Adobe: Dominating Creative Software with Expanding AI and Market Reach

Deep Dive into $ADBE: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Adobe: Company overview

About Adobe

Adobe Inc., founded in December 1982 by John Warnock and Charles Geschke, is headquartered in San Jose, California. It went public on August 20, 1986, at a split-adjusted price of $0.17 per share. Adobe pioneered desktop publishing through its PostScript language, which Apple licensed for its LaserWriter in 1985. The company now employs over 30,700 professionals globally. Core products include Photoshop, Illustrator, Acrobat Reader, and PDF, spanning creative design, document workflows, digital marketing, and AI-powered solutions. Adobe has grown through both organic development and key acquisitions, notably Macromedia, which brought Flash under its umbrella.

Company Mission

Adobe’s mission is "To change the world through digital experiences". It reflects a focus on broad, transformative impact through technology. The company emphasizes digital interaction as its core value, building tools that power everything from film editing and brand creation to global photo sharing. The mission drives Adobe's long-term strategy and commitment to innovation.

Sector

Adobe operates in the technology sector, within the software industry. It reports across three segments: Digital Media, Digital Experience, and Publishing and Advertising. Digital Media includes Creative Cloud and Document Cloud with products like Firefly, Express, and Acrobat. Digital Experience delivers marketing and business tools via Experience Cloud. The Publishing and Advertising segment covers legacy offerings. Adobe recently introduced GenStudio, an AI-driven content supply chain platform targeting enterprise efficiency through generative automation.

Competitive Advantage

Adobe holds an 80% share of the creative software market and 21% in document software as of 2023. Its brand equity and product standardization create high entry barriers. Adobe benefits from network effects, where user adoption enhances product value, and its Creative Cloud ecosystem ensures seamless integration. High switching costs and steep learning curves further protect Adobe’s market position. Its subscription-based model provides stable, recurring revenue while maintaining customer flexibility. Adobe also leverages proprietary AI models trained on high-quality data, supported by a large creative community and strong financial capacity for long-term investment.

Total Addressable Market (TAM)

Adobe’s TAM is projected to reach $293 billion by 2027, growing at a 13% CAGR from 2024 to 2027. In FY23, Adobe’s revenue accounted for only 7% of this opportunity, leaving ample room for expansion.

Creative Cloud is forecasted to hit $91 billion by 2027 (31% of total TAM), growing at a 13% CAGR. Within this, the Creative Pros market will reach $44 billion (7% CAGR) and the Communicators market will reach $47 billion (20% CAGR).

Document Cloud is projected at $47 billion by 2027 (16% of TAM), with Knowledge Workers representing $25 billion (11% CAGR) and Communicators at $22 billion (19% CAGR).

Experience Cloud is the largest component, forecasted at $155 billion by 2027 (53% of TAM), growing at 12% CAGR, divided across Data Insights (32%), Content, Commerce & Workflows (50%), and Customer Journeys (19%).

Adobe is expanding its TAM through broader use cases, improved free-to-paid user conversion, and enhanced feature offerings. AI-driven products like Firefly, GenStudio, and Acrobat AI Assistant are expected to generate over $250 million in revenue in FY25, doubling current levels. Adobe addresses a vast audience: 68 million creative professionals, 131 million knowledge workers, 900 million communicators, and 4 billion consumers.

Adobe’s strategic focus on AI, coupled with its dominant market position and growing platform integrations, positions the company to capture significant value from its expanding TAM in the years ahead.

Valuation

$ADBE Adobe is trading at a Forward EV/Sales multiple of 6.1, significantly below its median of 10.8. The company's current Forward EV/Sales multiple is at a historical low, even below the lows seen in 2022.

$ADBE Adobe trades at a Forward P/E of 16.7, with revenue growth of +10% YoY in the most recent quarter.

The EPS growth forecast for 2026 is 12.4%, with a P/E of 16.7, resulting in a 2026 PEG ratio of 1.3.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Analysts forecast 11.3% revenue growth for $ADBE Adobe in 2025 and 9.9% in 2026. Based on these projections, the company’s P/S multiple suggests it is fairly valued compared to peers in the Digital Marketing and Media Solutions space.

Analysts expect solid revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Adobe Inc. has established a formidable economic moat that protects its business from competitors and enables it to maintain industry leadership. Let's examine each component of Adobe's economic moat and assess its strength.

