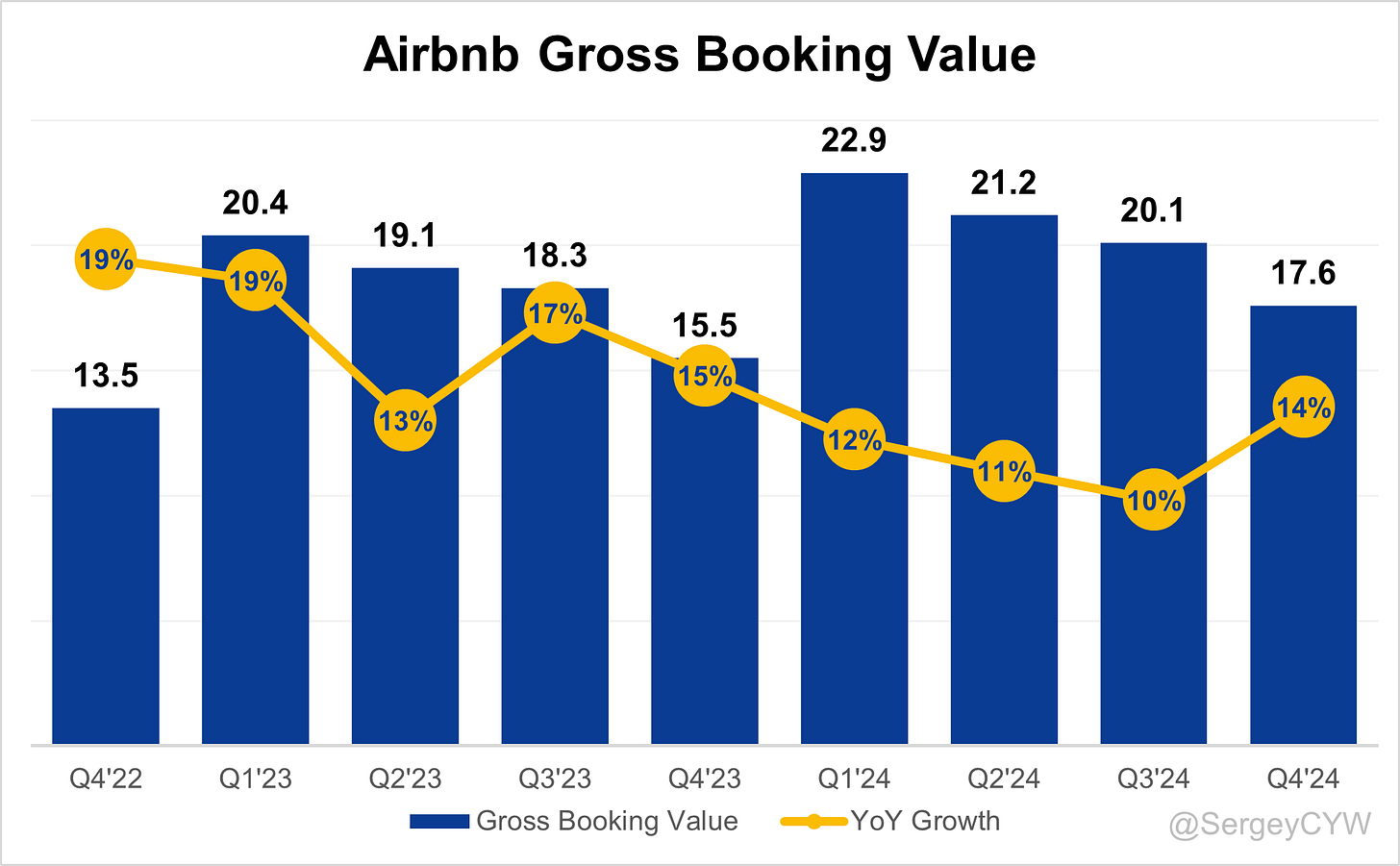

↗️Gross Booking Value $18B (+13.5% YoY)🟢

↗️Nights and Experiences Booked $111.00M (+12.3% YoY)

↗️Average Daily Rates $158.10(+0.9% YoY)

↘️Total Take Rate 14.1%, -0.2PPs YoY

Regional Breakdown

↘️United States $1,111.0M rev (+6.5% YoY, 45% of Rev)

↗️Europe, Middle East, and Africa $794.0M rev (+16.3% YoY, 32% of Rev)

↗️Asia Pacific $278.0M rev (+12.1% YoY, 11% of Rev)

↗️Other $297.0M rev (+21.7% YoY, 12% of Rev)

Operating expenses

↗️S&M/Revenue 22.1% (+2.9 PPs YoY)

