Snowflake Q1 2025 Earnings Analysis

Dive into $SNOW Snowflake’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

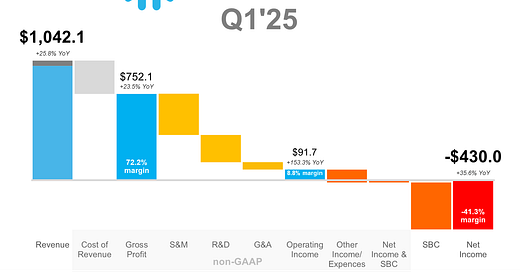

Financial Results:

↗️$1,042M rev (+25.8% YoY, +5.6% QoQ) beat est by 3.9%

↘️GM* (72.2%, -1.3 PPs YoY)🟡

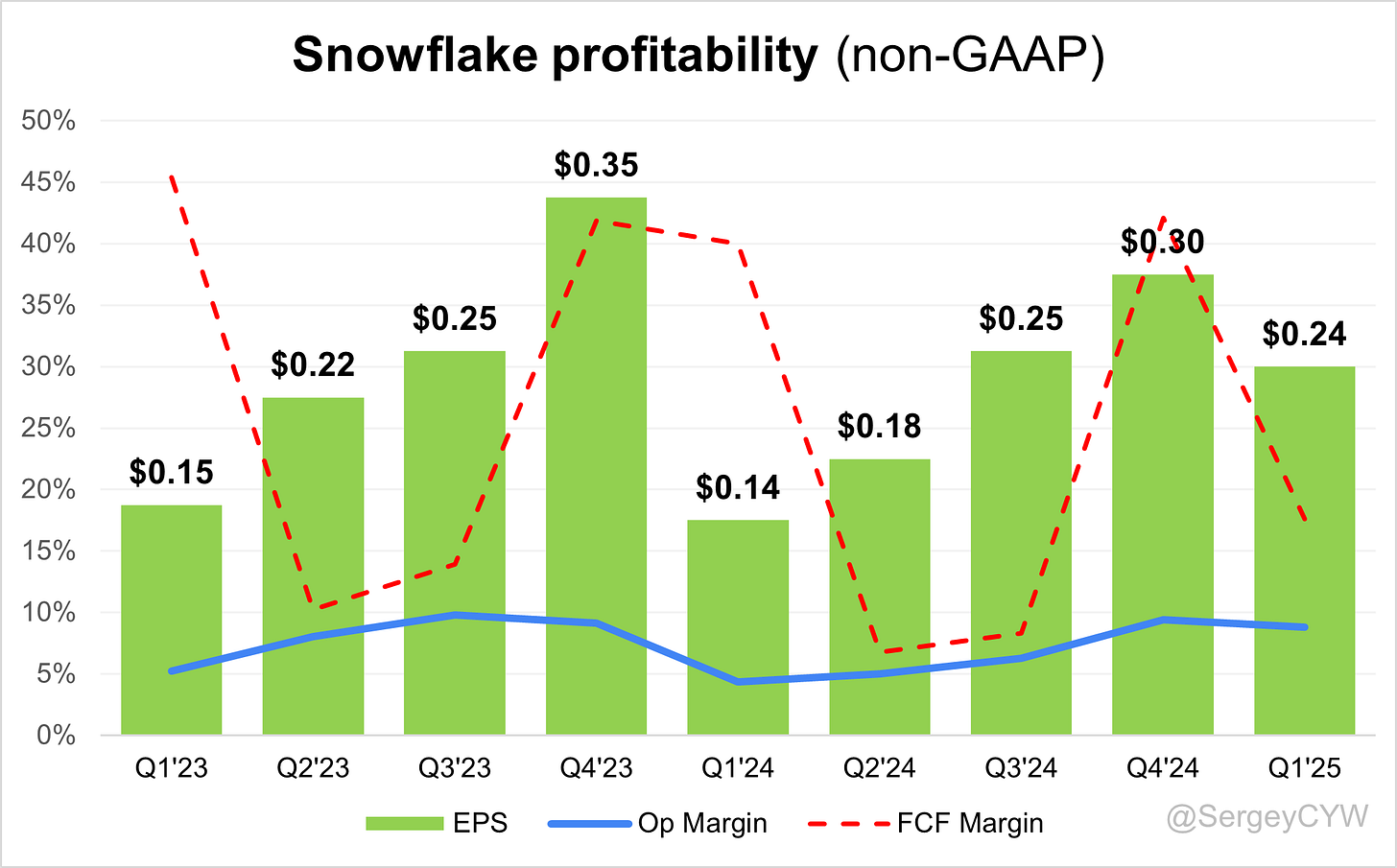

↗️Operating Margin* (8.8%, +4.4 PPs YoY)