Economies of Scale

Adobe operates at an efficient global scale, serving millions of users while keeping marginal costs low. This scale allows Adobe to spread substantial R&D and operational expenses across a broad base, supporting strong profitability. Its subscription model ensures predictable recurring revenue, enabling continued product investment. Adobe’s working capital was strongly negative (-$2B in 2018) due to upfront customer payments for licenses and subscriptions, which carry minimal delivery costs. The company’s online distribution model reinforces scalability, eliminating physical distribution expenses. While not cost-leading, Adobe’s comprehensive product suite offers enough value to justify premium pricing, discouraging price-based competition. Economies of scale are a significant moat, though not Adobe’s most dominant.

Network Effect

Adobe benefits from powerful network effects through industry-standard file formats like PDF (Acrobat) and PSD (Photoshop). Shared workflows in these formats create compatibility dependencies that drive broader product adoption. With over 500 million copies of Acrobat downloaded, Adobe has cemented itself on desktops worldwide. The more users that adopt Adobe, the greater its value to others, reinforcing retention and ecosystem growth. Its early leadership in desktop publishing and freemium adoption strategies helped capture this advantage. Adobe’s network effect is one of its strongest moat components, creating a self-reinforcing growth loop that makes it difficult for competitors to displace.

Brand

Adobe’s brand is synonymous with creative software leadership. Products like Photoshop are so culturally ingrained they've become verbs. The brand is built on decades of delivering professional-grade, reliable, and innovative tools. Adobe commands premium pricing because of this entrenched reputation. The move to a subscription model further strengthened its position as an all-in-one creative platform. Adobe’s brand recognition in fields like graphic design, photography, film production, and marketing creates a substantial barrier to entry. This brand moat is exceptionally strong and continues to shape Adobe's competitive edge.

Intellectual Property

Adobe owns a large portfolio of patents and proprietary technologies, protecting innovations across its product suite. Core technologies, software architecture, and features are legally safeguarded. The company introduced Adobe Sensei in 2016, a proprietary AI and machine learning platform embedded across its tools. This platform enhances features and workflows in ways that competitors cannot easily replicate. Adobe’s intellectual property also includes UI/UX elements and workflow integrations refined over decades. The moat remains robust, though vigilance is required to defend against future standards shifts and technological disruptions.

Switching Costs

Adobe products create exceptionally high switching costs. Retraining users, disrupting workflows, and risking file incompatibility make transitions difficult. Professionals are typically trained on Adobe software early in their careers, deepening reliance. The value of Adobe’s ecosystem compounds with adoption—tools like Premiere Pro and After Effects work better together, creating functional synergies. Cloud integration and subscription bundling further lock users in, storing data and projects within Adobe’s environment. The switching cost moat is one of Adobe’s strongest, anchoring user retention and ecosystem durability.

Adobe's economic moat is among the strongest in the software industry. It benefits from extremely strong brand equity and high switching costs, making user retention exceptionally high. The network effect further reinforces its leadership, with widespread adoption of standard formats like PDF and PSD. Economies of scale and proprietary intellectual property strengthen profitability and innovation, though they play a supporting role. Combined, these advantages create a durable, multi-layered moat that protects Adobe’s market dominance and supports long-term growth.

Revenue growth

$ADBE Adobe's revenue growth slightly slowed to +10.3% YoY in Q1. Based on the forecast for the next quarter, if the company beats its guidance by 0.6%, as it did in Q1, Q2 revenue growth would also reach +10.3%, indicating a stabilization in growth.

RPO growth slowed to +12.0% YoY, but remains above revenue growth.

Billings growth slightly accelerated to +11.3% YoY, which is also above revenue growth.

Segments and Main Products

Adobe operates through two main segments: Digital Media and Digital Experience, each targeting distinct user needs with tailored product suites.

Digital Media

The Digital Media segment generated $4.23 billion in revenue in Q1 FY2025, up 11% YoY. It includes Creative Cloud and Document Cloud. Creative Cloud features industry-standard tools like Photoshop, Illustrator, Premiere Pro, and Frame.io. Adobe Firefly, a suite of generative AI models, enhances creative workflows with high-quality outputs and user control. Adobe Express provides a fast, flexible design solution, with Express for Business offering brand consistency through template locking and Firefly model customization.

