Airbnb Q2 2024 Earnings Analysis

Dive into $ABNB Airbnb’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

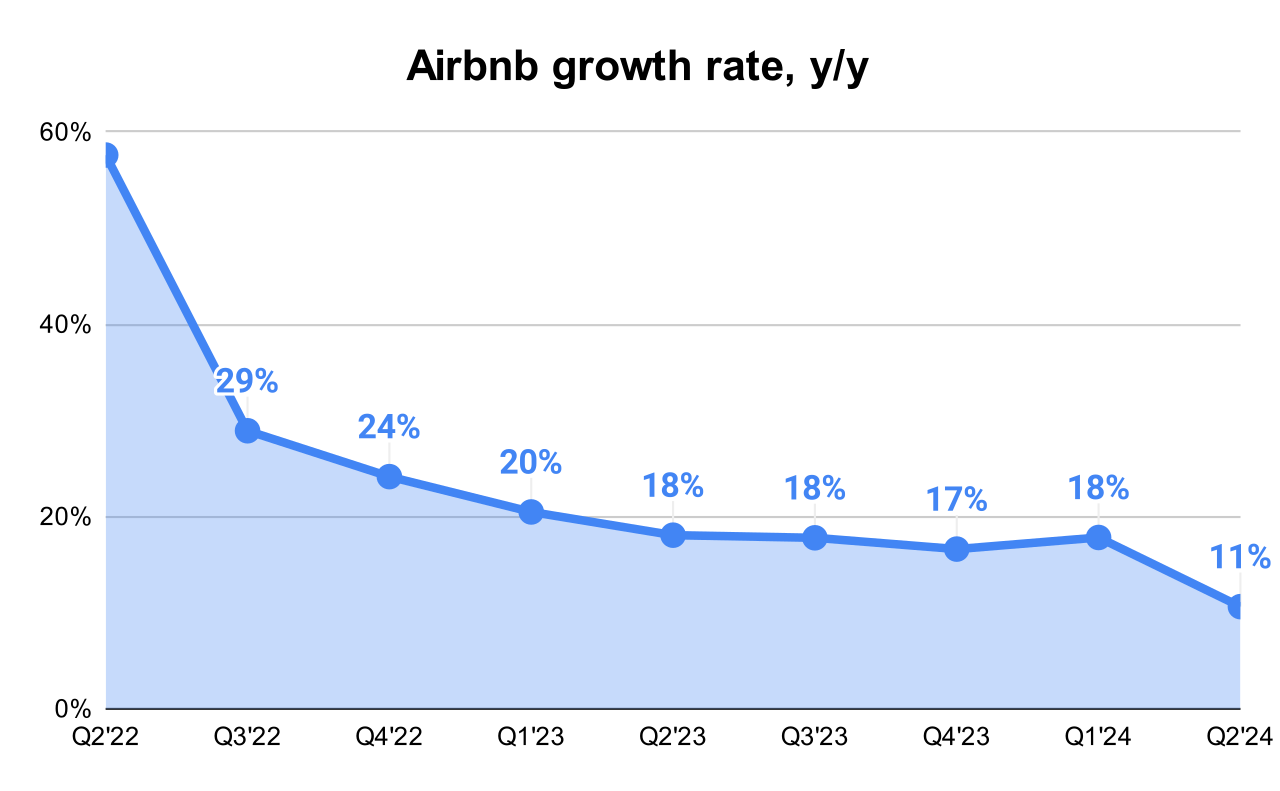

↗️$2.748B rev (+10.6% YoY, 17.8% LQ) beat est by 0.3%

↘️GM (81.6%, -1.0 PPs YoY)🟡

