Adobe Q2 2025 Earnings Analysis

Dive into $ADBE Adobe’s Q2 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

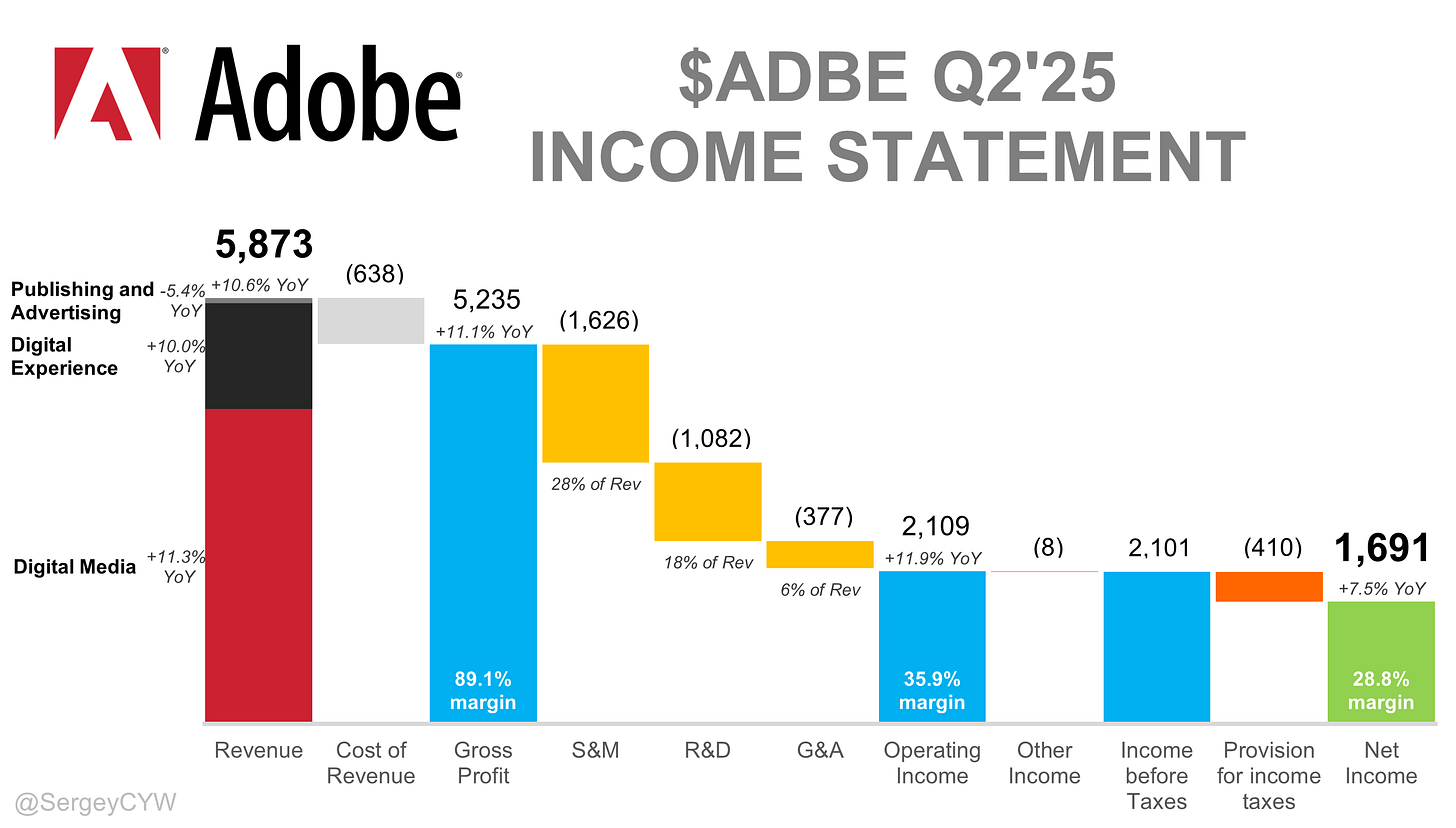

Financial Results:

↗️$5,873.0M rev (+10.6% YoY, +2.8% QoQ) beat est by 1.3%

↗️GM (89.1%, +0.4 PPs YoY)