↗️R&D/Revenue 21.7% (+2.2 PPs YoY)

↘️G&A/Revenue 10.0% (-44.2 PPs YoY)

Dilution

↗️SBC/rev 12%, +2.0 PPs QoQ

↗️Basic shares down YoY, +1.4 PPs QoQ🟢

↗️Diluted shares down YoY, +2.7 PPs QoQ🟢

Guidance

↘️Q1'25$2,230 - $2,270M guide (+5.0% YoY) missed est by -2.3%🔴

Key points from Airbnb’s Fourth Quarter 2024 Earnings Call:

Financial Performance

Airbnb reported Q4 2024 revenue of $2.5 billion, reflecting 12% YoY growth. Net income reached $461 million, while adjusted EBITDA totaled $765 million, achieving a 36% full-year EBITDA margin. Free cash flow stood at $458 million in Q4 and $4.5 billion for the year, with a 40% free cash flow margin.

Stock repurchases totaled $838 million in Q4 and $3.4 billion for the full year, leaving $3.3 billion available for future buybacks. The company ended 2024 with $10.6 billion in corporate cash and investments, reinforcing a strong balance sheet.

Q1 2025 revenue guidance ranges between $2.23 billion and $2.27 billion, reflecting 4% to 6% YoY growth or 7% to 9% growth when excluding FX headwinds. The revenue growth rate is lower due to tough YoY comps from Easter timing and leap year effects in Q1 2024, which added six percentage points to last year’s growth. The company expects a full-year adjusted EBITDA margin of at least 34.5%, with profitability improving in the latter half of 2025.

Product Innovations

Over 500 product upgrades have been introduced in the past two years, focusing on search, payments, and merchandising. Mobile bookings accounted for 60% of total bookings, up from 55% YoY, reflecting a shift toward app usage and improved conversion rates.

A streamlined checkout experience increased conversion rates, while AI-driven destination suggestions, customized welcome tours, and tailored filter recommendations improved usability. Total price display led to higher-value bookings.

The launch of Guest Favorites drove 250 million nights booked, and 400,000 underperforming listings were removed to improve reliability.

AI Strategy

AI investments focus on customer support, product optimization, and long-term travel and living assistance. AI-powered customer support will launch in 2025, providing 24/7 multilingual service and reducing support costs.

Internally, AI is improving engineering efficiency. While early gains are evident, a 30%+ increase in engineering productivity is expected over time. AI will gradually expand from customer support to search enhancements and eventually become a full travel concierge.

Advertising & Marketplace

Advertising presents a $1 billion+ revenue opportunity, but Airbnb will not prioritize it in 2025. A deliberate approach ensures advertising enhances the user experience without diluting the platform’s value.

AI-driven ad placements will optimize conversion rates while maintaining a natural user experience. Future monetization will allow hosts and service providers to promote their listings, boosting visibility and revenue.

A broader marketplace strategy is evolving, integrating third-party services and local businesses to extend the platform beyond short-term rentals. The goal is to create a dynamic ecosystem that increases engagement, frequency of use, and revenue per user.

Expanding Beyond Rentals

$200 million to $250 million will be allocated in 2025 for new business lines launching in May. The company aims to become a broader travel and lifestyle platform, incorporating concierge services, grocery delivery, and gym/spa access.

New offerings will scale over 3-5 years, driving higher engagement and booking frequency from 1-2 times per year per user to more frequent usage. A subscription-based model may allow travelers to bundle services like transportation and local experiences.

Each new initiative must enhance the core rental business without diluting its value. Execution risk lies in maintaining service quality while expanding offerings.

Co-Host Network Growth

The Co-Host Network expanded from 10,000 hosts managing 10,000 listings to 15,000 hosts managing 100,000 listings in four months. These listings generate 2x the revenue of standard listings due to higher service levels and better guest experiences.

85% of Co-Host listings are Guest Favorites, while 75% of Co-Hosts are Superhosts, reinforcing quality and reliability. Expansion into Japan and South Korea is planned for 2025 to address strong demand for localized hosting solutions.

This program reduces friction for new hosts, making it easier to join Airbnb while ensuring high service quality. Scaling efficiently remains a challenge, requiring strict quality control to preserve brand reputation.

International Growth

Growth outside Airbnb’s top five markets (U.S., UK, Canada, France, Australia) is twice as fast as within them. Brazil is a success story, benefiting from localized brand marketing and user experience optimizations.

Similar strategies are being implemented in Japan, South Korea, Argentina, and Germany, with a focus on localized payment options and search functionalities. Expansion into two dozen countries introduced flexible payment options, improving accessibility and increasing adoption.

Regulatory challenges remain, requiring ongoing collaboration with governments to ensure compliance while advocating for balanced policies that support hosts and local communities.