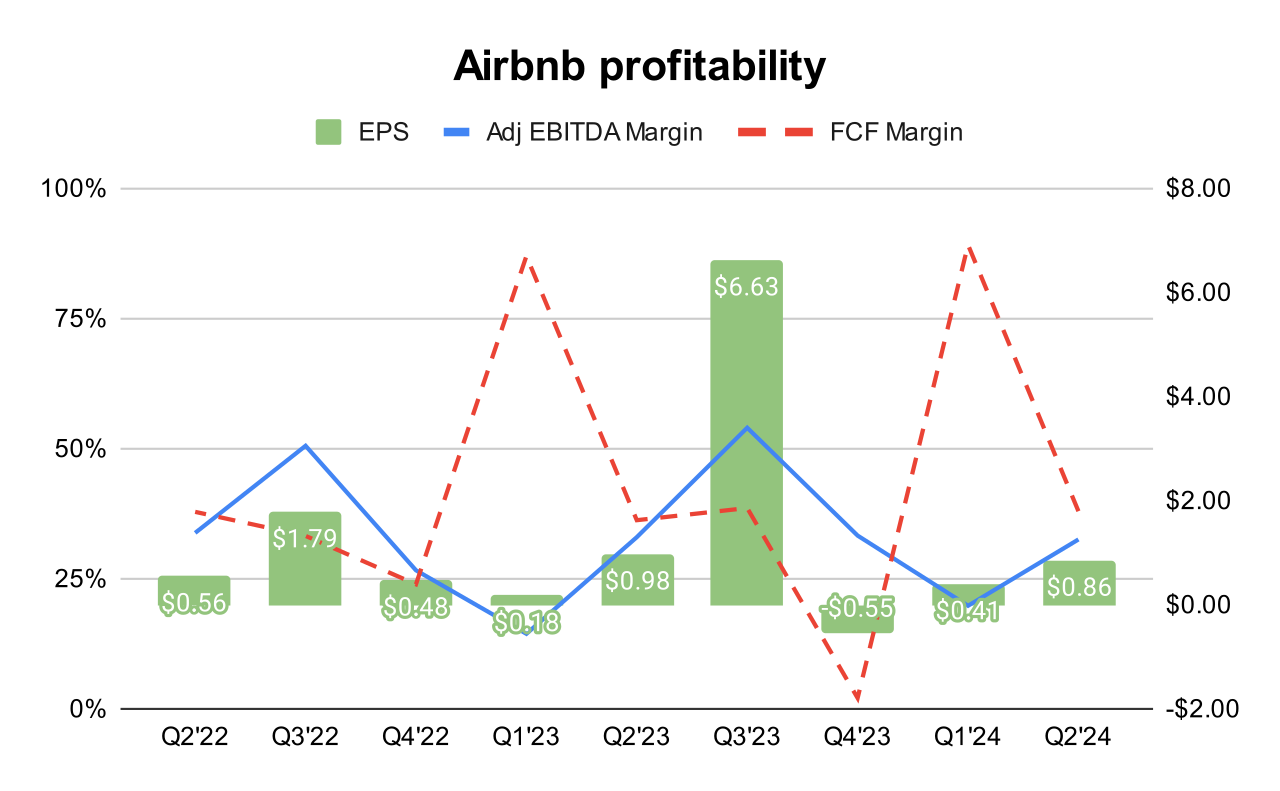

↘️Adj EBITDA Margin (32.5%, -0.4 PPs YoY)🟡

↗️FCF Margin (38.0%, +1.7 PPs YoY)

↘️Net Margin (20.2%, -6.0 PPs YoY)🟡

↘️EPS $0.86 missed est by -5.5%

KPI

↗️Gross Booking Value $21B (+11.0% YoY)