↗️Operating Margin (35.9%, +0.4 PPs YoY)

↗️FCF Margin (36.5%, +0.7 PPs YoY)

↘️Net Margin (28.8%, -0.8 PPs YoY)🟡

↗️EPS* $5.06 beat est by 1.8%

*non-GAAP

Segment Revenue

↗️Digital Media $4,350M rev (+11.3% YoY, 95.2% Gross Margin)🟢

➡️Digital Experience $1,460M rev (+10.0% YoY, 71.9% Gross Margin)🟡

➡️Digital Experience Subscription $1,330M rev (+10.5% YoY)🟡

↘️Publishing and Advertising $70M rev (-5.4% YoY, 71.4% Gross Margin)🟡

Key Metrics

➡️RPO $19.69B (+10.3% YoY)🟡

↗️Billings $5,747M (+17.6% YoY)🟢

↗️Total Digital Media ARR $18.09B (+11.3% YoY, +460 net new ARR)🟢

Quarterly Performance Highlights

↗️Net New ARR $636M (+25.2% YoY)

↘️CAC Payback Period 31.7 Months (-4.4 YoY)🟢

↗️R&D Index (RDI) 0.59 (+0.01 YoY)🟢

Operating expenses

↗️S&M/Revenue 27.7% (+0.5 PPs YoY)

↘️R&D/Revenue 18.4% (-0.1 PPs YoY)

↘️G&A/Revenue 6.4% (-0.3 PPs YoY)

