Airbnb Q1 2025 Earnings Analysis

Dive into $ABNB Airbnb’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

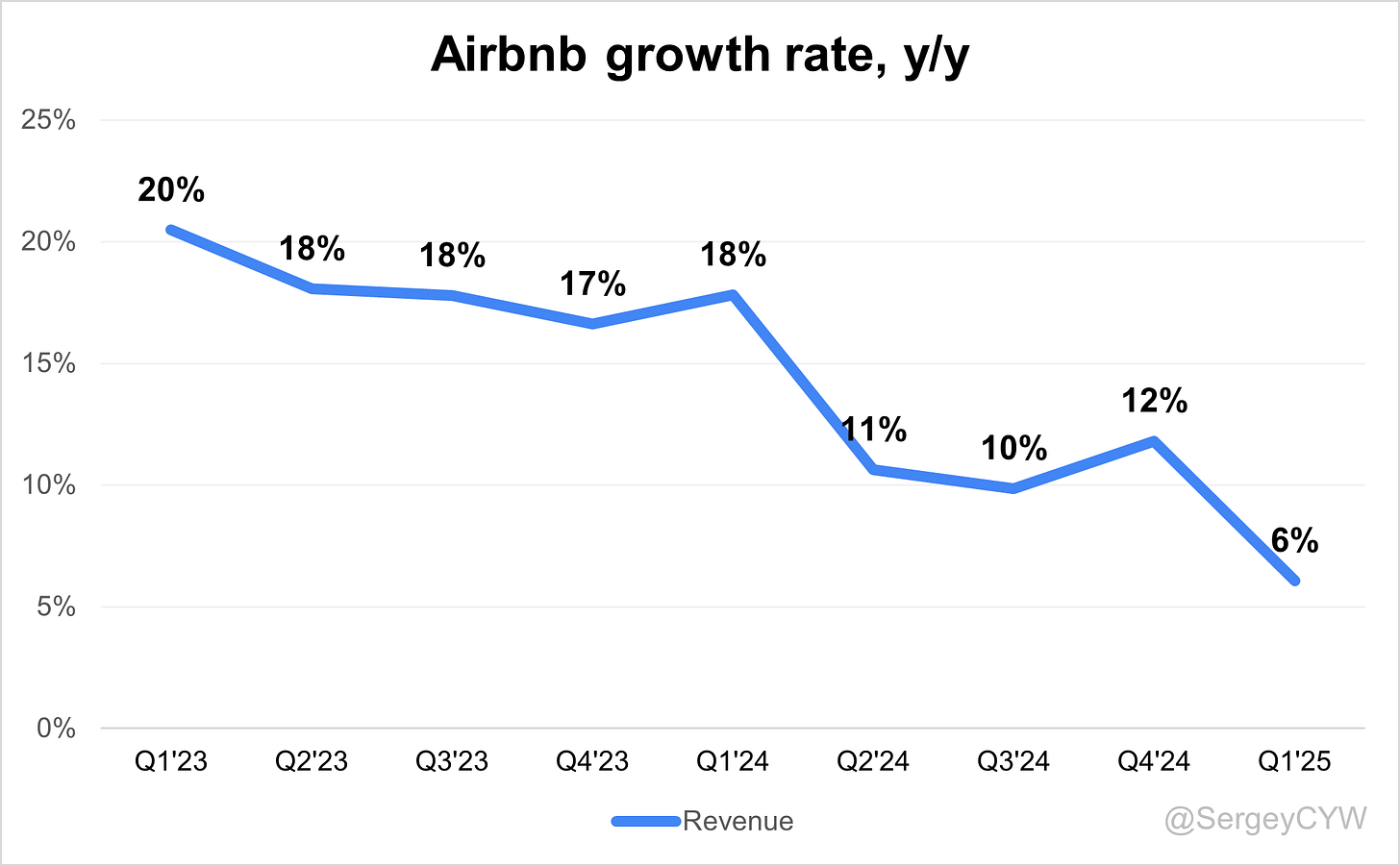

↗️$2,272M rev (+6.1% YoY, +11.8% LQ) beat est by 0.5%

↗️GM (77.7%, 0.1 PPs YoY)