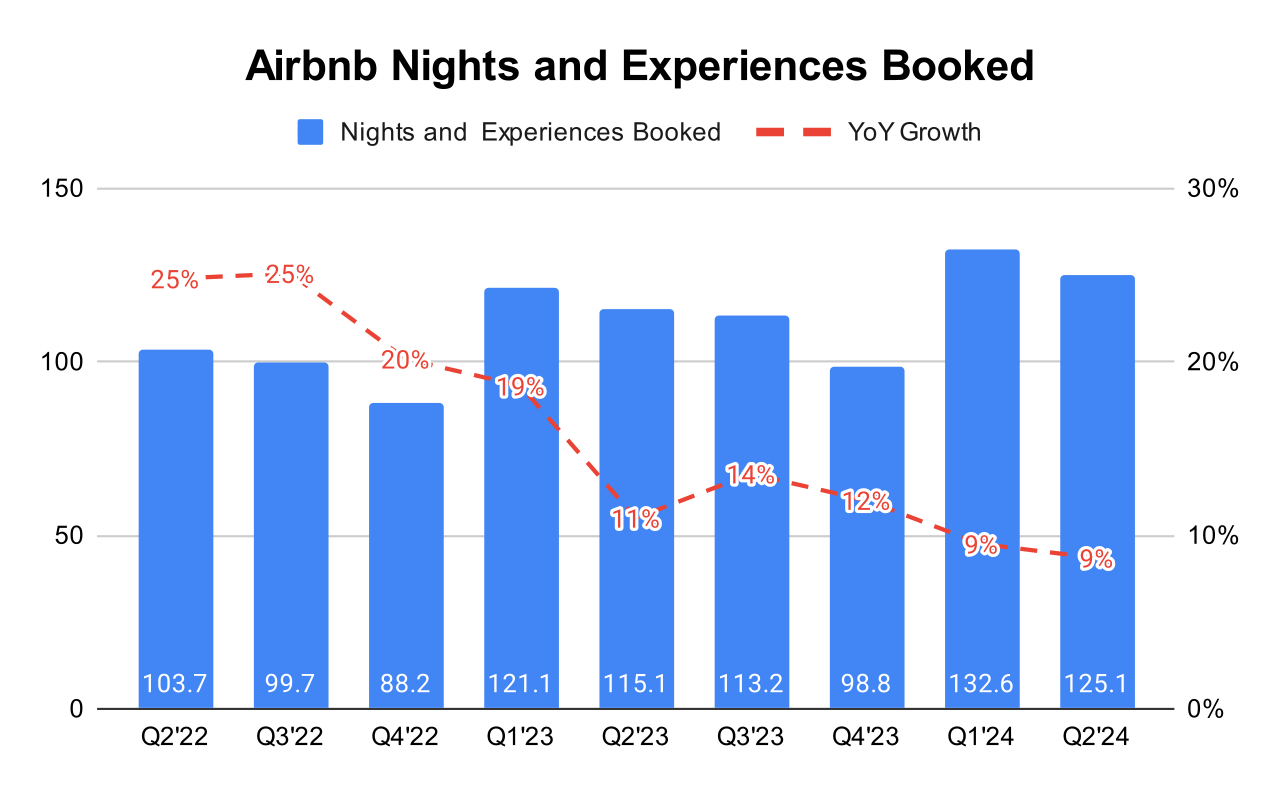

↗️Nights and Experiences Booked $125.10M (+8.7% YoY)

↗️Average Daily Rates $169.53(+2.1% YoY)

Operating expenses

↗️S&M*/Revenue 19.1% (+0.4 PPs YoY)

↘️R&D*/Revenue 10.2% (-0.3 PPs YoY)

↗️G&A*/Revenue 8.8% (+0.1 PPs YoY)

*non-GAAP

Dilution

↗️SBC/rev 14%, +0.1 PPs QoQ

↘️Basic shares down 0.0% YoY, -0.6 PPs QoQ🟢

↘️Diluted shares down -2.4% YoY, 0.0 PPs QoQ🟢

Guidance

↘️Q3'24 $3.670 - $3.730B guide (+8.9% YoY) missed est by -3.6%🔴

Key points from Airbnb’s Second Quarter 2024 Earnings Call:

Financial Performance:

Airbnb reported a revenue increase of 11% year-over-year, reaching $2.75 billion. Net income was $555 million, translating to a net income margin of 20%. The company also highlighted a record $1 billion in free cash flow for the quarter, with a trailing 12-month free cash flow of $4.3 billion, the highest ever.

Innovations:

Airbnb is focusing on underpenetrated markets and diversifying its offerings beyond traditional accommodations, indicating a strategic move to capture new markets and user demographics. This includes launching a co-hosting marketplace in October and a relaunch of Airbnb experiences aimed at making them more affordable, unique, and visible within the app.

Airbnb plans to introduce new guest and host services, enhancing the platform's utility and appeal. The company is poised for annual launches of new products and services starting next year, aiming to transform Airbnb into a more comprehensive travel service provider.

