Adobe Q4 2024 Earnings Analysis

Dive into $ADBE Adobe’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$5,606.0M rev (+11.1% YoY, +10.6% LQ) beat est by 1.2%

↗️GM (89.0%, +1.6 PPs YoY)

↗️Operating Margin (34.9%, +0.4 PPs YoY)

↗️Net Margin (30.0%, +0.6 PPs YoY)

↗️EPS* $4.81 beat est by 3.2%

*non-GAAP

Segment Revenue

↗️Digital Media $4,145M rev (+11.5% YoY, 95.4% Gross Margin)🟢

➡️Creative $3,302M rev (+10.3% YoY)🟡

↗️Document Cloud $843M rev (+16.9% YoY)

➡️Digital Experience $1,396M rev (+10.3% YoY, 71.2% Gross Margin)🟡

↗️Digital Experience Subscription $1,265M rev (+12.6% YoY)🟢

↘️Publishing and Advertising $65M rev (-1.5% YoY, 64.6% Gross Margin)🟡

Key Metrics

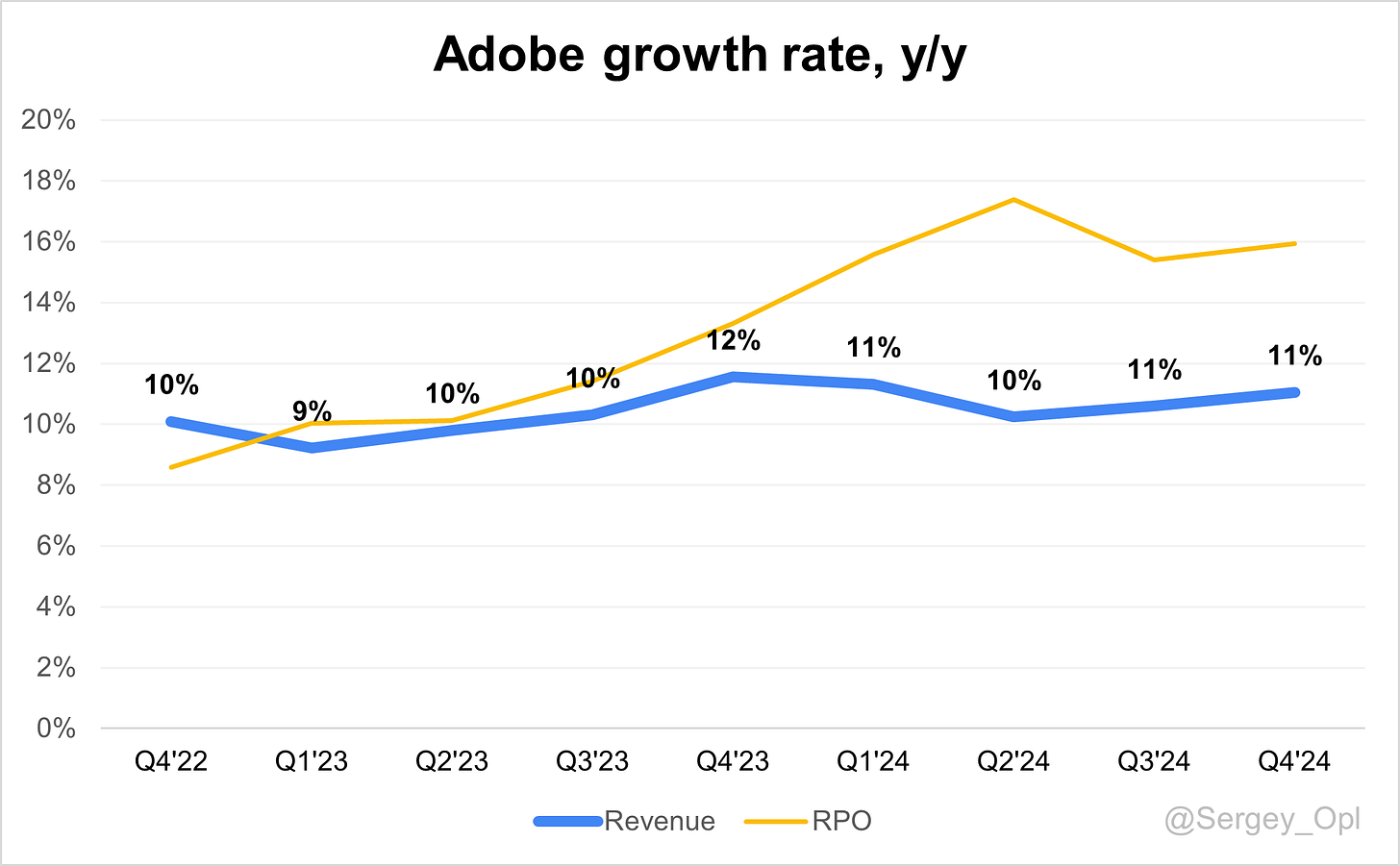

↗️RPO $19.96B (+15.9% YoY)🟢

➡️Creative ARR $13.74B (+10.0% YoY, +399 net new ARR)🟡

↗️Document Cloud ARR $3.48B (+22.4% YoY, +173 net new ARR)

↗️Total Digital Media ARR $17.22B (+12.3% YoY, +572 net new ARR)🟢

Quarterly Performance Highlights

↗️Net New ARR $204M (+21.0% YoY)

↗️CAC Payback Period 19.5 Months (+6.2 YoY)🟡

↘️R&D Index (RDI) 1.40 (-0.29 YoY)🟡

Operating expenses

↗️S&M/Revenue 27.4% (+0.3 PPs YoY)

↗️R&D/Revenue 17.8% (+0.2 PPs YoY)

↗️G&A/Revenue 8.1% (+0.8 PPs YoY)

Dilution

↘️SBC/rev 8%, -0.9 PPs QoQ

↘️Basic shares down -3.1% YoY, -0.2 PPs QoQ🟢

↘️Diluted shares down -3.5% YoY, -1.1 PPs QoQ🟢

Headcount

↘️30,709 Total Headcount (+2.6% YoY, -121 added)

Guidance

↘️$5,630.0 - $5,680.0M guide (+9.1% YoY) missed est by -1.3%🔴

↘️$23,300.0 - $23,550.0M FY guide (+8.9% YoY) missed est by -1.5%🔴

Key points from Adobe’s Fourth Quarter 2024 Earnings Call:

Financial Performance

