Airbnb Q3 2024 Earnings Analysis

Dive into $ABNB Airbnb’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$3.732B rev (+9.9% YoY, +10.6% LQ) beat est by 0.3%

↗️GM (87.5%, 1.1 PPs YoY)🟢

↘️Adj EBITDA Margin (52.5%, -1.5 PPs YoY)🟡

↘️FCF Margin (28.8%, -9.8 PPs YoY)🟡

↘️Net Margin (36.7%, -92.1 PPs YoY)🟡

↘️EPS $2.13 missed est by -0.5%

KPI

➡️Gross Booking Value $20B (+9.8% YoY)🟡

↗️Nights and Experiences Booked $122.80M (+8.5% YoY)

↗️Average Daily Rates $163.64(+1.4% YoY)

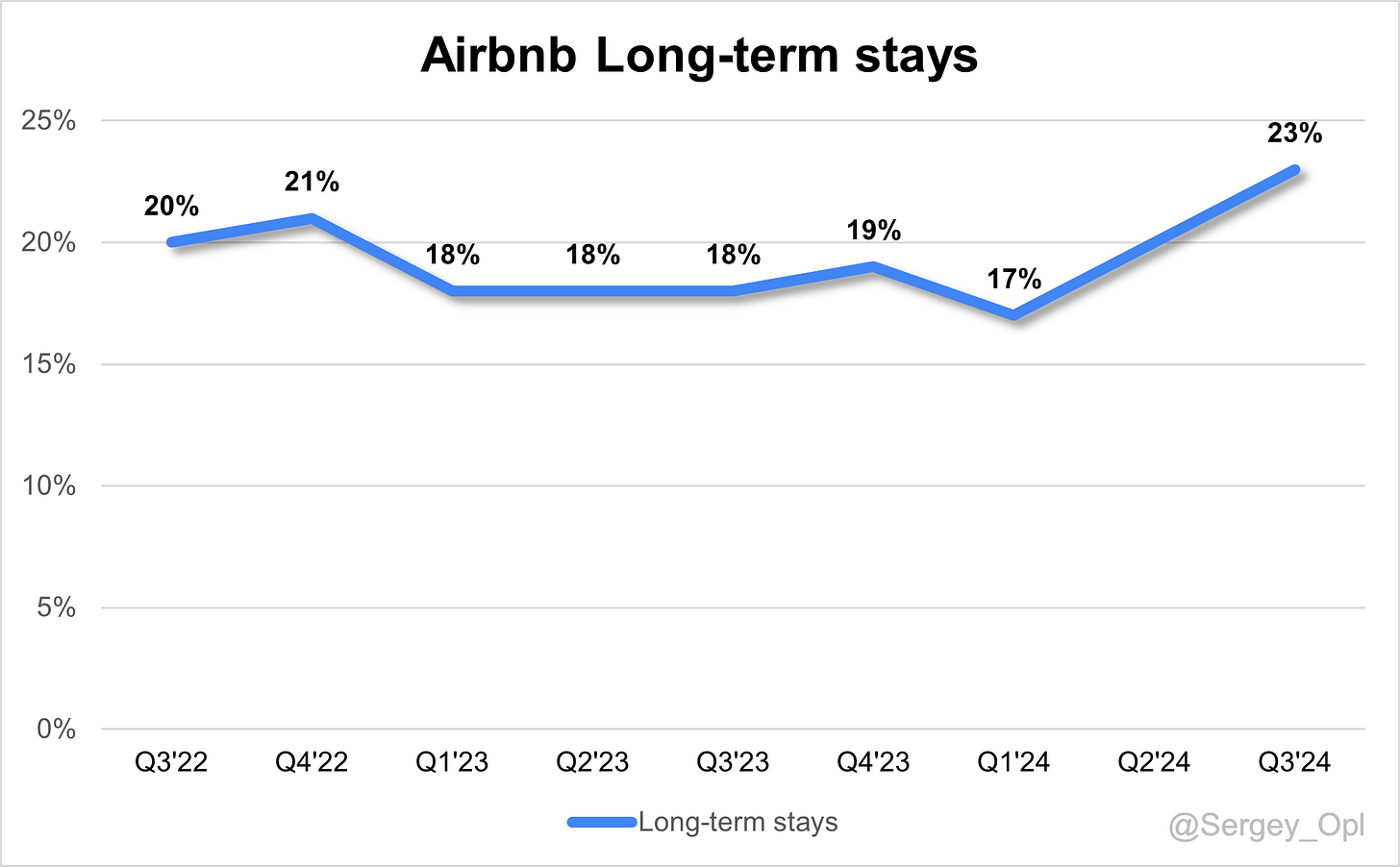

↗️Long-term stays 23.0%, +5.0 PPs YoY

Operating expenses

↗️S&M*/Revenue 12.6% (+1.8 PPs YoY)

↗️R&D*/Revenue 7.9% (+0.7 PPs YoY)

↗️G&A*/Revenue 7.2% (+0.0 PPs YoY)

*non-GAAP

Dilution

↘️SBC/rev 10%, -4.2 PPs QoQ

↘️Basic shares down -1.4% YoY, -1.4 PPs QoQ🟢

↘️Diluted shares down -2.7% YoY, -0.3 PPs QoQ🟢

Guidance

➡️Q4'24$2.390 - $2.440B guide (+8.9% YoY) in line with est

Key points from Airbnb’s Third Quarter 2024 Earnings Call:

Financial Performance

Airbnb reported strong Q3 2024 financial results, demonstrating growth and resilience. Revenue rose 10% year-over-year (YoY) to $3.7 billion. Net income was $1.4 billion, reflecting a 37% net income margin, a substantial achievement in the current market. Free cash flow reached $1.1 billion for the quarter, contributing to a trailing 12-month free cash flow of $4.1 billion. This financial strength enabled $1.1 billion in share repurchases, with $4.2 billion remaining in authorized repurchases, signaling confidence in the company’s long-term strategy.