Document Cloud focuses on Acrobat and PDF, foundational technologies for digital workflows. PDFs ensure reliable file creation and sharing across platforms. Acrobat allows secure document generation, viewing, form completion, and printing. The AI Assistant in Acrobat and Reader introduces conversational document interaction, enabling users to extract insights, summarize, and draft communications directly from content.

Digital Experience

The Digital Experience segment reported $1.41 billion in revenue in Q1 FY2025, reflecting 10% YoY growth. It helps enterprises deliver real-time, personalized digital experiences. Adobe Experience Platform (AEP) powers data-driven customer engagement and has surpassed $1 billion in annual revenue. Adobe GenStudio unifies tools across Adobe’s ecosystem—including Creative Cloud, Experience Manager, Workfront, Journey Optimizer, and Customer Journey Analytics—to streamline content supply chains. It enables marketers to manage content from planning to measurement within a connected workflow.

Main Products Performance in the Last Quarter

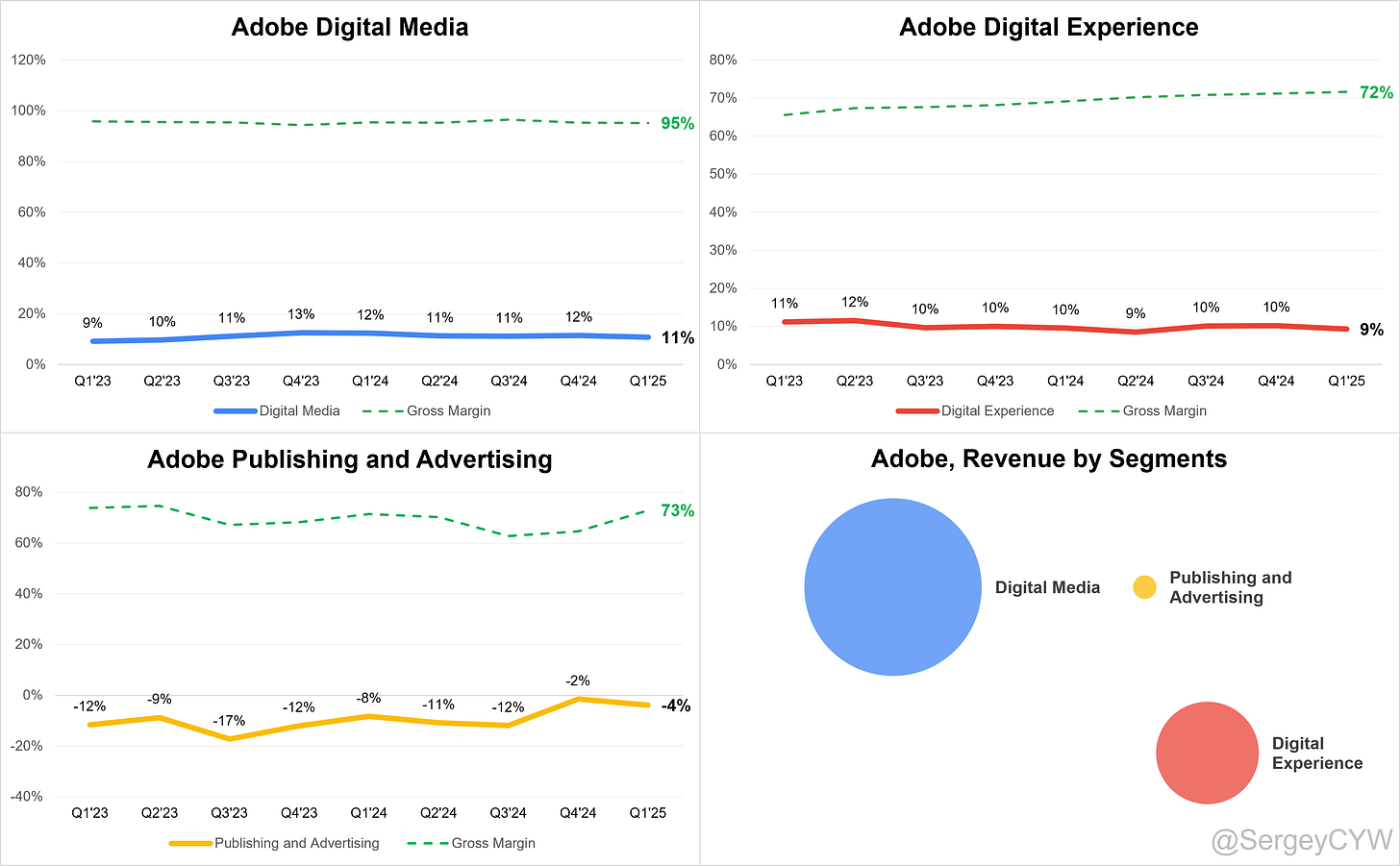

$ADBE Revenue by Segment: 74% of the company’s revenue comes from Digital Media. Digital Experience accounts for 24.7%, and Publishing and Advertising makes up the remaining 1.3% of total revenue.

Digital Media revenue remained strong with +10.8% YoY growth in Q1. Non-GAAP gross margin reached 88%, down 0.2 percentage points YoY.

Digital Experience revenue grew by +9.4% YoY, with Non-GAAP gross margin at 71.6%, up 1.4 percentage points YoY.

Publishing and Advertising revenue declined by -3.9% YoY, while Non-GAAP gross margin improved to 73.0%, up 1.6 percentage points YoY.

Digital Media Segment

Digital Media ARR reaching $17.63B, growing 12.6% YoY. Growth was driven by strong demand for Acrobat, continued expansion in web and mobile through the freemium funnel, and top-of-funnel improvements for Adobe Express. AI-powered enhancements like Acrobat AI Assistant and integrated Express tools drove 23% YoY increase in Acrobat and Reader usage.

Express usage through Acrobat grew 10x YoY, and 6,000 new SMBs were onboarded to Express, up 50% QoQ. Student premium access grew 85% YoY. Creative Cloud also saw momentum from Photoshop web and mobile launches, driving 35% YoY growth in paid subscriptions. Enterprise adoption of Firefly Services and GenAI capabilities continues to rise. Key customer wins included AT&T, Delta Airlines, IBM, Microsoft, Disney, and JPMorgan Chase.