↘️Adj EBITDA Margin (18.4%, -1.4 PPs YoY)🟡

↘️FCF Margin (78.7%, -10.4 PPs YoY)🟡

↘️Net Margin (6.8%, -5.5 PPs YoY)🟡

↗️EPS $0.24 beat est by 4.3%

KPI

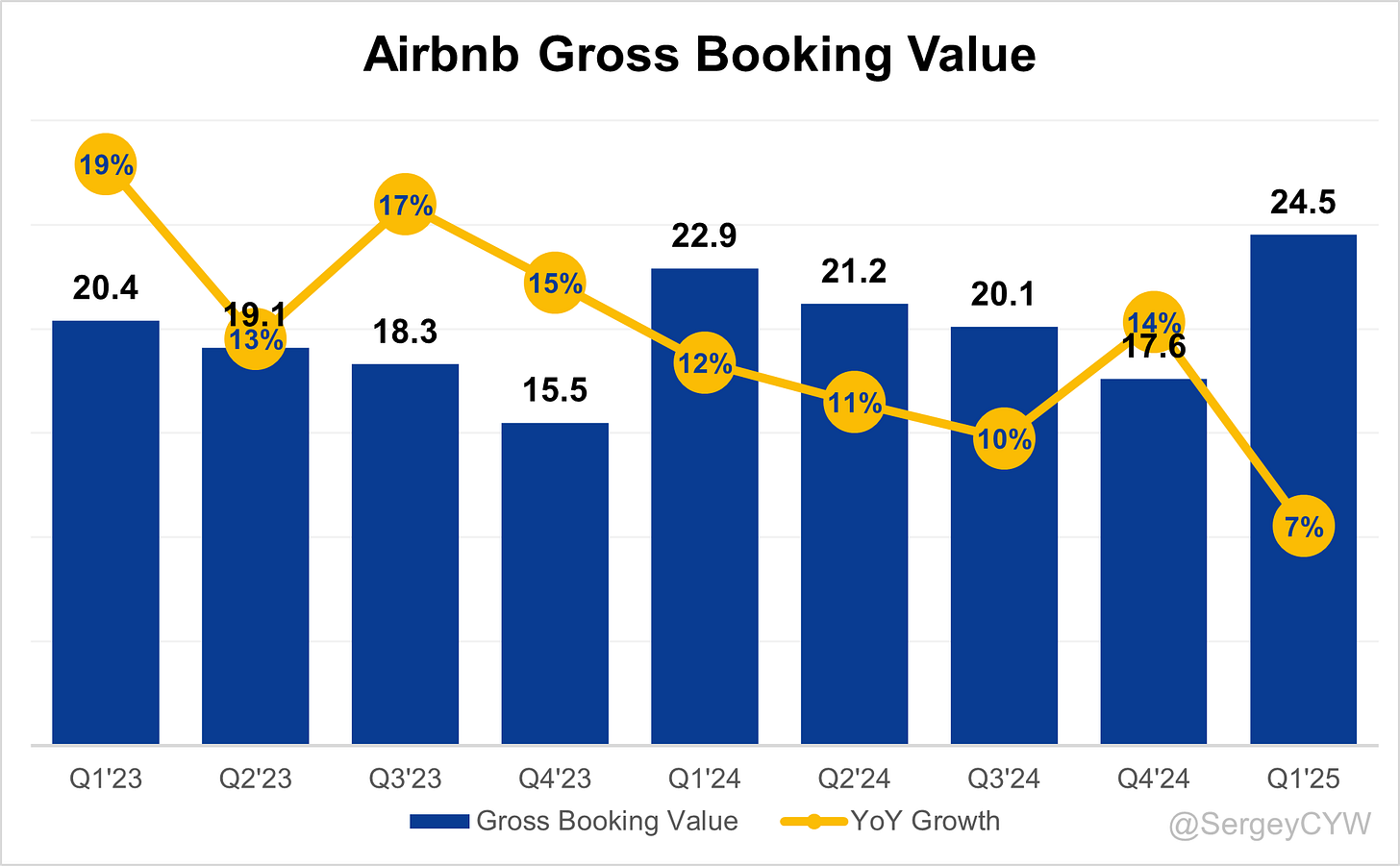

↗️Gross Booking Value $25B (+7.0% YoY)