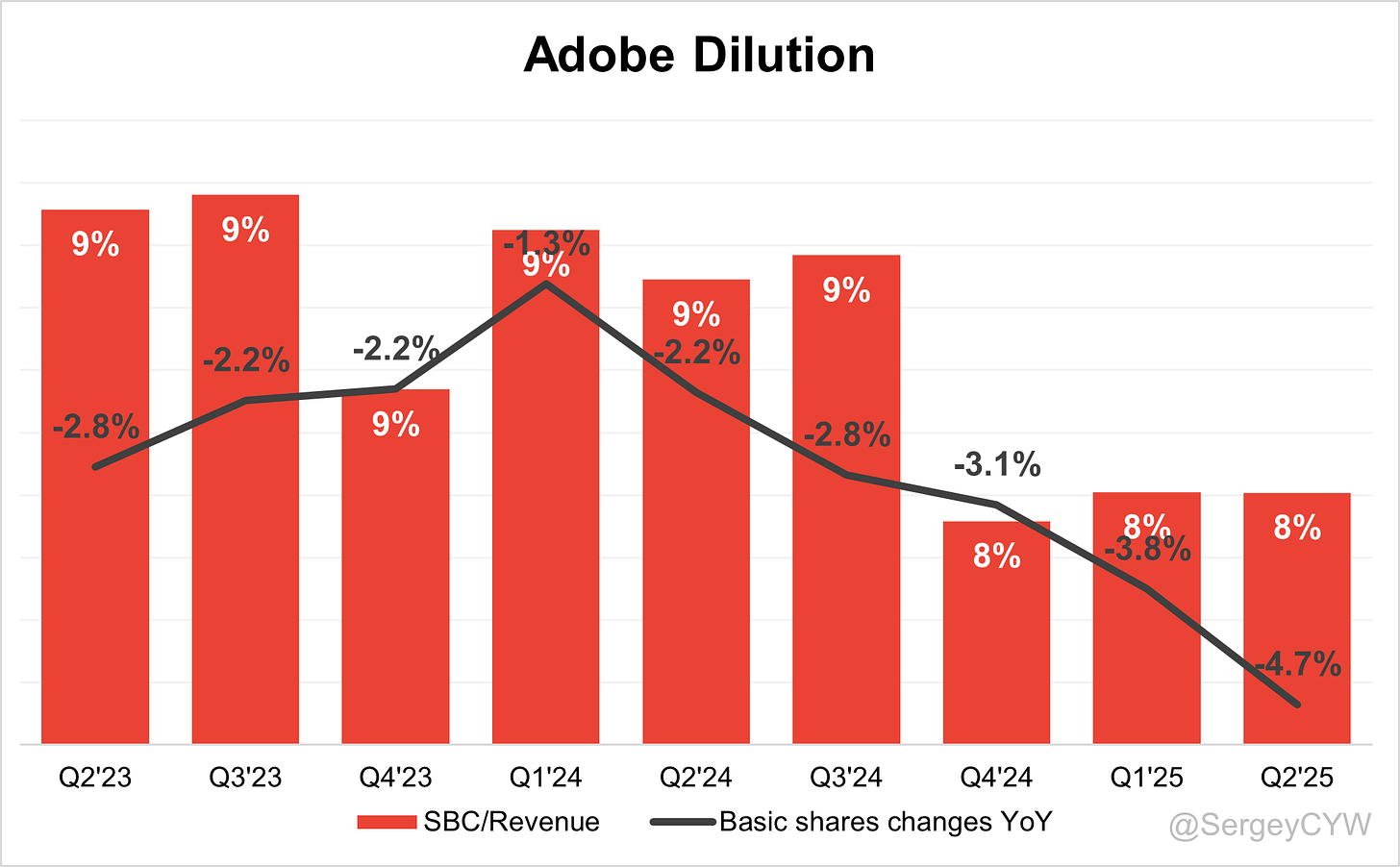

Dilution

↘️SBC/rev 8%, -0.0 PPs QoQ

↘️Basic shares down -4.7% YoY, -0.9 PPs QoQ🟢

↘️Diluted shares down -4.9% YoY, -0.9 PPs QoQ🟢

Guidance

➡️Q3'25 $5,875.0 - $5,925.0M guide (+9.1% YoY) in line with est

↗️$23,500.0 - $23,600.0M FY guide (+9.5% YoY) raised by 0.2% beat est by 0.4%

Key points from Adobe Fourth Quarter 2024 Earnings Call:

Financial Performance

Adobe reported Q2 FY2025 revenue of $5.87B, up 11% YoY. Non-GAAP EPS reached $5.06, a 13% YoY increase. GAAP EPS was $3.94.

The Digital Media segment contributed $4.35B, with ARR of $18.09B, growing 12.1% YoY. The Digital Experience segment delivered $1.46B, with subscription revenue at $1.33B, up 11% YoY.

Operating cash flow hit a Q2 record of $2.19B. Adobe ended the quarter with $5.71B in cash and short-term investments. RPO totaled $19.69B, growing 10% YoY.

Creative & Marketing Professionals

Segment subscription revenue reached $4.02B, growing 10% YoY. Creative Cloud adoption increased in Latin America, India, and Eastern Europe, supported by strong uptake of Photoshop, Illustrator, and Premiere Pro.

Creative Pro revenue growth accelerated from 7.9% in Q2 FY24 to 10.1% in Q2 FY25. Over 24B Firefly generations indicate rapid user adoption of AI-enhanced creative workflows.

New customers included Cisco, Wells Fargo, Ulta Beauty, and Schwartz Global Sourcing.

Main challenge: monetizing generative AI features at scale and migrating legacy users to higher-tier plans like Creative Cloud Pro during renewal cycles.

Creative Cloud Pro

Creative Cloud Pro bundles desktop apps with Firefly, offering high-value AI features such as Generative Fill, Remove, Expand, and Extend.

Initially launched in North America, global rollout is expected in the second half of FY2025.

Creative subscription revenue growth from 7.9% to 10.1% reflects early Pro adoption. Adobe anticipates Pro becoming the default choice for creative professionals.

Key usage indicators include over 24B AI generations and high engagement with advanced creative features.

Revenue recognition remains delayed due to subscription renewal timing. Global expansion and customer education are priorities.

GenStudio

GenStudio is central to Adobe’s marketing tech stack, supporting content production, planning, delivery, and performance optimization.

Quarter-over-quarter ARR grew 45%, while Firefly Services and custom models saw 4x YoY ARR growth.

The launch of GenStudio Foundation added campaign planning visibility and integration.

Supported platforms include Google, Meta, LinkedIn, Snap, TikTok, and Microsoft.

Enterprise adoption includes NFL, Australia Post, Manulife, and Dyson. Coca-Cola's Project Vision, built on Firefly, delivers 10x faster brand-compliant creative output.

Challenges include complex integration with legacy stacks and educating enterprise teams on agentic AI benefits.

Business Professionals & Consumers

Segment subscription revenue reached $1.6B, up 15% YoY—the highest among all groups.