Challenges are not apparent in this segment, as demand remained consistent across geographies and product tiers. AI integration is increasing engagement and monetization across the funnel.

Digital Experience Segment

Q1 revenue reached $1.41B, with subscription revenue at $1.3B, both up 11% YoY. Growth was led by Adobe Experience Platform (AEP) and native applications, with AEP and Apps subscription revenue up nearly 50% YoY. The GenStudio solution surpassed $1B in ending ARR.

The company expanded Real-Time CDP Collaboration, secured partnerships with NBCUniversal, Warner Bros. Discovery, and clients like Coca-Cola, MLB, Lenovo, Red Hat, and others. Adobe’s work with Publicis Sapient promises to reduce labor costs in migrations by up to 35%.

Integration between creativity and marketing, delivered through GenStudio, is creating competitive differentiation. There is strong pipeline momentum heading into 2025, with growing adoption of generative AI across the content supply chain.

Publishing and Advertising

Ad-related innovation includes integration with platforms like Google, Meta, Microsoft Ads, Snap, and TikTok, enabling personalized ad delivery and performance measurement. Key advertising clients include GroupM, Alterra Mountain Company, and University of Phoenix.

Innovations and Product Updates

Adobe is accelerating its AI strategy with three layers: innovation, usage, and monetization. The new Firefly App is positioned as the central destination for generative creation across images, vectors, video, and design.

The Firefly Video Model allows for text-to-video generation, camera angle control, and scene creation using 3D sketches. Over 20 billion assets have been generated with Firefly. New subscription tiers—Standard, Pro, and Premium—are launched to expand monetization.

Photoshop mobile and web debuted, receiving 30M+ social engagements. Adobe integrated AI features like Clip Maker, Text Rewrite, and caption translation in 17 languages into Express and Premiere Pro. Photoshop GenAI MAUs reached 35%, and Lightroom GenAI MAUs hit 30%.

AI innovation generated $125M in new book of business exiting Q1, with management expecting to double it by end of FY25. This figure excludes AI embedded within bundled SKUs like Acrobat and Creative Cloud.

Adobe’s cross-cloud bundling strategy under “One Adobe” is driving success, particularly in the enterprise. The company entered into $3.25B in share repurchases during Q1 and has $14.4B remaining under its new authorization. Q1 operating cash flow hit a record $2.48B.