↗️Nights and Experiences Booked $143.10M (+7.9% YoY)🟢

↘️Average Daily Rates $171.30(-0.9% YoY)

➡️Total Take Rate 9.3%

Regional Breakdown

↘️United States $1,054.0M rev (+3.8% YoY, 46% of Rev)

↘️Europe, Middle East, and Africa $597.0M rev (+5.3% YoY, 26% of Rev)

↗️Asia Pacific $343.0M rev (+11.7% YoY, 15% of Rev)

↗️Other $278.0M rev (+9.9% YoY, 12% of Rev)

Operating expenses

↗️S&M/Revenue 24.8% (+0.8 PPs YoY)

↗️R&D/Revenue 25.0% (+2.8 PPs YoY)

↘️G&A/Revenue 12.9% (-0.5 PPs YoY)

Dilution

↗️SBC/rev 16%, +4.1 PPs QoQ

↘️Basic shares down -2.7% YoY, -0.3 PPs QoQ🟢

↘️Diluted shares down -3.4% YoY, -2.7 PPs QoQ🟢

Guidance

➡️Q2'25 $2,990 - $3,050M guide (+9.9% YoY) in line with est

Key points from Airbnb’s First Quarter 2025 Earnings Call:

Financial Performance

Airbnb reported $2.3B in Q1 2025 revenue, up +6% YoY. Adjusting for FX and calendar shifts, growth reached +11% YoY. Adjusted EBITDA totaled $417M, yielding an 18% margin. Free cash flow was $1.8B, with TTM FCF at $4.4B and a 39% FCF margin. Airbnb ended the quarter with $11.5B in cash and investments and $9.2B in guest funds. $807M in stock was repurchased, with $2.5B remaining in the buyback program.

Product Innovations

Over the past three years, Airbnb launched 500+ upgrades. The Guest Favorites filter drove 350M nights booked, while Rare Finds improved discovery of high-quality listings. The Compare Listings tool, used by 2M+ hosts, and simplified checkout enhanced conversion. Airbnb also rolled out total price display globally, improving transparency. A full app rebuild enables faster iteration and supports future offerings.

AI Integration

The new AI customer service agent is live for 50% of U.S. users and will reach 100% in Q2. It has already cut live agent support needs by 15%. Management plans deeper AI integration across trip planning, self-service, and personalization, aiming to enhance automation and reduce friction across the booking journey.

Marketplace Strategy

Airbnb applies a localized, full-funnel marketing strategy in global expansion. Marketing spend will outpace revenue in Q2, driven by the May 13 product release. App usage continues to increase, delivering higher conversion rates than web. Features like Rare Finds and improved checkout drive engagement and listing efficiency.

App-based behavior is now a central metric. Brand investments in Latin America and Asia-Pacific are paying off—Brazil’s first-time bookers rose +30% YoY in Q1. Despite macro uncertainty in the U.S., international demand is partially offsetting advertising risks.

New Offerings

Airbnb will launch new non-lodging products on May 13, supported by a rebuilt app. While Q2 contribution is minimal, investments will scale in H2 and total $200–250M in 2025. The strategy focuses on instant booking, AI personalization, and app-native integration to drive retention.

The risk lies in execution. Management expects early margin dilution, but sees long-term upside from new verticals becoming scalable revenue streams.

Pricing Flexibility

U.S. hosts earned an average of ~$15,000 annually, mostly supplemental, giving Airbnb more pricing elasticity than hotels. 80%+ of hosts use pricing tools like Compare Listings and long-stay discounts. Airbnb is steering supply visibility based on value to drive competitive pricing and guest satisfaction. No broad ADR reductions noted, but elasticity remains a lever if demand softens.

Hotels and Urban Supply

Urban hotels are now part of Airbnb’s supply strategy. HotelTonight has been reactivated with a 10% booking credit promotion to increase crossover conversion. Airbnb plans to onboard more hotels, filling inventory gaps in high-occupancy regions and serving as a backup for travelers when home supply is constrained.

Global Expansion

Expansion markets grew at 2x the rate of core markets in Q1. Brazil led with +27% origin night growth and +30% first-time bookers, up from Q4. Latin America rose in the low 20s, and Asia-Pacific in the mid-teens, while North America posted low single-digit growth. Success stems from localized product and payment flows and tailored marketing in underpenetrated regions.