↘️FCF Margin (17.6%, -22.4 PPs YoY)🟡

↘️Net Margin (-41.3%, -3.0 PPs YoY)🟡

↗️EPS* $0.24 beat est by 14.3%

*non-GAAP

Product

↗️Product Revenue $997M (+26.2% YoY)

↘️GM* (75.7%, -1.3 PPs YoY)

Key Metrics

↗️NDR 124% (-4 PPs YoY, -2 PPs QoQ)

↗️RPO $6.70B (+34.3% YoY)🟢

↗️сRPO $3.35B (+31.7% YoY)🟢

↗️Billings $770M (+36.1% YoY)🟢

↗️Data sharing 39.0% (+3.0 PPs QoQ)

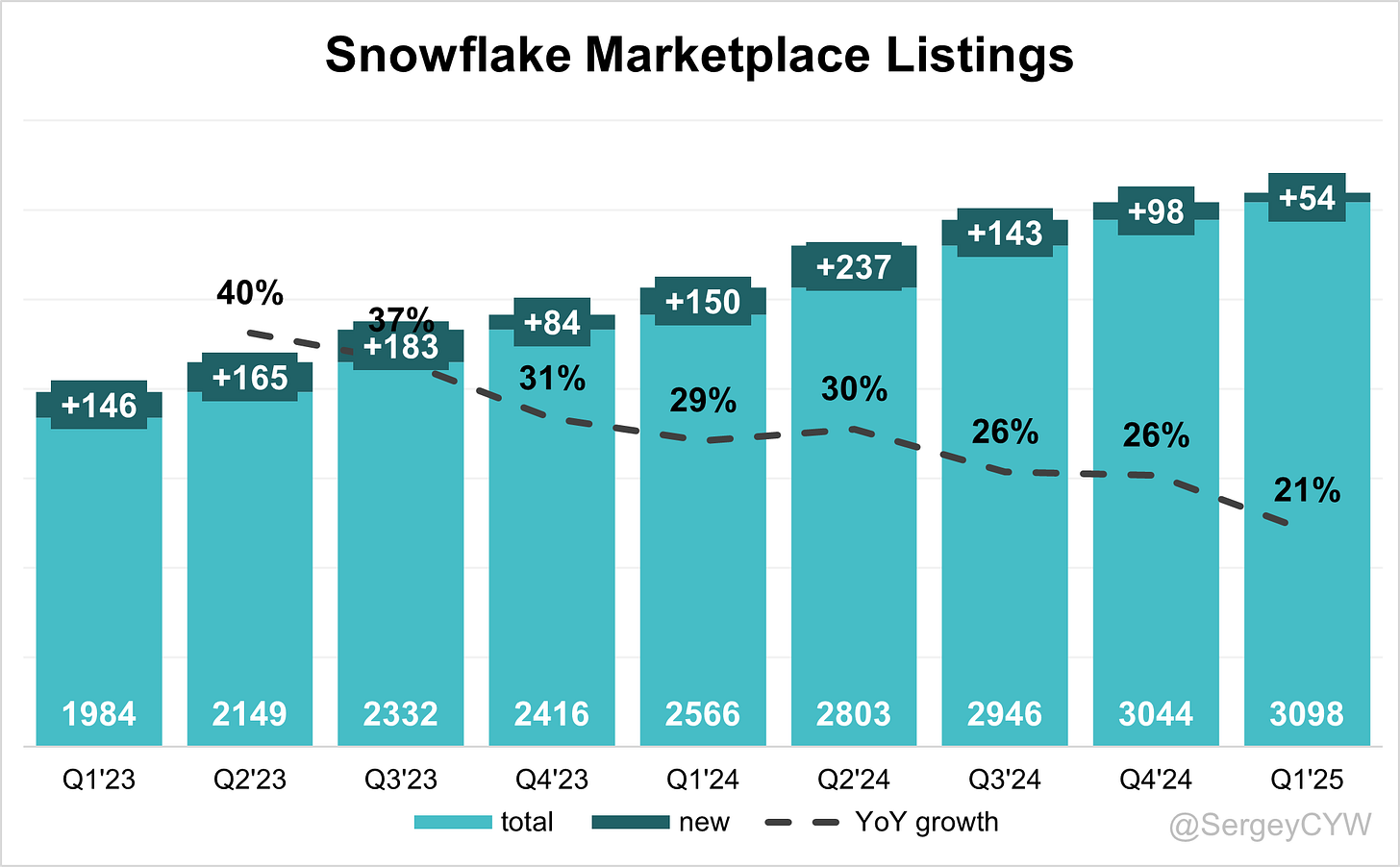