Adobe achieved record financial results in Q4 FY 2024, with revenue reaching $5.61 billion, reflecting an 11% year-over-year (YoY) increase. For the full fiscal year, revenue totaled $21.51 billion, growing 11% YoY. GAAP EPS was $12.36, while non-GAAP EPS stood at $18.42, growing 5% and 15% YoY, respectively. Operating cash flow reached $8.06 billion, and Adobe repurchased 17.5 million shares, leaving $17.65 billion authorized for future buybacks. However, YoY ARR growth for Digital Media slowed to 11%, raising concerns about growth momentum.

Product Innovations

In 2024, Adobe significantly advanced generative AI and product integration. The Firefly family of AI models expanded to include video capabilities, complementing existing image, vector, and design models. Adobe introduced GenStudio, an integrated solution combining Creative Cloud, Express, and Experience Cloud to enhance enterprise-level content workflows. Adobe Express adoption grew substantially, with an 84% YoY increase in premium access for education users during the back-to-school season.

Creative Cloud

Creative Cloud revenue rose 11% YoY in Q4 to $3.3 billion, supported by $405 million in net new ARR. Firefly capabilities drove engagement, with over 16 billion generative AI-powered creations recorded in FY 2024. The platform’s tools, including Photoshop, Lightroom, and Premiere Pro, were enhanced with faster image generation and generative video models, set for commercial release in FY 2025.

While Creative Cloud innovated strongly, net new ARR growth slowed to 2% YoY in Q4. However, the platform’s adoption among enterprise customers and plans for tiered subscription offerings in FY 2025 highlight future monetization opportunities.

Document Cloud

The Document Cloud segment delivered $843 million in Q4 revenue, a 17% YoY increase, with total ARR growing 23% YoY to $3.48 billion. Monthly active users increased 25% YoY, driven by demand for Acrobat AI Assistant, which accelerated document tasks by four times. Key innovations included Liquid Mode for document readability and integrated image generation with Adobe Express.