Consumer Trends

Booking windows have shifted shorter. Short-lead bookings are rising, while long-lead bookings show softness—particularly in the U.S. High-income travelers remain steady, while lower-budget travelers are opting for drive-to, affordable options. Inbound U.S. travel declined, but was offset by increased travel to destinations like Mexico, Brazil, and Europe.

Buybacks

Airbnb repurchased $807M in Q1 and holds $2.5B in authorization. The company maintains a strong cash position and disciplined capital allocation strategy, signaling continued confidence in its long-term profitability and cash generation.

Competitive Positioning

Airbnb continues to gain U.S. market share, aided by a distributed, exclusive supply model and geographic diversification. Unlike hotels, Airbnb's platform adapts quickly to shifts in demand and consumer behavior, strengthening its relative position during market volatility.

Macro Risks

Soft U.S. consumer sentiment and FX volatility—especially in Latin America—remain headwinds. While USD weakness vs. EUR helps marginally, hedging limits FX tailwinds. Management flagged H2 margins will be pressured by scaled investment and continued marketing.

Outlook

Q2 revenue is projected at $2.99–$3.05B, or +9–11% YoY. Adjusted EBITDA margin is expected to be flat to slightly down YoY, with FY 2025 margin guidance reaffirmed at ≥34.5%. New business lines, international growth, hotel supply, and co-hosting are key to long-term upside.

Management comments on the earnings call.

Product Innovations

Brian Chesky, Co-Founder and Chief Executive Officer

“We spent the last few years rolling out hundreds of upgrades to make Airbnb better for guests and hosts. It's now easier to use, more affordable, and more reliable.”

Ellie Mertz, Chief Financial Officer

“We’ve made Airbnb significantly better for both guests and hosts. We’ve been driving growth from product improvements, like enhanced search and better merchandising.”

Brian Chesky, Co-Founder and Chief Executive Officer

“The vast majority of people come to Airbnb and don’t find a booking. Last year, over 1.5 billion devices accessed Airbnb. So part of this is about having the right homes, but also about having the right tools.”

AI Strategy

Brian Chesky, Co-Founder and Chief Executive Officer

“We just rolled out our AI customer service agent this past month. 50% of US users are now using the agent, and we’ll roll it out to 100% of US users this month.”

“We believe this is the best AI-supported customer travel agent in the industry. It’s already led to a 15% reduction in people needing to contact live human agents, and it’s going to get significantly more personalized and agentic.”

Advertising & Marketplace

Ellie Mertz, Chief Financial Officer

“Every month, we're looking at the relative efficiencies by channel, by market, and adjusting accordingly. So far this year, we’ve been doing that on a regular basis.”

Ellie Mertz, Chief Financial Officer

“We’re applying effectively the full funnel of our marketing approach to expansion markets. That includes brand, performance, comms, and policy to deliver a differential outcome.”

Ellie Mertz, Chief Financial Officer

“You can see the booking share has gone up quite dramatically over the last couple of years as we encouraged people to use our app. It’s additive in terms of consolidated conversion level.”

Pricing Strategy

Brian Chesky, Co-Founder and Chief Executive Officer

“Most of the income that people make on Airbnb is supplemental. What this means is there’s typically more flexibility for Airbnb hosts than hotels to adjust their prices.”

“We now have over two million listings using our Compare Listings tool, which shows hosts how their prices compare to similar Airbnbs. When hosts have more visibility, they tend to provide more competitive pricing.”

Ellie Mertz, Chief Financial Officer

“When we test elasticity, we often see that driving down prices is more than compensated by increased volume. In many cases, that will be to reduce your price.”

Hotels and Urban Strategy

Brian Chesky, Co-Founder and Chief Executive Officer

“We think hotels are a massive opportunity for Airbnb. Over the coming years, we're going to be doing a lot more to bring great hotels onto our platform.”

Brian Chesky, Co-Founder and Chief Executive Officer

“We just did a promotional campaign with HotelTonight—book a hotel, get 10% credit towards an Airbnb booking. This increases conversion and introduces hotel travelers to Airbnb.”

Competitors

Brian Chesky, Co-Founder and Chief Executive Officer

“For every person who books an Airbnb, we estimate about nine people are booking hotels. If we could just get one of those nine to book an Airbnb, we’d double the size of our business.”