Revenue by Region

The Americas account for 60% of total revenue, making it Adobe’s $ADBE largest market, with revenue growing +9% YoY in Q1.

EMEA represents 36% of total revenue, also holding a significant share, and is growing at a faster pace of +14% YoY.

APAC contributes 14% of total revenue and is growing at +7% YoY.

Market Leaders

Adobe $ADBE Named Leader in Gartner Magic Quadrants:

· Digital Experience Platforms – Adobe named Leader for the 8th consecutive year, driven by Adobe Experience Cloud and its B2C-focused tools for content, analytics, and journey orchestration.

· Content Marketing Platforms – Adobe Cloud Platform recognized for enabling real-time data integration and AI-powered personalization.

· B2B Marketing Automation Platforms – Marketo Engage supports complex B2B workflows with an extensible data model and bi-directional CRM integration.

· Personalization Engines – Adobe Target leads with advanced A/B testing, real-time decisioning, and personalized content delivery at scale.

Digital Experience Platforms

Adobe has been recognized as a Leader in the 2025 Gartner Magic Quadrant for Digital Experience Platforms for the eighth consecutive year. The report, published on January 28, 2025, evaluated vendors on Ability to Execute and Completeness of Vision.

Adobe Experience Cloud powers the platform, offering tools for content management, analytics, personalization, customer journey orchestration, and customer data management. It is available as both PaaS and SaaS, with a strong focus on B2C use cases across industries.

Content Marketing Platforms

In March 2025, Gartner named $ADBE Adobe a Leader in the Magic Quadrant for Content Marketing Platforms. Adobe Cloud Platform, now enables real-time integration of data from multiple systems, enhancing personalization and expanding AI customization capabilities.

B2B Marketing Automation Platforms

$ADBE Adobe was recognized as a Leader in the Gartner Magic Quadrant for B2B Marketing Automation Platforms, based on Ability to Execute and Completeness of Vision.

Adobe maintains its position through Marketo Engage, designed to support complex B2B journeys across sectors like technology, professional services, and financial services.

Marketo Engage features an extensible data model, enabling integration of multiple data sources to build unified customer profiles. It supports bi-directional CRM and SFA integration, giving sales teams direct access to marketing engagement data within CRM systems.

Personalization Engines

$ADBE Adobe was recognized as a Leader in the Gartner Magic Quadrant for Personalization Engines, led by its Adobe Target solution.

Adobe Target enables advanced A/B and multivariate testing, supporting experimentation at scale. It delivers next-best experience insights, helping marketers present optimal content across user touchpoints.

The platform offers real-time decisioning powered by advanced algorithms, driving relevant user experiences automatically. Adobe Target also includes comprehensive measurement tools to track personalization impact on key business outcomes.

Customer Success Stories

Adobe continues to see broad adoption of its AI-powered tools and digital platforms across global enterprises. High-profile creative professionals and large organizations are leveraging new generative AI capabilities to improve productivity and creative output.

PepsiCo, Dentsu, and Stagwell are already using the Firefly Video Model to generate production-ready video assets. Estee Lauder is working with Adobe to build custom AI models for branded content generation. Tapestry implemented a digital twin workflow with Firefly and custom models, improving brand consistency and production speed.

AT&T, Delta Airlines, Disney, EY, IBM, JPMorgan Chase, Microsoft, Paramount, and Qatar Airlines adopted solutions across Acrobat, Express, and Firefly, highlighting Adobe’s cross-cloud enterprise relevance. Academy Award winners like Dune: Part Two and Anora used Adobe Creative Cloud tools in production, reinforcing Adobe’s dominance in the professional creative market.

In the education sector, student adoption of Adobe Express premium grew 85% YoY, supported by campus ambassador programs. Strong onboarding of 6,000 new SMBs in Q1 further expanded Adobe’s reach in the small business market.

Enterprise Growth

New product adoption in the enterprise segment is accelerating, especially in performance marketing, where Adobe partnered with Google, Meta, Microsoft Ads, Snap, and TikTok to enhance campaign activation.

Key enterprise customers include Ford, Microsoft, IBM, PNC Financial, Tyson Foods, and M.H. Alshaya. Adobe’s collaboration with Publicis Sapient introduced a cloud accelerator for AEM, reducing migration labor costs by up to 35%.