➡️3,098 Marketplace Listings (+20.7% YoY, +54)🔴

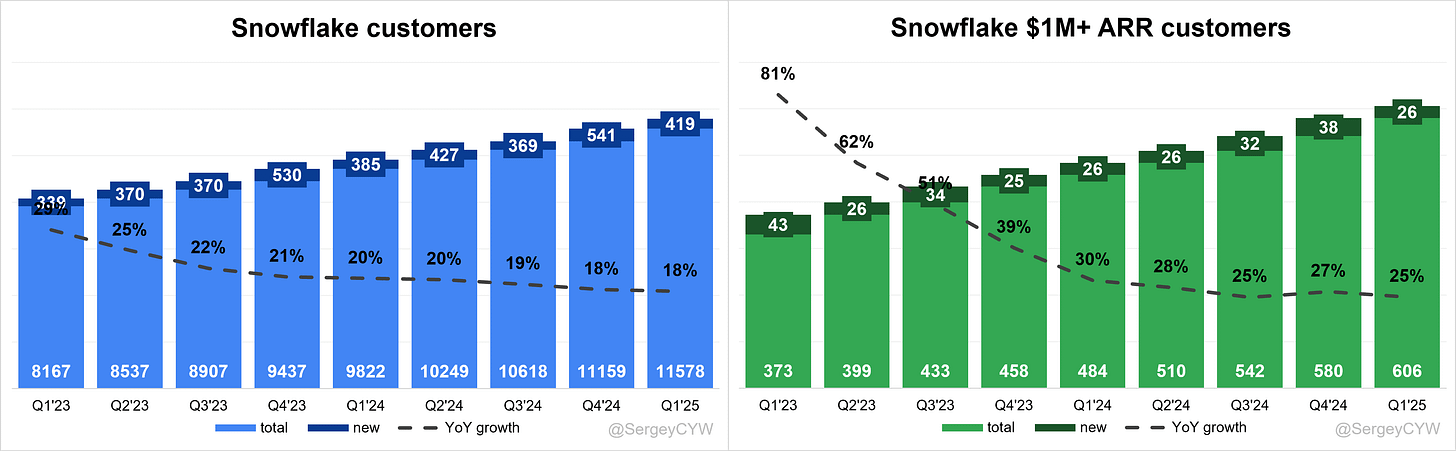

Customers

➡️11,578 customers (+17.9% YoY, +419)

➡️606 $1M+ customers (+25.2% YoY, +26)

Operating expenses

↘️S&M*/Revenue 34.3% (-3.4 PPs YoY)

↘️R&D*/Revenue 22.9% (-1.6 PPs YoY)

↘️G&A*/Revenue 6.1% (-0.8 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $214M (+3.9% YoY)