Major customer wins, such as Kaiser Permanente and the U.S. Department of State, strengthened the segment’s leadership in digital document solutions. Balancing freemium growth with paid subscriptions remains a challenge, particularly in SMB and international markets.

Experience Cloud

Experience Cloud generated $1.4 billion in Q4 revenue, growing 10% YoY, with subscription revenue up 12% YoY to $1.27 billion. The Adobe Experience Platform (AEP) exceeded $1 billion in ARR, growing 40% YoY, while GenStudio offered enterprises streamlined workflows for personalized content production.

Large customer wins, including Bank of America, Procter & Gamble, and Disney, showcased Experience Cloud’s enterprise appeal. Firefly integration within GenStudio added value for customers seeking scalable and personalized content creation. Growth rates slowed amid competitive market conditions, raising questions about sustaining high bookings growth.

Adobe Firefly and AI

Adobe Firefly powered over 16 billion generative creations, underscoring its importance to Adobe’s innovation strategy. The platform expanded into video models and gained enterprise traction for use cases such as content personalization and localization. Firefly services enabled companies like PepsiCo and Tapestry to scale production efficiently.

Adobe plans to introduce higher-tier Firefly offerings in FY 2025, targeting video professionals and enterprises. Challenges include converting high engagement into accelerated revenue growth, with commercial viability of Firefly’s video models playing a critical role in its long-term success.

Customers and Success Stories

Adobe secured major enterprise wins in FY 2024, including Coca-Cola, Alphabet, Nestlé, Procter & Gamble, and the U.S. Department of Defense. GenStudio adoption enabled customers like PepsiCo to personalize merchandise, while Tapestry scaled content production efficiently. Document Cloud solutions gained traction in healthcare and government sectors, highlighting Adobe’s ability to meet diverse customer needs.

In education and SMBs, Adobe Express adoption surged, with approximately 4,000 businesses added in Q4 and an 84% YoY increase in premium access for students and educators.

Market Expansion

Adobe expanded its presence in SMB and education markets by promoting Adobe Express and Acrobat on web and mobile platforms. Partnerships with AWS, Google, and Meta broadened its ecosystem. Advanced AI features and language support enhanced its global appeal, helping penetrate new markets.

Challenges and Weak Guidance

Guidance for FY 2025 indicated revenue of $23.3 billion to $23.55 billion, representing slower growth of 8% YoY compared to 11% in FY 2024. Foreign exchange headwinds are expected to reduce revenue by $200 million, while ARR growth projections of 11% YoY suggest limited acceleration. Investors expressed concern over Creative Cloud’s slowing ARR growth and Adobe’s ability to fully capitalize on its innovations.

Future Outlook

Adobe’s future depends on monetizing generative AI and scaling enterprise solutions like Firefly and GenStudio. The planned introduction of tiered offerings in FY 2025 aims to boost revenues, while continued adoption in SMBs and education markets presents growth opportunities. Adobe’s strategic focus on innovation and market expansion positions it well for long-term success, but near-term pressures remain a challenge.

Management comments on the earnings call.

Product Innovations

Shantanu Narayen, Chair and CEO

"Our generative AI models in the Firefly family, including imaging, vector, design, and video, are designed to be commercially safe and deeply integrated into our flagship applications, offering unprecedented levels of user control and output quality."

David Wadhwani, President of Digital Media

"The introduction of Firefly video models early next year will allow us to further tier our Creative Cloud offerings and unlock new monetization opportunities by aligning value with pricing."

Creative Cloud

David Wadhwani, President of Digital Media

"Firefly-powered generations across our tools surpassed 16 billion, with every month setting new records. This innovation has been integrated deeply into Photoshop, Lightroom, Premiere Pro, and Adobe Express, driving incredible value for creative professionals."

Shantanu Narayen, Chair and CEO

"Our Creative Cloud business continues to see strong adoption, but we are focused on introducing new tiers to optimize pricing and increase ARPU as video generation and other advanced capabilities evolve."

Document Cloud

David Wadhwani, President of Digital Media

"AI Assistant in Acrobat enables users to complete document tasks four times faster, making Acrobat more than just a PDF tool—it’s becoming a general-purpose productivity platform."