Combined Acrobat and Express MAUs surpassed 700M, growing 25% YoY. Express functionality within Acrobat rose 11x YoY.

The Acrobat AI Assistant streamlines consumption-to-creation with document summarization and pitch deck generation. Generative feature usage in Acrobat and Express rose 3x YoY.

Customer growth included 35,000+ new businesses, with Express adding 8,000, a 6x YoY increase.

Student access grew 75% YoY, expanding early engagement.

Key challenges: freemium-to-paid conversion and scaling international brand awareness for Express.

Firefly and AI

Adobe Firefly generated 4B new creations in Q2, reaching 24B cumulative generations.

Firefly app traffic grew 30% QoQ; paid subscriptions nearly doubled. Subscriptions grew 30% QoQ, and first-time Adobe users via Firefly rose 30% QoQ.

New models launched: Image Model 4, 4 Ultra, and 4K video generation. Firefly Boards (beta) enable collaborative AI ideation.

Third-party model integration now includes Google, OpenAI, and Black Forest Labs, with Runway, Pika, and Ideogram coming.

Enterprise deployments include Infosys, DEBT Holding, and County of San Diego.

Key strength: commercial safety through licensed Adobe Stock content.

Monetization is in early stages but tracking ahead of the $250M AI ARR FY2025 target.

Product Innovation

Key launches include:

Acrobat AI Assistant for conversational document queries

Express + Acrobat integration for seamless creation

Photoshop Mobile release

Firefly Boards (Beta) for collaborative ideation

AI Assistants in AEP for segmentation, insight generation, and content delivery

Enterprise Growth

Digital Experience subscription revenue hit $1.33B, up 11% YoY. AEP and apps grew over 40% YoY.

GenStudio adoption surged, with 45% QoQ ARR growth. Firefly services in enterprise environments posted 4x YoY ARR growth.

Enterprise AI revenue is tracking ahead of the $250M FY target.

Adobe’s stack spans content (Firefly), workflow (Workfront), orchestration (AEP), and activation (GenStudio).

Customer Wins

Enterprise expansion included:

NFL (all 32 teams) using Adobe for AI-driven fan personalization

Coca-Cola, co-developer of Project Vision

Cisco, Infosys, SAP, Australia Post, Manulife

MLB, Premier League, Ulta Beauty, Wells Fargo

Public sector: DISA and County of Los Angeles increased adoption.

Adobe tools are driving faster time-to-content, improved personalization, and campaign ROI across sectors.

Customer Expansion

Adobe added 35,000+ new business customers in Q2. Express contributed 8,000, growing 6x YoY.

Acrobat and Express MAUs exceeded 700M, with PDF link sharing MAUs up 20% YoY.

Strong freemium engagement and PLG funnel fueled expansion across SMBs, enterprises, and education.

Student engagement rose 75% YoY, positioning Adobe for long-term lifetime value.

Competitive Position

Express surpassed 50M MAUs, reinforcing its standing vs. Canva and Visme.

Adobe’s differentiation lies in deep integration across Creative Cloud, Firefly, and Acrobat, combined with superior AI tooling and enterprise-grade IP safety.

GenStudio positions Adobe for co-opetition with ad platforms like Meta, Snap, and TikTok, integrating directly into ad workflows.

Strategic Partnerships

Adobe is expanding ties with Meta, Google, TikTok, Microsoft, Snap, and AWS.

Upcoming announcements at Cannes Lions Festival will highlight new ad and media integrations, reinforcing Adobe’s CXO leadership.

Stock Buybacks

Adobe repurchased $3.5B in Q2. $10.9B remains authorized under its $25B buyback program announced in March 2024.

Challenges

Monetization of new AI-native tiers like Firefly and Creative Cloud Pro is in early rollout.

Revenue impact is delayed by subscription renewal timing.

Freemium-to-paid conversion in students and SMBs needs improvement.

Global rollout of new pricing tiers and packaging still in progress.

Future Outlook

FY2025 revenue guidance raised to $23.5B–$23.6B. Non-GAAP EPS guidance increased to $20.50–$20.70.

Digital Media revenue target: $17.5B with 11% ARR growth.

AI is driving core monetization, influencing billions in revenue and fueling subscription growth.