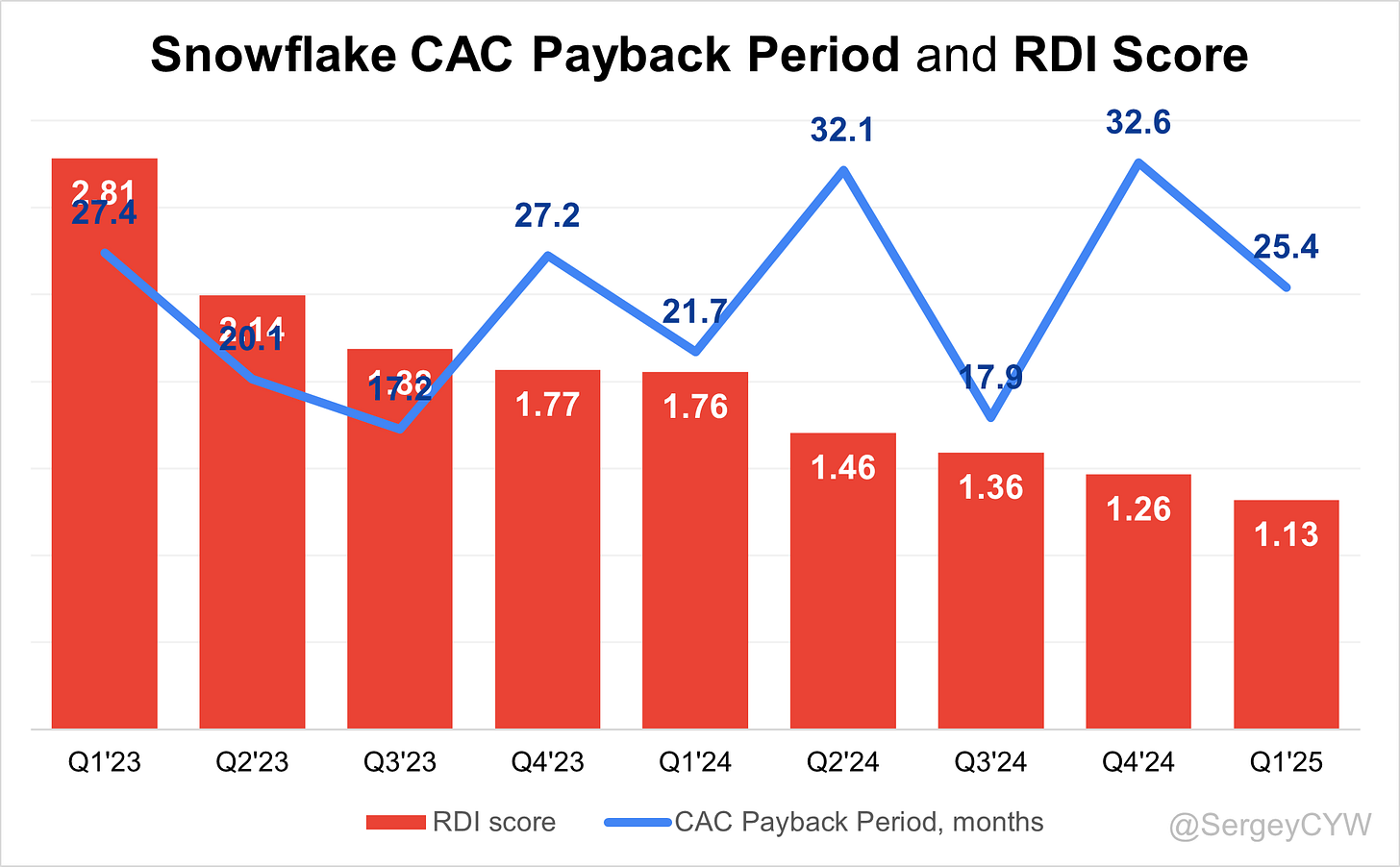

↗️CAC* Payback Period 25.4 Months (+3.7 YoY)🟡

↘️R&D* Index (RDI) 1.13 (-0.63 YoY)🟡

Dilution

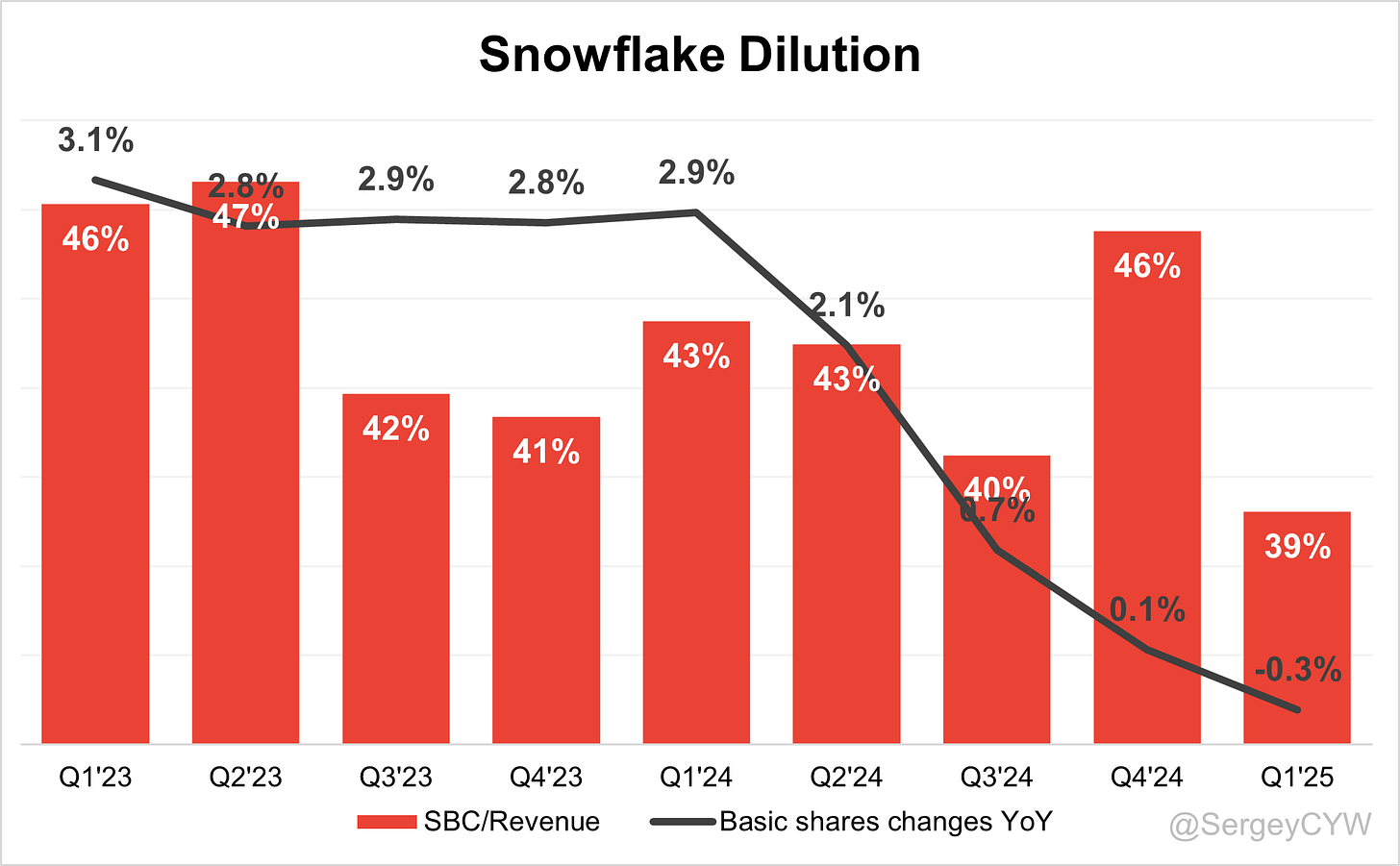

↘️SBC/rev 39%, -6.3 PPs QoQ

↘️Basic shares down -0.3% YoY, -0.4 PPs QoQ🟢

↗️Diluted shares up 2.1% YoY, +0.2 PPs QoQ

Headcount

➡️8,240 Total Headcount (+12.9% YoY, +403 added)

Guidance

↗️Q2'25 $1,035.0 - $1,040.0M guide (+25.1% YoY) beat est by 1.7%

↗️$4,325.0M FY guide (+24.9% YoY) raised by 1.1% beat est by 1.2%

Key points from Snowflake’s First Quarter 2025 Earnings Call:

Financial Results

Snowflake reported Q1 FY26 product revenue of $997 million, up 26% YoY. Adjusted for the leap year, normalized growth reached 28% YoY, with no sequential deceleration. Remaining Performance Obligations (RPO) rose to $6.7 billion, up 34% YoY, indicating strong forward demand. Net Revenue Retention (NRR) was 124%, lower than historical peaks, reflecting more efficient enterprise spending.

Non-GAAP product gross margin was steady at 75.7%, while non-GAAP operating margin expanded to 9%, a +442 basis point YoY improvement. Free cash flow margin reached 20%, with FY26 guidance at 25%, signaling expected second-half strength.

Cortex AI

Cortex AI is now embedded in enterprise workflows, with 5,200+ weekly active accounts. New capabilities include Cortex Agents and Cortex Analyst, enabling agentic automation and natural language querying across structured and unstructured data.

Enterprises like Kraft Heinz use Cortex to build internal tools such as the Heinz AI Tool (HAT), while Samsung Ads applies it for real-time ML-powered advertising. Luminate Data leverages Cortex Agents for unified search.

Cortex integrates models from Meta (Llama) and OpenAI via Azure, supporting multi-model flexibility. Monetization occurs indirectly via platform consumption, not as a standalone SKU. Snowflake plans to maintain adoption momentum before applying targeted pricing.