The company now supports 1,400+ custom AI models, meeting demand for brand-safe content creation at scale. Real-Time CDP Collaboration, powered by AEP, is being piloted by major advertisers like MLB and The Coca-Cola Company, alongside publishers such as NBCUniversal and Warner Bros. Discovery.

ARR

$ADBE Adobe's Total Digital Media ARR was $17.63 billion, representing +12% YoY growth.

Net new ARR

$ADBE Adobe added $432 million in net new ARR in Q1 2025, representing a -19% year-over-year decline. This net new ARR addition was in line with the two-year average.

CAC Payback Period and RDI Score

$ADBE Adobe's return on Sales & Marketing (S&M) spending increased to 47.9, with a CAC Payback Period worse than the SaaS average (the median for the SaaS companies I track is 20.8 months).

The R&D Index (RDI Score) for Q1 is 0.6, which is below the 1.2 median of the SaaS companies I monitor but roughly in line with the broader industry median of 0.7, indicating a healthy level of R&D investment.

An RDI Score above 1.4 is considered best-in-class, underscoring the importance of efficient R&D allocation.

Profitability

Over the past year, $ADBE Adobe has experienced changes in its margins:

Gross Margin significantly increased from 88.6% to 89.1%.

Operating Margin slightly improved from 36.8% to 37.8%.

Free Cash Flow (FCF) Margin significantly improved from 30.7% to 42.9%.

Operating expenses

$ADBE Adobe's non-GAAP operating expenses have slightly decreased, driven by reduced Sales & Marketing (S&M) spending. S&M expenses declined from 28% two years ago to 26%.

R&D expenses remained unchanged at 18%. The R&D share remains high, reflecting the company’s continued investment in future growth through platform enhancements and updates.

General & Administrative (G&A) expenses slightly decreased to 6%.