Ellie Mertz, Chief Financial Officer

“We continue to gain market share in the US. We are not seeing any losses—much to the contrary.”

Customers

Ellie Mertz, Chief Financial Officer

“We haven't particularly seen consumers trade down in terms of choosing a lower ADR booking or a shorter trip.”

Ellie Mertz, Chief Financial Officer

“The higher income traveler is somewhat unimpacted by the current macro conditions. We see very stable, healthy growth in higher ADR bookings.”

International Growth

Ellie Mertz, Chief Financial Officer

“For the fifth quarter in a row, growth in expansion markets significantly outperformed our core markets. In Q1, the average growth rate in expansion markets was more than double that of our core markets.”

Ellie Mertz, Chief Financial Officer

“In Brazil, origin nights grew 27%, and first-time bookers grew over 30%, both accelerating from Q4.”

Ellie Mertz, Chief Financial Officer

“We are taking a much more localized approach to product and marketing in underpenetrated markets. If they’re important, they can be quite meaningful in terms of driving growth.”

Challenges

Ellie Mertz, Chief Financial Officer

“We’re staying close to geopolitical and macroeconomic uncertainty and monitoring any short-term impact they could have.”

Ellie Mertz, Chief Financial Officer

“In the U.S., we've seen relatively softer trends, which we believe is largely driven by broader economic uncertainty.”

Ellie Mertz, Chief Financial Officer

“We saw a meaningful step down from January to February in consumer sentiment, but March recovered and brought the full quarter in line with expectations.”

Future Outlook

Ellie Mertz, Chief Financial Officer

“We expect to deliver revenue between $2.99B and $3.05B in Q2, representing 9–11% year-over-year growth.”

Ellie Mertz, Chief Financial Officer

“For the full year, we continue to expect an adjusted EBITDA margin of at least 34.5%. That includes $200M to $250M of investment to launch and scale new businesses.”

Brian Chesky, Co-Founder and Chief Executive Officer

“We think we’re just scratching the surface of how much bigger our core business could be. There’s no reason to think it couldn’t be double the size it is today.”

Ellie Mertz, Chief Financial Officer

“Our intent with both the core and the new businesses is to invest in growth upfront and to optimize margins over time.”

Thoughts on Airbnb Earnings Report $ABNB:

🟢 Positive

Revenue grew to $2.27B (+6.1% YoY, +11.8% QoQ), beating estimates by 0.5%

EPS of $0.24, beating by 4.3%

Gross Booking Value reached $25B (+7.0% YoY)

Nights and Experiences Booked hit 143.1M (+7.9% YoY)

Asia Pacific revenue rose +11.7% YoY, now 15% of total

Other international regions grew +9.9% YoY

Brazil first-time bookers increased +30% YoY

Basic shares down -2.7% YoY, diluted shares down -3.4% YoY

$807M in stock repurchases, with $2.5B remaining

Strong cash position with $11.5B in corporate cash and $9.2B in guest funds

AI agent rollout reached 50% of U.S. users, reduced support volume by 15%

🟡 Neutral

Adjusted EBITDA margin at 18.4%, down -1.4pp YoY

Total Take Rate held at 9.3%

Gross Margin stable at 77.7% (+0.1pp YoY)

Q2 revenue guidance of $2.99–$3.05B (+9.9% YoY) in line with expectations

U.S. high-income travelers showing stable demand

Marketing spend to increase in Q2, aligned with May 13 product release

🔴 Negative

Net Margin fell to 6.8% (-5.5pp YoY)

Free Cash Flow Margin declined to 78.7% (-10.4pp YoY)

Average Daily Rates (ADR) dropped to $171.30 (-0.9% YoY)

United States revenue up only +3.8% YoY, now 46% of total

Europe, Middle East, and Africa revenue up just +5.3% YoY

Sales & Marketing expense rose to 24.8% of revenue (+0.8pp YoY)

R&D expense increased to 25.0% of revenue (+2.8pp YoY)

Stock-based compensation rose to 16% of revenue (+4.1pp QoQ)

U.S. booking softness continues on longer lead times due to macro uncertainty

Management expects H2 margins to be pressured by new business investments

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.