Apache Iceberg

Snowflake now offers native support for Apache Iceberg, allowing users to apply core features like governance, sharing, and performance optimization to Iceberg datasets. This enables flexible architecture and open format compatibility, expanding Snowflake’s reach into hybrid environments and multi-engine data lakes.

While specific customer names were not disclosed, Iceberg integration is expected to boost workload diversity. Maintaining performance efficiency as usage of external formats grows remains a focus.

Snowpark and Dynamic Tables

Snowpark and Dynamic Tables exceeded expectations in Q1. These are central to capturing workloads traditionally owned by Spark and Python-based tools. Snowpark supports unstructured data processing, ML training, and embedded notebooks with AI coding assistance.

Customers like Hilton and Disney use Snowpark for next-best-action modeling and real-time guest routing. Adoption is expanding across entire enterprises, reducing tool fragmentation.

Dynamic Tables power real-time, auto-refreshing datasets for streaming analytics and personalization. Snowflake continues optimizing performance to balance cost and scale.

Snowflake Marketplace

CloudZero uses Snowflake Marketplace to operate hundreds of active data-sharing pipelines, showing ecosystem-scale engagement. Marketplace supports governed data exchange across partners, enhancing Snowflake’s data network effect.

Marketplace is integrated with Connectors and Cortex, but still evolving into a transactional layer for third-party AI agents. Additional monetization functionality is expected at the June Summit.

Connectors Expansion

Snowflake Connectors, built using Datavolo technology, now support direct integration with Google Drive, Slack, Workday, SharePoint, SAP, and others. These reduce ETL friction and enable real-time ingestion from business-critical SaaS platforms.

AstraZeneca now efficiently connects SAP and Workday data for faster analytics. Dentsu reduced costs by 30% after consolidating workflows using Connectors and Clean Rooms.

AI Adoption

Snowflake is now positioned as a full-stack AI data platform. Enterprises are building AI-ready infrastructure using its tools.

Siemens connects plant-floor and IT data through Snowflake + Cortex. Samsung Ads uses real-time data pipelines for targeting. Luminate Data and others leverage agentic workflows for unstructured search.

AI adoption is no longer aspirational—it’s operational.

Product Innovation

Snowflake released 125+ new product capabilities in Q1, a 50% YoY increase. Key additions include:

Support for containerized ML training

Semantic models for natural language queries

Expanded Cortex Agent orchestration

AI-powered migration tools in SnowConvert

Internal productivity also improved: AI assistants help sales teams access insights, and engineering teams use AI for code generation and testing.

Sector Expansion

Snowflake launched Snowflake Public Sector Inc., securing DoD IL5 authorization to serve the U.S. Department of Defense and federal agencies. Vertical growth also includes:

Automotive analytics for CarMax, Nissan

Expanded footprint in financial services, healthcare, and public sector

Pilot conversations are active across federal departments, indicating long-term opportunity.

Public Sector Strategy

Snowflake’s IL5-certified platform is now eligible for mission-critical federal workloads. Discussions are underway with U.S. agencies, military branches, and defense partners.

Data Sharing

Data sharing remains Snowflake’s structural moat. Dentsu and CloudZero use live data connections to collaborate across networks and eliminate third-party tools.

Snowflake’s Data Clean Room supports secure, privacy-preserving sharing—critical for industries like advertising and finance.

Margins and Efficiency

Operating margin rose to 9%, up from 4% YoY, despite front-loaded hiring in GTM roles. CapEx increased due to HQ and Bellevue office buildouts, but is not expected to repeat.

AI is improving internal efficiency: engineers code faster, and sales reps close smarter.

Share Buybacks

Snowflake repurchased 3.2 million shares in Q1 for $491M at an average price of $152.63. $1.5B remains under authorization through March 2027. Management is pursuing a disciplined, opportunistic buyback approach.

Customer Growth

Snowflake added 451 net new customers in Q1, a +19% YoY increase, one of its strongest new logo quarters ever. Growth is driven by a dedicated acquisition team and expansion across financial services, healthcare, manufacturing, and federal sectors.

Two $100M+ contracts were signed in Q1, both in financial services. These were deferred from Q4 FY25 and reinforce the scalability of Snowflake’s land-expand-retain model.

Customer Use Cases

Kraft Heinz built the HAT AI assistant using Cortex.