Hotel Integration Strategy

Urban travel remains dominated by hotels, but Airbnb aims to shift market share by improving affordability, reliability, and service offerings.

Hotel prices increased YoY, while Airbnb prices declined, making short-term rentals a more competitive alternative. Guest Favorites, Co-Host programs, and enhanced services are improving reliability and consistency, appealing to traditional hotel users.

Future initiatives will include concierge-style services, such as spa and gym access, to blur the lines between Airbnb and full-service hotels. Increasing brand trust and consistency is key to attracting business and urban travelers.

Travel Market Trends

Nights and Experiences booked grew 12% YoY in Q4 2024, the highest growth rate of the year. Mobile bookings now represent 60% of total reservations, demonstrating strong app adoption.

With 70-80% of nights booked exceeding 30 days, demand for extended stays continues to grow. Hotels raised prices, while Airbnb prices declined, strengthening competitive positioning.

Stock Buybacks & Capital Allocation

$3.4 billion in stock repurchases occurred in 2024, with $3.3 billion remaining under authorization. Future buybacks will be strategic, based on stock price sensitivity.

Strong profitability ensures capital flexibility for M&A, growth initiatives, and shareholder returns while maintaining industry-leading free cash flow.

Competitive Landscape

Market share gains are evident, particularly against hotels. Vrbo’s Q4 growth was due to soft comps from a weak 2023, while Airbnb maintained steady volume expansion.

A supply advantage exists, with most new short-term rental listings debuting exclusively on Airbnb.

Regulatory Landscape

80% of Airbnb’s top 200 markets have established regulations, allowing Airbnb to remit taxes and partner with cities for major events, such as the Paris Olympics, where it hosted 700,000 visitors.

New York’s ban on most Airbnb listings in 2023 failed to reduce rent prices, which increased 3% YoY, while hotel prices surged 7% YoY, highlighting the inefficiency of the restrictions.

Future Outlook

2025 will be transformative, with:

New business expansions launching in May

International expansion into Asia and other high-growth markets

AI-driven customer support and platform optimizations

Continued share repurchases and strong capital discipline

A clear diversification roadmap and strong financials position Airbnb for long-term sustainable growth.

Management comments on the earnings call.

Product Innovations

Brian Chesky, Co-Founder & CEO

"We’ve done more than 500 product upgrades in the past two years, focusing on search, payments, and merchandising. Every year, we are increasing the throughput of features and upgrades, making the service more intuitive and frictionless for guests and hosts alike."

Brian Chesky, Co-Founder & CEO

"Our new tech stack has been a multi-year effort, and we are now seeing the benefits. The new infrastructure allows us to innovate faster, roll out features more efficiently, and ultimately, enhance both the guest and host experience at scale."

AI Strategy

Brian Chesky, Co-Founder & CEO

"Most companies are focused on AI integrations for trip planning, but we are taking a different approach—starting with AI-powered customer support. AI can provide service in every language, 24/7, process large amounts of data, and significantly improve efficiency. Later, we will integrate AI into search and, eventually, build a fully AI-driven travel concierge."

Brian Chesky, Co-Founder & CEO

"AI is going to have a profound impact on travel, but it is still early. We are focused on building AI applications that truly enhance our platform, drive conversion, and improve guest and host interactions over time."

Competitors

Ellie Mertz, Chief Financial Officer

"Our results in Q4 and throughout 2024 indicate that we are continuing to gain market share globally, particularly from hotels. The improvements we’ve made in reliability, affordability, and customer experience have attracted more travelers who traditionally opted for hotels."

Ellie Mertz, Chief Financial Officer

"The competition in non-urban U.S. markets remains strong, but our growth in these regions has been one of the fastest in the country. Our supply is expanding, and the majority of new listings are exclusive to our platform, further differentiating our offering."

Strategic Partnerships

Brian Chesky, Co-Founder & CEO

"We historically operated as a more closed ecosystem, but this next chapter will be much more open. Airbnb has the potential to become a true platform where third-party companies—whether they offer cleaning services, key exchanges, or local experiences—can integrate seamlessly into our ecosystem."

Brian Chesky, Co-Founder & CEO

"The way we see it, we don’t need to build everything ourselves. The world can build on Airbnb. Whether through local partnerships or global integrations, there’s a tremendous opportunity to expand what we offer beyond our own platform."

International Growth

Ellie Mertz, Chief Financial Officer

"We’ve made significant investments in international expansion, and the results are clear. Our targeted growth markets outside our core five are growing at twice the rate of our established regions. Brazil is a prime example of how effective localized brand marketing and product optimization can drive meaningful adoption."