Shantanu Narayen, Chair and CEO

"Document Cloud’s strong growth is driven by innovations like Liquid Mode and AI Assistant, alongside continued investment in accessibility across mobile, desktop, and web."

Experience Cloud

Anil Chakravarthy, President of Digital Experience

"The Adobe Experience Platform and native apps surpassed $1 billion in ARR, growing more than 40% YoY, as enterprises increasingly rely on our solutions for real-time customer data and personalized experiences at scale."

Shantanu Narayen, Chair and CEO

"With the introduction of GenStudio for performance marketing, we’ve brought together creative and experience clouds to deliver an end-to-end content supply chain solution for enterprises."

AI

David Wadhwani, President of Digital Media

"Our AI efforts are driven by three pillars: commercially safe models, unparalleled user control, and deep integration into our tools, making us a leader in generative AI innovation."

Shantanu Narayen, Chair and CEO

"Generative AI, integrated across our solutions, is driving significant customer adoption and is central to unlocking the next wave of content creation and automation."

Customers

David Wadhwani, President of Digital Media

"Companies like Pepsi and Tapestry are using Firefly services to scale content production and personalize customer experiences, highlighting how our solutions are becoming mission-critical to enterprises."

Shantanu Narayen, Chair and CEO

"Our ability to secure key wins with enterprises like Coca-Cola, Procter & Gamble, and the U.S. Department of Defense demonstrates the growing importance of our solutions across industries."

Strategic Partnerships

Anil Chakravarthy, President of Digital Experience

"Our expanded partnership with AWS to bring Adobe Experience Platform to its cloud infrastructure reinforces our leadership across public clouds, enabling broader adoption of our technologies."

Challenges

Dan Dern, Executive Vice President and CFO

"The composition of growth in FY 2025 will shift, with a greater emphasis on new users and products. While this foundational approach is strategic, it may temper near-term acceleration."

Shantanu Narayen, Chair and CEO

"We are addressing growth challenges by introducing new tiered offerings and pricing models to align with the incredible value we are delivering to customers."

Future Outlook

Shantanu Narayen, Chair and CEO

"Our strategy to unleash creativity, accelerate document productivity, and power digital businesses represents a massive opportunity, and we’re well-positioned to capitalize on this in 2025 and beyond."

Dan Dern, Executive Vice President and CFO

"The investments we’re making in AI innovation and integration across our products are expected to drive meaningful contributions to our financial performance in FY 2025 and set the stage for sustained growth."

Thoughts on Adobe Earnings Report $ADBE:

🟢Positive

Q4 FY 2024 revenue reached $5.61 billion, growing 11% YoY, with full-year revenue of $21.51 billion, also up 11% YoY.

Non-GAAP EPS grew 15% YoY to $18.42, and operating cash flow totaled $8.06 billion.

Creative Cloud revenue increased 11% YoY to $3.3 billion, with over 16 billion Firefly-powered generative AI creations recorded.

Document Cloud revenue rose 17% YoY to $843 million, with ARR growing 23% YoY to $3.48 billion.

Experience Cloud ARR exceeded $1 billion, growing 40% YoY, driven by tools like Adobe GenStudio and customer wins including Bank of America, Procter & Gamble, and Disney.

Adobe Express premium access for education increased 84% YoY, adding 4,000 businesses in Q4.

🟡Neutral

Digital Media ARR grew 11% YoY, consistent with prior quarters, while subscription revenue from Experience Cloud grew 12% YoY to $1.27 billion.

Adoption of Firefly services among enterprises like PepsiCo and Tapestry showcased potential for scaling content workflows but has yet to materially accelerate ARR.

Partnerships with AWS, Google, and Meta expanded market reach, but the long-term impact remains unclear.

🔴Negative

FY 2025 revenue guidance of $23.3 billion to $23.55 billion represents slower growth of 8% YoY, compared to 11% YoY in FY 2024.

Creative Cloud net new ARR grew only 2% YoY in Q4, reflecting slowing momentum in the segment.

Foreign exchange headwinds are projected to reduce FY 2025 revenue by $200 million.

Concerns about Adobe’s ability to fully capitalize on generative AI innovations, with investor sentiment cautious due to slowing ARR growth and decelerating revenue trends.