Samsung Ads uses ML for personalized, privacy-safe advertising.

Dentsu consolidated pipelines and cut costs 30%, using Clean Rooms for marketing data.

AstraZeneca integrates Snowflake with SAP and Workday for agile pharma analytics.

CloudZero operates at scale using Marketplace pipelines.

Siemens unifies ERP and operational data with Cortex for industrial analytics.

Luminate Data applies Cortex Agents to manage entertainment insights.

Hilton and Disney apply ML models inside Snowflake for real-time optimization.

Strategic Partnerships

Snowflake expanded its AI stack integration with:

Meta’s Llama 3 (day-one support)

OpenAI via Microsoft Azure

Active collaborations with Anthropic, Mistral, Reka

Infrastructure partnerships include bi-directional access with Microsoft OneLake, reinforcing Snowflake’s cooperative stance even amid competition from Fabric.

Competitive Landscape

Snowflake acknowledges competitive pressure from Microsoft Fabric, particularly given its integration with Azure and Office Copilot. Still, leadership emphasized that Snowflake + Azure offers better outcomes for joint customers.

Maintaining differentiation while partnering with hyperscalers is a key balancing act.

Challenges

NRR declined to 124%, from historical highs of ~135%

Customer behavior normalizing post-COVID

Market education needed for AI and agentic workflows

Competition from point-solution AI tools and hyperscaler-native fabrics

FY26 Outlook

Q2 product revenue is guided between $1.035B–$1.04B (+25% YoY), with operating margin at 8%. Full-year product revenue guidance raised to $4.325B (+25%).

Management expects stronger free cash flow in H2, tied to customer seasonality and late-stage deal execution. Investor Day on June 3 will detail AI monetization and next-gen roadmap.

Management comments on the earnings call.

Product Innovations

Sridhar Ramaswamy, Chief Executive Officer

“Our product delivery remains in overdrive, and our go-to-market engine continues to get stronger and stronger. We are off to a strong start to the year.”

Sridhar Ramaswamy, Chief Executive Officer

“In fact, this quarter alone, we have brought over 125 product capabilities to market, a 50% increase over what we delivered in Q1 of last year.”

Christian Kleinerman, Executive Vice President of Product

“The best way to think about Gen 2 is our latest and greatest compute environment… it’s part of our internal ongoing promise to customers to always deliver the best price-performance in the market.”

Cortex AI

Sridhar Ramaswamy, Chief Executive Officer

“Now we have over 5,200 accounts using our AI and machine learning on a weekly basis.”

Sridhar Ramaswamy, Chief Executive Officer

“By working with us, by bringing data into Snowflake, they are making their data, they're making their processes AI-ready as it were.”

Sridhar Ramaswamy, Chief Executive Officer

“We are beginning to see compound systems get adopted... from chatbots on documents to data agents integrating multiple sources to support complex workflows.”

Sridhar Ramaswamy, Chief Executive Officer

“We launched the first of our AI-powered migration enhancements... making a time-intensive process much more efficient. And this is just the start of what AI can do to make migrations go fast.”

Apache Iceberg

Sridhar Ramaswamy, Chief Executive Officer

“We continue to see strong adoption of open data formats, especially truly open modern table formats like Apache Iceberg... giving [customers] even more flexibility to manage and query data at scale.”

Christian Kleinerman, Executive Vice President of Product

“Our investment around Iceberg also creates an opportunity for customers to have an open architecture and be able to mix and match technologies as they see fit.”

Snowpark

Sridhar Ramaswamy, Chief Executive Officer

“Snowpark and Dynamic Tables outperformed expectations in Q1... They’re part of our strategy to cover the entire data lifecycle, from ingestion to insight.”

Christian Kleinerman, Executive Vice President of Product

“We see lots of people leveraging [Snowpark] for unstructured data processing... extracting structure and signal and doing traditional ML on unstructured data is a common use case.”

Snowflake Marketplace

Sridhar Ramaswamy, Chief Executive Officer

“Customers like CloudZero leverage hundreds of powerful active data sharing connections to securely exchange data with their partners and customers, driving value across our ecosystem.”

Competitors

Sridhar Ramaswamy, Chief Executive Officer

“Hyperscalers are formidable... but we’ve learned that cooperating really leads to a better outcome.”

Sridhar Ramaswamy, Chief Executive Officer

“There are more cases than not where we are very effectively working together [with Microsoft], and it’s on the uptick, especially with Azure.”