Adobe reaffirmed its double-digit growth North Star, anchored in creative AI and enterprise automation.

Management comments on the earnings call.

Product Innovations

David Wadhwani, President of Digital Media

“We continue to see strong performance across our Business Professionals and Consumers group, where users are increasingly turning to Adobe for products that combine creativity and productivity.”

“Sales professionals can gather industry reports on a prospect, use AI Assistant to quickly identify effective sales conversations, and automatically generate a pitch deck with Express.”

Shantanu Narayen, Chair and CEO

“Our strategy is to bring productivity and creativity to life for billions of users across a variety of surfaces. Acrobat AI Assistant is redefining how people extract value from digital documents, unlocking new levels of productivity.”

“Firefly empowers creative professionals to generate images, video, audio, and vectors from a single place with unmatched creative control, iterate on their creations through Adobe's creative apps, and seamlessly deliver them into production.”

Creative Cloud Pro

David Wadhwani, President of Digital Media

“The value [users are] getting out of it is enormous. We talked about the fact that we’ve crossed 24 billion generations to date. And as a result, we’ve been able to introduce the Creative Cloud Pro plan, which is a higher-priced plan, but has a lot more value integrated into the ecosystem of the desktop applications.”

“As we go down this path, some of this will take time to play out because we have premium and lower-priced offers. But we’re starting to see the early signs of that.”

Dan Durn, Chief Financial Officer

“In the current quarter, Creative Pro subscription revenue grew 10.1% year-over-year, up from 7.9% a year ago. That acceleration validates the adoption of Creative Cloud Pro and associated AI value.”

GenStudio

Anil Chakravarthy, President of Digital Experience

“With Adobe GenStudio, we’re amplifying the value of cutting-edge Gen AI capabilities across the end-to-end content supply chain. GenStudio optimizes the process of planning, creating, managing, activating, and measuring content for marketing campaigns and personalized customer experiences.”

“We launched GenStudio Foundation, a unified interface to bring together data from our full suite of content supply chain applications, providing visibility and actionable insights into campaign plans, projects, and assets.”

“At Adobe Summit in March, we introduced the Adobe AI platform with an agentic layer to scale customer experience orchestration. We unveiled 10 agents purpose-built for creative, marketing, and technology teams that leverage Adobe Experience Platform to act intelligently and in alignment with business goals.”

Adobe Firefly and AI

David Wadhwani, President of Digital Media

“One of the core principles for us has always been a great deal of respect for content creators. We trained our Firefly models on stock and licensed content and have a Contributor Fund that pays out to those individuals. As a result, we feel like we’re in a very advantaged position when it comes to people choosing models, especially in enterprises.”

“Firefly offers the flexibility to explore the diverse aesthetic styles of Google’s Imagen and VO models, OpenAI’s GPT image model, and Black Forest Labs’ Flux image model… with Runway, Ideogram, Luma, and Pika coming soon.”

Shantanu Narayen, Chair and CEO

“I do believe the fact that Firefly has been designed to preserve intellectual attributes of people is going to become an increasingly important factor in enterprise adoption. Everybody’s experimenting. As it becomes mainstream, that’s going to matter.”

Competitors

David Wadhwani, President of Digital Media

“One of the things that has been most exciting to see is Express adoption within businesses. We talked about how we onboarded 8,000 new businesses in the quarter, including NFL, Premier League, Intuit, Cisco. And what’s really great is that it’s part of a full enterprise-wide content supply chain sale.”

Shantanu Narayen, Chair and CEO

“Every advertising platform wants the Adobe partnership as it relates to GenStudio for performance marketing… We’re going to be the one company that people look at to ensure seamless collaboration and omnichannel posting—Microsoft, Google, Snap, TikTok, Meta, Amazon—you name it.”

Customers

David Wadhwani, President of Digital Media

“As a result of our integrated strategy, we’re seeing steady growth across Acrobat and Express, with MAUs crossing 700 million, and usage of generative AI features growing 3x year-over-year.”

Anil Chakravarthy, President of Digital Experience

“The National Football League expanded our global partnership combining content, data, and journeys to deliver a new level of AI-powered fan experiences… All 32 clubs will scale personalized fan touchpoints using our technology.”