Ellie Mertz, Chief Financial Officer

"We are now applying our playbook to Japan, South Korea, Argentina, and Germany, markets that have strong potential but require a tailored approach. By integrating localized payment methods, refining search functionalities, and increasing awareness, we are building long-term growth drivers in these regions."

Hotel Integration Strategy

Brian Chesky, Co-Founder & CEO

"The vast majority of urban travelers still stay in hotels, and we see that as a massive opportunity. If we continue improving the reliability, affordability, and overall experience of Airbnb stays, we believe we can convert more hotel guests into Airbnb users."

Brian Chesky, Co-Founder & CEO

"For every one person that books an Airbnb, nine book a hotel. If we capture even a small portion of that market, we can double our room nights. We believe reliability, pricing, and service expansion will be the key to making Airbnb a serious alternative to hotels in every major city."

Travel Market Trends

Ellie Mertz, Chief Financial Officer

"The demand we saw in Q4 was fueled not only by organic travel trends but also by the improvements we’ve made in product optimizations. We estimate that our exit rate growth was lifted by a couple of hundred basis points due to these enhancements."

Ellie Mertz, Chief Financial Officer

"Mobile bookings now account for 60% of our total volume, up from 55% last year. This shift reinforces the importance of an optimized mobile experience, and we are continuously refining our app to maximize conversion and engagement."

Challenges

Brian Chesky, Co-Founder & CEO

"Regulation remains a key challenge, particularly in major urban markets. While 80% of our top 200 markets have established frameworks for short-term rentals, cities like New York have imposed restrictions that we believe do not effectively address affordability concerns."

Brian Chesky, Co-Founder & CEO

"A year after New York’s restrictions went into effect, rent prices are still up 3% year-over-year, while hotel prices have surged 7%. The data suggests that banning short-term rentals is not a viable solution to housing challenges, and we continue to advocate for fair and balanced regulation."

Future Outlook

Brian Chesky, Co-Founder & CEO

"2025 marks the beginning of Airbnb’s next chapter. We are not just refining our core offering but expanding beyond short-term rentals to create an ecosystem of travel and living services. Our goal is to make Airbnb a platform that users engage with not just once or twice a year but multiple times a week."

Ellie Mertz, Chief Financial Officer

"Even with increased investments in new businesses, we expect to maintain strong profitability, delivering a full-year adjusted EBITDA margin of at least 34.5%. Our financial discipline allows us to invest in long-term growth while continuing to generate industry-leading free cash flow."

Thoughts on Airbnb Earnings Report $ABNB:

🟢 Positive

Revenue: $2.48B (+11.8% YoY, +9.9% QoQ), beat estimates by 2.4%

Gross Booking Value (GBV): $18B (+13.5% YoY)

Nights & Experiences Booked: 111M (+12.3% YoY)

Free Cash Flow (FCF) Margin: 18.5% (+16.4 PPs YoY)

Net Margin: 18.6% (+34.3 PPs YoY)

EPS: $0.73, beat estimates by 23.7%

Stock Buybacks: $3.4B repurchased in 2024, with $3.3B remaining for future repurchases

Co-Host Growth: Expanded to 100K listings, generating 2x revenue per listing

International Growth: Strongest in EMEA (+16.3% YoY) and Other regions (+21.7% YoY)

Mobile Bookings: Now 60% of total, up from 55% YoY

🟡 Neutral

Adjusted EBITDA Margin: 31.0%, down -2.3 PPs YoY, but still strong

Average Daily Rate (ADR): $158.10, up +0.9% YoY, indicating price stability

Total Take Rate: 14.1%, down -0.2 PPs YoY, minor impact

Advertising Strategy: Potential $1B+ opportunity, but not prioritized for 2025

R&D Expense: 21.7% of revenue, up +2.2 PPs YoY, supporting innovation

Marketing Spend: 22.1% of revenue, up +2.9 PPs YoY, aligned with growth strategy

Urban Market Growth: Still dominated by hotels, but Airbnb is improving pricing & services

🔴 Negative

U.S. Revenue Growth Slowing: $1.11B revenue (+6.5% YoY), lowest regional growth rate

Q1 2025 Guidance: $2.23B - $2.27B revenue, only +5% YoY, missing estimates by -2.3%

Adjusted EBITDA Margin Decline: Lowered due to higher investments in new business expansion

Stock-Based Compensation (SBC): 12% of revenue, up +2.0 PPs QoQ, adding dilution pressure

Regulatory Challenges: New York restrictions failed to reduce rent prices, hotel prices surged +7% YoY, proving regulations remain a hurdle

U.S. Market Share Pressure: Hotel prices increased while Airbnb’s declined, indicating competitive pressure from hotels