Making Hosting Mainstream:

Airbnb surpassed 8 million active listings, indicating robust growth driven by new hosts across all regions. The increase in listings supports the company's goal of making hosting as popular as traveling on Airbnb.

Enhanced tools and support for hosts to improve ease of hosting and streamline the hosting process, making it more attractive and manageable for new and existing hosts.

Perfecting Core Service:

Ongoing efforts to make Airbnb more reliable and affordable through the introduction of new features and enhancements aimed at improving the overall service quality for hosts and guests.

The rollout of features like guest favorites and top listing highlights, along with simplified site navigation and clear cancellation policies, all contribute to a better user experience and higher booking conversion rates.

Regional Dynamics:

Notable growth in Latin America and Asia Pacific, with these regions identified as key expansion targets due to their significant growth potential.

Growth of gross nights booked on a regional basis significantly outpaced core markets on average, demonstrating the effectiveness of Airbnb's international expansion strategy.

Challenges:

Airbnb has observed a recent trend of shorter booking lead times, particularly noted in July, where bookings are shifting towards more immediate travel dates rather than long-term planning. This trend impacts the visibility and predictability of future revenues, as guests delay bookings for traditionally planned periods like Thanksgiving or Christmas.

New regulations in California affecting pricing transparency and cancellation policies pose challenges, impacting booking behaviors in a significant market.

There's an indication of slowing demand from U.S. guests, which is factoring into the company's cautious outlook for Q3. This trend reflects broader uncertainties possibly linked to macroeconomic conditions influencing consumer spending habits.

Hotel Integration Strategy:

While Airbnb primarily focuses on unique accommodations, it also acknowledges the role of traditional hotel rooms in filling network gaps during high occupancy periods or catering to guests who prefer the predictable service hotels offer.

The company sees an opportunity to leverage its platform to include more hotel options without compromising its core identity of offering unique, localized travel experiences. By integrating select hotel offerings, Airbnb can cater to a broader audience, including those who might otherwise prefer hotels for certain types of trips, such as business travel or short stays.

Share Repurchase:

Airbnb repurchased $749 million of its shares in Q2, with $5.25 billion remaining in its share repurchase authorization program, signaling confidence in its financial health and future prospects.

Future Outlook:

Looking forward, Airbnb plans to continue its investment in growth, particularly in international markets and new services. This includes the upcoming launch of a co-hosting marketplace and a relaunch of Airbnb experiences with enhanced features targeted at affordability and uniqueness.

Airbnb is closely monitoring global economic pressures that might affect travel behavior and spending. The company's guidance incorporates these trends, suggesting a conservative approach to manage potential downturns or fluctuations in travel demand.

Management comments on the earnings call.

Product Innovations

Brian Chesky, CEO: "We're now beginning to prepare the next chapter of Airbnb. And I want Airbnb to be one of the most important companies of our generation and to do that, we're going to do more than one thing. We're going to do multiple new things. We're going to have multiple new products and multiple new services."

Hotel Integration Strategy

Brian Chesky, CEO: "We think of hotels as a filling in network gap during high occupancy nights. We generally think our if there's an incredible home at a low price, they're always going to choose that but when occupancy goes up they are going to go towards hotels... We do think between filling in a network gap and getting more of those one night business travel stays, there is an opportunity to offer hotels on Airbnb."

Customers

Brian Chesky, CEO: "Second Airbnb is uniquely positioned for special events where continuously more guests choose Airbnb for major holidays and events. The week of July 4th for example represents our single highest week of revenue ever in North America and we saw similar trends in Europe."

International Expansion

Brian Chesky, CEO: "In Q2, growth of gross nights booked on origin basis and our expansion markets significantly outperformed our core markets on average... And Asia, you really have like the big four, big five countries. So you have China, Japan, Korea, India and then maybe we could kind of call out Southeast Asia as a holistic region."

Challenges

Ellie Mertz, CFO: "What we’ve seen more recently and in particular in July is a shrinking of the lead times and in particular what we've seen is that there continues to be very strong growth of the shorter lead times... But what we're not seeing the same level of strength is in those longer lead times... So it's that that I would say softness in terms of longer lead times as a big factor in terms of the outlook that we've provided."