Product Innovations

In Q3, Airbnb launched a series of platform enhancements focused on improving host and guest experiences. The 2024 Winter Release included 50+ upgrades such as a personalized welcome tour for first-time users, recommended destinations based on search history, and tailored listing highlights. Additionally, the Co-Host Network launched with 10,000 co-hosts and received interest from 20,000 applicants in three weeks, showing significant demand for efficient hosting support.

AI-Powered Customer Support

Airbnb has advanced customer support with an AI-driven system designed to enhance service quality and reduce operational costs. This system is being piloted in three phases: basic responses, personalized responses, and full action handling. For instance, AI can guide users through canceling bookings, and eventually, handle requests autonomously. This AI integration aims to streamline support, improving both response times and customer satisfaction.

International Growth

International expansion remains a primary growth focus, with high-potential markets including Japan, Brazil, Germany, and Italy. In Japan, a new brand campaign targeted domestic travelers. Brazil’s market size has tripled over the past two years, driven by localized product and payment options. Currently, Airbnb’s core markets (U.S., Canada, Australia, France, and the U.K.) represent 75% of gross booking value, while expansion markets account for 15%, indicating substantial international growth potential.

Hotel Integration Strategy

To navigate regulatory constraints in cities like New York, Airbnb has incorporated hotel listings as a supplemental inventory source. With New York’s short-term rental laws restricting Airbnb’s listings, hotels have become a key alternative to maintain local market presence. Over the past year, rental prices in New York rose 3.5%, and hotel rates increased 7%, illustrating the demand gap Airbnb’s hotel listings are helping to fill. The company is similarly expanding hotel listings in other regulated markets to meet demand while staying competitive.

Challenges

Regulatory challenges, particularly in cities like New York with restricted short-term rentals, present ongoing complexities. Airbnb’s pivot to hotel listings mitigates some of these impacts, but long-term regulatory constraints remain a consideration. International expansion requires careful investment balancing and regional adjustments, which may necessitate additional resources to scale effectively.

Share Repurchases

With robust cash flow, Airbnb executed $1.1 billion in share repurchases during Q3. This aligns with its capital return strategy and reflects management’s confidence in sustained growth. As of Q3’s end, $4.2 billion remains in repurchase authorization, supporting potential buybacks as free cash flow continues to grow.

Future Outlook

Airbnb’s growth priorities for Q4 and beyond include investments in core optimizations, international markets, and new services. Margin compression is expected, with an anticipated EBITDA margin of 27-28%, driven by elevated product development and marketing expenses, especially in expansion markets. The company plans to introduce new offerings, including a reimagined Experiences service in 2025. Management forecasts incremental revenue contributions next year, with the full impact anticipated over a five-year horizon as Airbnb’s ecosystem scales further.

Management comments on the earnings call.

Product Innovations

Brian Chesky, Co-Founder and CEO:

“Our mission is to make hosting as popular as traveling on our platform. The Co-Host Network is a major step in that direction, connecting hosts who need support with experienced co-hosts. In just three weeks, we’ve seen over 20,000 applications from potential new co-hosts. This initiative, alongside more than 50 upgrades in our recent Winter Release, reinforces our commitment to make Airbnb a seamless, intuitive experience for both hosts and guests.”

AI-Powered Customer Support

Brian Chesky, Co-Founder and CEO:

“We are seeing real progress in our AI-powered customer service. This AI support is advancing in three stages: from answering general questions, to personalizing responses, and ultimately, to taking actions like rebooking or cancellation. As we look ahead, AI has the potential to resolve a majority of customer interactions through chat, providing faster and more convenient support.”

International Growth

Ali Mertz, Chief Financial Officer:

“Our global market strategy is working well, especially in focus regions like Brazil and Japan. Brazil’s market, for example, is now three times its pre-pandemic size, demonstrating the impact of our localized approach. In Japan, we recently launched a brand campaign aimed at domestic travelers, which is helping drive brand awareness and demand. With these and other initiatives, we see our international markets as key to our long-term growth trajectory.”

Hotel Integration Strategy

Brian Chesky, Co-Founder and CEO:

“In cities like New York, where short-term rental regulations have limited supply, we’re actively working to expand our hotel listings. This aligns with our vision that, for us to win, hotels don’t have to lose. By adding more hotels, we’re ensuring travelers have options to stay in the areas they want, and this is especially important in regulated markets.”

Challenges

Ali Mertz, Chief Financial Officer:

“We’re adapting to the regulatory environments in major urban centers by not only meeting compliance requirements but also enhancing our inventory with hotels in regions with tight short-term rental laws. This balanced approach helps us support both host and guest experiences while addressing external challenges.”

Share Repurchases

Ali Mertz, Chief Financial Officer:

“With over $4.1 billion in trailing 12-month free cash flow, we’re in a strong position to return value to our shareholders. Our share repurchases in Q3 reflect our confidence in the company’s long-term growth potential. We still have $4.2 billion in repurchase authorization, which we view as a significant lever for shareholder returns.”

Future Outlook

Brian Chesky, Co-Founder and CEO:

“We are looking at the next chapter of Airbnb as a journey toward unlocking new business areas beyond our core accommodations. This includes reimagining experiences, and over the coming years, we expect to introduce new offerings that have the potential to contribute billions in annual revenue. Our investments in product development and market expansion next year will reflect this vision, positioning us to drive sustainable, long-term growth.”