Balance Sheet

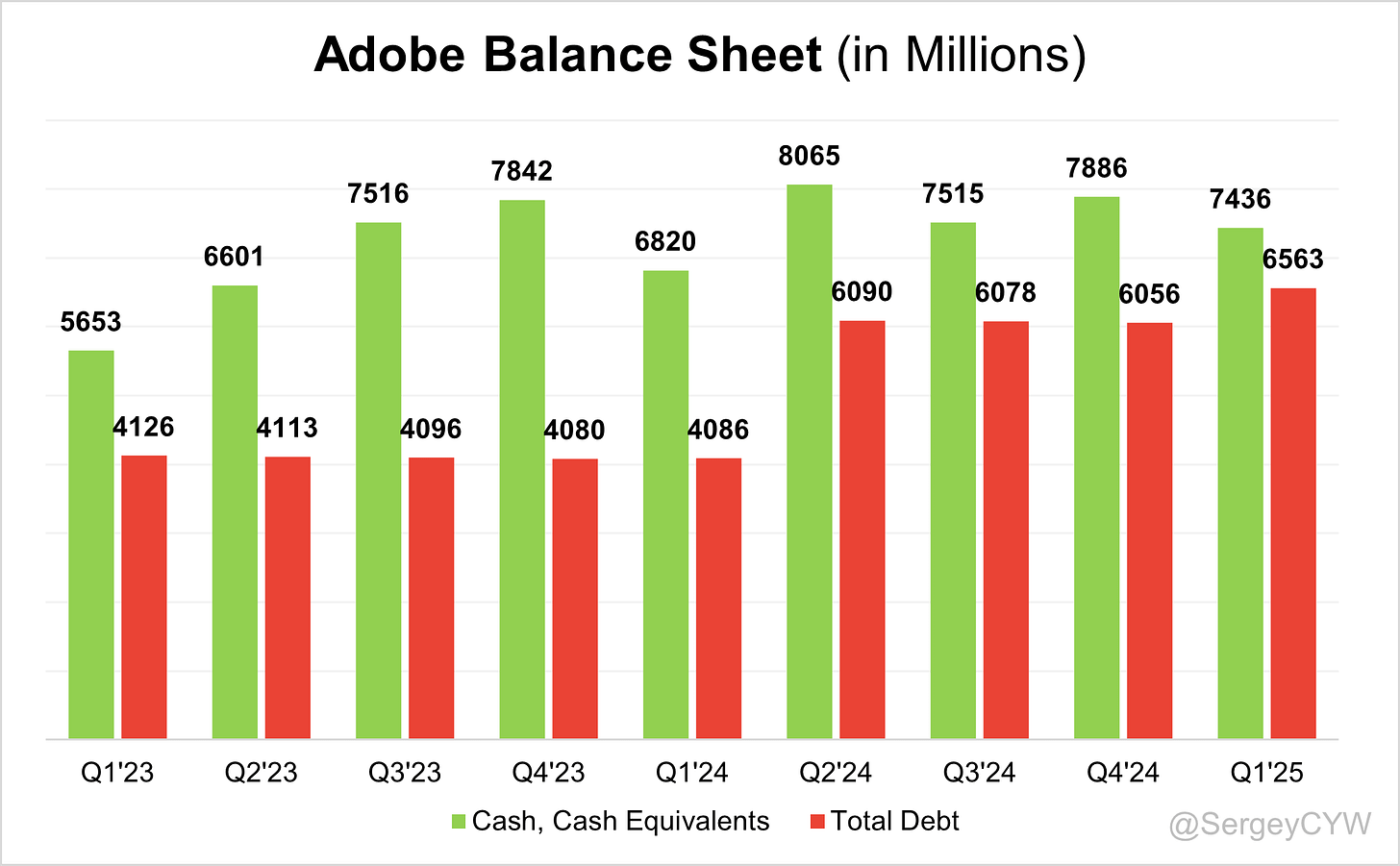

$ADBE Balance Sheet: Total debt stands at $6,563 million, while Adobe holds $7,436 million in cash and cash equivalents, far exceeding its liabilities and reflecting a healthy balance sheet.

Dilution

$ADBE Shareholder Dilution: Adobe’s stock-based compensation (SBC) expenses remain at 8% of revenue, which is below the SaaS sector average.

Shareholder dilution is well-managed, with the weighted-average number of basic common shares outstanding decreasing by -3.8% YoY. The company is actively buying back its stock.

Adobe repurchased $3.25 billion in shares in Q1, with $14.4 billion remaining under its $25 billion repurchase program. Over the past four quarters, Adobe has repurchased $11 billion worth of shares, reflecting management’s confidence in the company’s growth.

Conclusion

$ADBE Adobe is a strong player in the Digital Marketing and Media Solutions space. Gartner recognizes Adobe’s leadership in multiple Magic Quadrants: Digital Experience Platforms, Content Marketing Platforms, B2B Marketing Automation Platforms, and Personalization Engines. Notably, Adobe has been named a Leader in Digital Experience Platforms for the 8th consecutive year.

The company’s TAM is large, estimated at $293 billion by 2027, growing at a 13% CAGR from 2024 to 2027. Adobe's economic moat is built on extremely strong switching costs, driven by professional training on Adobe products, workflow disruption risks when switching, a deeply integrated product ecosystem, and cloud storage lock-in. Adobe’s brand strength is also exceptionally high—products like Photoshop have become verbs, synonymous with creative excellence.

Leading Indicators:

• RPO growth of +12% is above revenue growth.

• Billings growth of +11.3%, slightly above revenue growth.

• Total Digital Media ARR grew +11.8%, outpacing revenue growth.

• Net new ARR additions are in line with the two-year average but declined -19% YoY.

Key Indicators:

• CAC Payback Period worsened to 47.9 months, well above the SaaS median.

• RDI Score came in at 0.6, also below the SaaS median.

The Q2 revenue guidance suggests a stabilization in growth. With leading indicators such as RPO, billings, and ARR growth outpacing revenue, there is some support for continued momentum.

Valuation appears fair relative to the sector and revenue growth forecasts. However, from a historical perspective, Adobe is trading at valuation multiples near historical lows. This discount largely reflects investor concerns around competition from generative AI models capable of creating and editing images, photos, and videos.

Adobe is actively integrating AI into its Creative Cloud and Experience Cloud products to enhance the user experience. The company is also leveraging its strong market position to adapt to a rapidly evolving creative and marketing technology landscape. Adobe’s AI model Firefly is trained on Adobe Stock content, which gives it a competitive edge.

AI landscape is evolving rapidly, and Adobe faces a significant challenge in defending its position. I view the competitive threat from generative AI models as material.

I continue to keep $ADBE on my watchlist as a strong, well-positioned player in the Digital Marketing and Media Solutions space, supported by a wide economic moat, but facing high uncertainty regarding long-term growth due to intensifying AI competition in this segment.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.