Sridhar Ramaswamy, Chief Executive Officer

“We announced that from Snowflake, you could read tables that are in OneLake... and we are also actively talking to [Microsoft] about OneLake being the data layer for Snowflake.”

Customers

Sridhar Ramaswamy, Chief Executive Officer

“Enterprise leaders like Canva and JPMorgan Chase bet their business on Snowflake because our platform is easy to use, connected, and trusted.”

Mike Scarpelli, Chief Financial Officer

“We added 451 net new customers in Q1, growing 19% year over year.”

Mike Scarpelli, Chief Financial Officer

“Both of the $100 million-plus accounts that signed this quarter were in the financial services vertical.”

Strategic Partnerships

Sridhar Ramaswamy, Chief Executive Officer

“We continue to provide our customers with choice and flexibility to leverage the world’s leading models for their enterprise AI applications... including Meta, Anthropic, OpenAI, Mistral, and others.”

Sridhar Ramaswamy, Chief Executive Officer

“We have further solidified our leadership by continuing to integrate cutting-edge models into Cortex, ensuring day-one availability of Meta’s Llama core model.”

Challenges

Mike Scarpelli, Chief Financial Officer

“Our customers are constantly optimizing... but we are not seeing any big optimization trends like we did coming out of COVID.”

Sridhar Ramaswamy, Chief Executive Officer

“Inefficient spend from customers inevitably leads to a contraction later anyway. And we are better off making sure that it is always efficient spend.”

Sridhar Ramaswamy, Chief Executive Officer

“Part of what we want to be able to do is have Snowflake Connectors point to repositories like SharePoint… and then create an index with Cortex search and hook it up to a chatbot.”

Future Outlook

Mike Scarpelli, Chief Financial Officer

“We expect Q2 product revenue between $1.035 billion and $1.040 billion, representing 25% year-over-year growth.”

Mike Scarpelli, Chief Financial Officer

“We are increasing our revenue guidance for FY26 to $4.325 billion... and we expect non-GAAP adjusted free cash flow margin of 25%.”

Sridhar Ramaswamy, Chief Executive Officer

“We believe Snowflake’s long-term profile is one that showcases durable, high growth, and continued margin expansion.”

Sridhar Ramaswamy, Chief Executive Officer

“It’s an exciting time for our company, and I look forward to sharing more of our progress in the quarters ahead.”

Thoughts on Snowflake Earnings Report $SNOW:

🟢 Positive

Revenue: Q1 product revenue grew +26.2% YoY to $997M, beating estimates by 3.9%

RPO: Reached $6.70B, up +34.3% YoY

Billings: Increased +36.1% YoY to $770M

Operating Margin: Expanded to 8.8%, up +4.4 PPs YoY

EPS: Non-GAAP EPS of $0.24, beating estimates by 14.3%

Customer Growth: Added +451 net new customers, now totaling 11,578 (+17.9% YoY)

$1M+ Customers: Reached 606, up +25.2% YoY

Data Sharing: Grew to 39.0%, up +3.0 PPs QoQ

Free Cash Flow Guidance: Maintained at 25% for FY

FY26 Revenue Guidance Raised: Now $4.325B (+24.9% YoY)

Buybacks: Repurchased 3.2M shares for $491M; $1.5B authorization remains

AI Monetization: Cortex usage strong (5,200+ weekly users), but no direct revenue attribution

🟡 Neutral

Net Revenue Retention: At 124%, down -4 PPs YoY, but still healthy

Total Listings: Marketplace listings at 3,098, up +20.7% YoY but only +54 QoQ

Total Headcount: Increased +12.9% YoY to 8,240, supporting GTM expansion

CapEx: Temporarily elevated due to office expansion, not expected to recur

Payback Period: CAC payback rose to 25.4 months, up +3.7 YoY

R&D Index: Dropped to 1.13, down -0.63 YoY

🔴 Negative

Gross Margin: Product gross margin declined to 75.7%, down -1.3 PPs YoY

FCF Margin: Fell to 17.6%, down -22.4 PPs YoY

Net Margin: Declined to -41.3%, down -3.0 PPs YoY

SBC/Revenue: Still high at 39%, despite -6.3 PPs QoQ improvement

Competitive Pressure: Rising from Microsoft Fabric, especially in mid-market and public sector

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on Savvy Trader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.