Dan Durn, Chief Financial Officer

“In Q2, we added over 35,000 new businesses, including 8,000 from Express alone, with 6x year-over-year growth in that channel. We’re seeing strong uptake in education, with 75% YoY growth in students accessing Acrobat AI Assistant and Express Premium.”

Enterprise Growth

Anil Chakravarthy, President of Digital Experience

“Adobe is the only company unifying the entire workflow—from creation and production to delivery and measurement. Our customer experience orchestration strategy enables enterprises to combine creativity, marketing, and agentic AI to deliver personalized, conversational digital experiences in real-time at global scale.”

“We’re seeing strong demand for AEP, and our native apps subscription revenue grew over 40% year-over-year. GenStudio for Performance Marketing grew over 45% quarter-over-quarter.”

Strategic Partnerships

Anil Chakravarthy, President of Digital Experience

“At the Cannes Lions Festival, we’ll be unveiling several new partnerships and platform integrations. These announcements will underscore our category leadership in experience orchestration.”

Shantanu Narayen, Chair and CEO

“Leading enterprise players, including AWS, Microsoft, SAP, and ServiceNow, have endorsed us as their partner for customer experience orchestration. We’ve activated a global partner ecosystem spanning top-tier tech firms, integrators, and agencies.”

Challenges

Shantanu Narayen, Chair and CEO

“Creative Cloud Pro and Firefly subscriptions are still in early rollout phases, with most monetization coming on renewal cycles. We need to educate customers on the differential value between standard and pro offerings.”

“We are not really looking to grow our headcount dramatically. We are finding more internal efficiency through AI. We’re investing selectively in areas like PLG product management, go-to-market, and strategic interface design.”

Future Outlook

Shantanu Narayen, Chair and CEO

“The opportunity is there. We're retooling the business and investing in AI to enable more users to create and collaborate. Our performance in the first half gives us the confidence to raise our full-year targets.”

Dan Durn, Chief Financial Officer

“We are pleased to raise our targets for total revenue, Digital Media segment revenue, and EPS for FY25. Our AI direct revenue is tracking ahead of the $250 million ARR target. With a disciplined approach, we are confident in our ability to deliver strong shareholder value.”

Thoughts on Adobe Earnings Report $ADBE:

🟢 Positive

$5.87B revenue (+10.6% YoY) beat estimates by 1.3%

EPS $5.06 (non-GAAP) grew 13% YoY, beat by 1.8%

Gross margin 89.1%, up +0.4pp YoY

Operating margin 35.9%, up +0.4pp YoY

FCF margin 36.5%, up +0.7pp YoY

Billings $5.75B, up +17.6% YoY

Digital Media revenue $4.35B, up +11.3% YoY, with 95.2% GM

Digital Media ARR $18.09B, up +11.3% YoY, with $636M net new ARR (+25.2% YoY)

Creative Pro revenue growth accelerated from +7.9% to +10.1% YoY

GenStudio ARR grew +45% QoQ, Firefly services +4x YoY

Acrobat + Express MAUs 700M+, up +25% YoY

Express added 8,000 businesses, up 6x YoY

Firefly app traffic +30% QoQ, subscriptions nearly doubled

R&D Index 0.59, up +0.01 YoY

Basic shares -4.7% YoY, Diluted shares -4.9% YoY

$3.5B stock repurchased in Q2

🟡 Neutral

Digital Experience revenue $1.46B, up +10% YoY

Digital Experience subscription revenue $1.33B, up +10.5% YoY

RPO $19.69B, up +10.3% YoY

Publishing & Advertising revenue $70M, down -5.4% YoY

S&M/Revenue 27.7%, up +0.5pp YoY

Guidance Q3’25: $5.875B–$5.925B (+9.1% YoY), in line

FY2025 revenue guidance raised to $23.5B–$23.6B, up +0.2%, beats by 0.4%

Net margin 28.8%, down -0.8pp YoY

🔴 Negative

CAC payback period 31.7 months, still elevated despite -4.4 month YoY improvement

G&A/Revenue 6.4%, down -0.3pp YoY, but remains high

Firefly and Creative Cloud Pro monetization still early; growth dependent on renewals

Freemium-to-paid conversion in education and SMBs remains weak

Global rollout of new pricing/packaging delayed

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on Savvy Trader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.